Credit Suisse Investment Banking Pitch Book

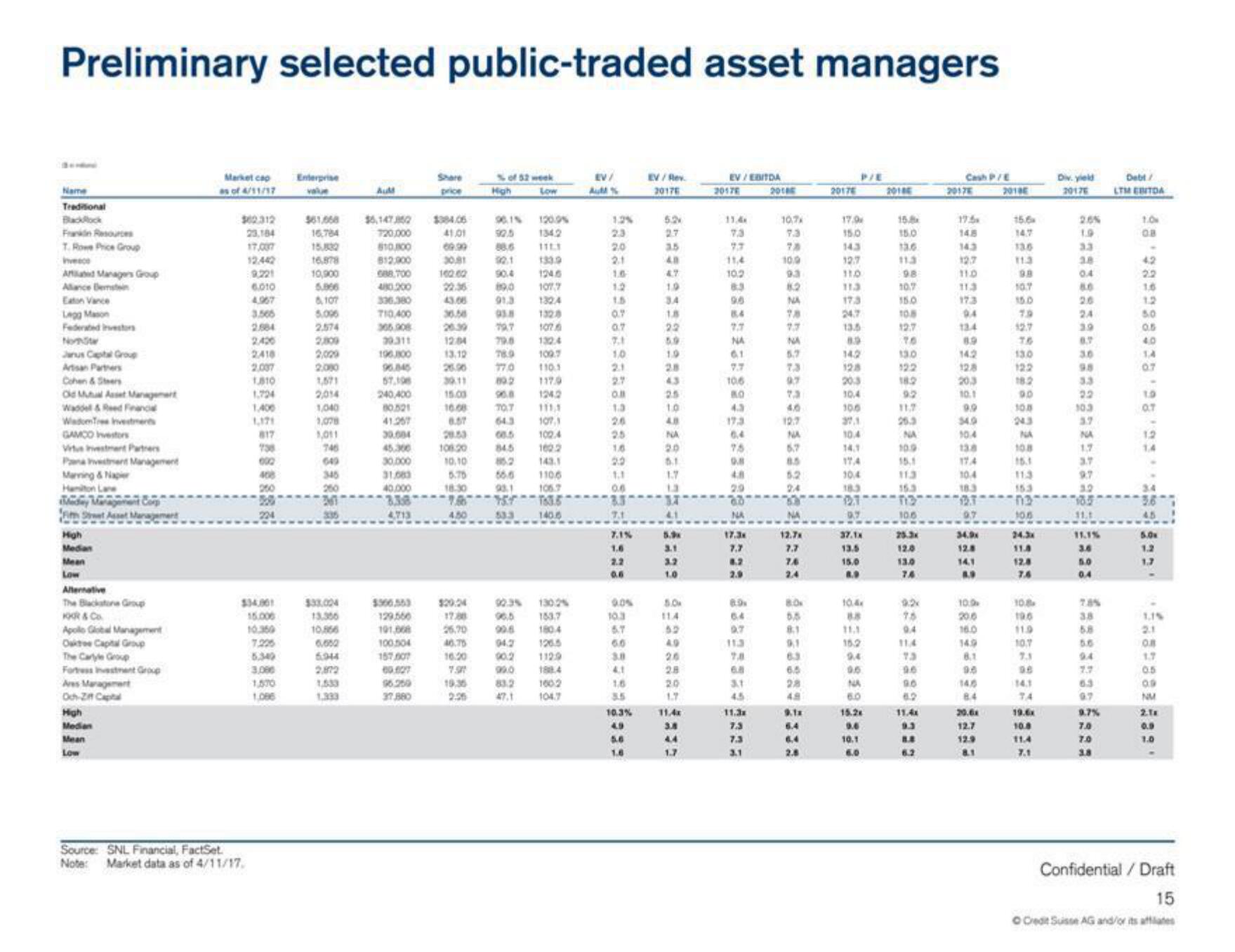

Preliminary selected public-traded asset managers

Name

Traditional

T. Rowe Price Group

Artabed Managers Group

Alliance Bestin

Eaton Vance

Legg Mason

Janus Capital Group

Artisan Parthers

Cohen &Steers

Old Mutual Asset Management

Waddel&Reed Finance

WadomTree Investments

GAMCO Investors

Pana Investment Management

Marving & Napier

Hamiton Lane

Buday Management Corp

Fim Set Asset Management

High

Median

Mean

Low

Alternative

The Blackstone Group

KOOR & Co.

Apollo Global Management

Oakto Capital Group

The Carlyle Group

Fortress Investment Group

Ares Management

Och-Ziff Capital

High

Median

Mean

Low

Market cap

$62312

23,184

17,007

12:442

9,221

6.010

4.967

3.506

2.884

2.426

2418

2.007

Source: SNL Financial, FactSet

Note: Market data as of 4/11/17.

1.810

1,724

1,400

1,171

817

738

002

200

$34.001

15.000

10.360

3,000

1,570

1,086

Enterprise

16,784

15,832

16.878

10,900

6,107

5,096

2.574

2,090

1,571

2014

1,040

1,078

1,011

746

260

M

$33.004

10.866

6.652

6.944

2.872

1.333

AuM

720,000

810,800

812,900

688,700

480.200

336.380

710,400

305.908

30.311

196.300

96.845

57.198

240,400

80.521

41.267

30.004

30.000

31,083

40.000

3.38

4,713

191,068

100.504

157.007

60.627

96.259

37.880

Share

price

41.01

69.99

102.62

43.06

36.58

26.39

12.04

13.12

26.90

30.11

15.00

16.08

8.57

$20.24

17.88

26,70

40.75

16.20

% of 52 week

Low

High

19.36

90.1%

92.5

120.9%

134.2

1113

92.1 133.9

124.6

107,7

1324

890

91.3

93.8

79.7

79.0

78.9

77.0

89.2

1242

70.7 111,1

643

107,1

60.5

845

20.53

106.20

10.10

5.70

1106

18.30

93.1

106.7

78 157 13.5

4.50

533 140.6

1076

132.4

109.7

110.1

85.2

66.6

92.3%

100.4

160.2

143.1

163.7

90.6

1804

94.2

126.5

00.2 1129

99.0

83.2 1602

47.1

104.7

EV/

2.3

20

21

12

0.7

0.7

1,0

2.1

2.7

O.B

1.3

26

2.5

1.6

0.6

7.1%

1.6

2.2

0.6

9.05

10.3

6.7

6.0

3.8

1.6

10.3%

4.9

5.6

1.6

EV/Rev.

30176

5.2

27

40

4.7

3.4

22

4.3

2.5

1.0

4.B

NA

6.1

1.7

13

5.9

3.1

3.2

1.0

5.0

11.4

20

11.4x

3.8

44

1.7

EV/EBITDA

2017E

11.4

7.3

7.7

11,4

10.2

9.6

8.4

NA

6.1

10.6

80

4.3

17.3

75

9.8

4.8

2.9

ad

17.3

7.7

8.2

8.9

6.4

9.7

113

6.8

3.1

45

11.3x

7.3

3.1

2016

10,7

78

10.0

NA

7.7

NA

5.7

7.3

4.0

12.7

NA

5.2

24

12.7x

7.6

2.4

80x

5.5

8.1

9.1

6.3

6.5

9.1x

6.4

6.4

2.8

20176

P/E

17.9

15.0

143

12.7

11.0

11.3

17.3

24.7

13.5

8.3

142

128

10.4

10.6

37.1

10.4

17,4

10,4

27

0.7

37.1x

13.5

15.0

8.9

10.4

15.2

05

NA

15.2x

9.6

10.1

6.0

20186

15.8

15.0

11.3

98

10.7

15.0

108

12.7

13.0

12.2

18.2

9.2

11,7

25.3

NA

10.9

15.1

11.3

16.3

113

10.6

25.3x

12.0

13.0

7.4

9:2

04

73

9.0

6.2

11.4x

6.2

Cash P/E

20176

17.5

14.3

12.7

11.0

11.3

17.3

9.4

13.4

14.2

128

10.1

9.9

54.9

10.4

138

174

10.4

12.3

9.7

34.9x

12.8

14.1

8.9

10.9

200

16.0

8.1

14.0

8.4

20.6x

12.7

12.9

8.1

2018E

15.6

14.7

136

11.3

10.7

1.9

12.7

7.6

13.0

122

182

90

108

243

NA

108

153

na

10.6

24.3x

11.8

12.8

7.4

10.8

196

11.9

10.7

7.3

14.1

TA

19.6x

10.8

11.4

7.1

Div. yield

20176

1.9

33

3.8

8.0

24

6.7

3.0

9.8

3.3

22

10.3

3.7

NA

1,7

3.7

9.7

32

11.1%

3.6

5.0

0.4

7.85

3.8

6.3

0.7

9.7%

7.0

7.0

3.8

Debt/

LTM EBITDA

1.0

OB

-

42

22

1.6

12

5.0

0.5

40

14

0.7

.

1.9

O.T

1.1%

2.1

0.8

0.5

09

NM

2.TM

0.9

1.0

Confidential / Draft

15

O Credit Suisse AG and/or its affiliatesView entire presentation