J.P.Morgan Investment Banking Pitch Book

APPENDIX

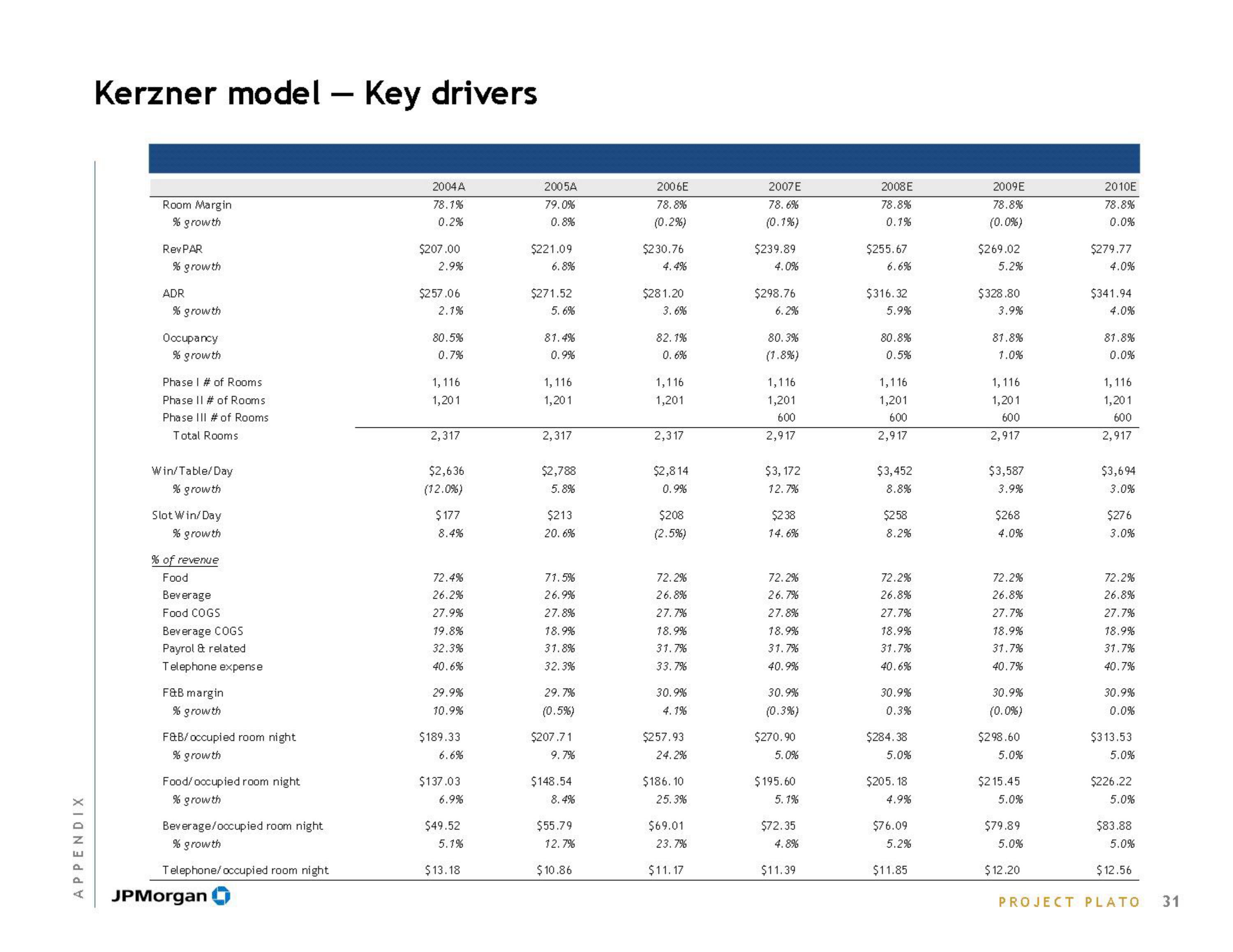

Kerzner model

Room Margin

% growth

Rev PAR

% growth

ADR

% growth

Occupancy

% growth

Phase I # of Rooms

Phase II # of Rooms

Phase III # of Rooms

Total Rooms

Win/Table/Day

% growth

Slot Win/Day

% growth

% of revenue

Food

Beverage

Food COGS

Beverage COGS

Payrol & related

Telephone expense

F&B margin

% growth

F&B/ occupied room night

% growth

Food/occupied room night

% growth

-

- Key drivers

Beverage/occupied room night

% growth

Telephone/occupied room night

JPMorgan

2004A

78.1%

0.2%

$207.00

2.9%

$257.06

2.1%

80.5%

0.7%

1,116

1,201

2,317

$2,636

(12.0%)

$177

8.4%

72.4%

26.2%

27.9%

19.8%

32.3%

40.6%

29.9%

10.9%

$189.33

6.6%

$137.03

6.9%

$49.52

5.1%

$13.18

2005A

79.0%

0.8%

$221.09

6.8%

$271.52

5.6%

81.4%

0.9%

1,116

1,201

2,317

$2,788

5.8%

$213

20.6%

71.5%

26.9%

27.8%

18.9%

31.8%

32.3%

29.7%

(0.5%)

$207.71

9.7%

$148.54

8.4%

$55.79

12.7%

$10.86

2006E

78.8%

(0.2%)

$230.76

4.4%

$281.20

3.6%

82.1%

0.6%

1,116

1,201

2,317

$2,814

0.9%

$208

(2.5%)

72.2%

26.8%

27.7%

18.9%

31.7%

33.7%

30.9%

4.1%

$257.93

24.2%

$186.10

25.3%

$69.01

23.7%

$11.17

2007 E

78.6%

(0.1%)

$239.89

4.0%

$298.76

6.2%

80.3%

(1.8%)

1,116

1,201

600

2,917

$3,172

12.7%

$238

14.6%

72.2%

26.7%

27.8%

18.9%

31.7%

40.9%

30.9%

(0.3%)

$270.90

5.0%

$195.60

5.1%

$72.35

4.8%

$11.39

2008 E

78.8%

0.1%

$255.67

6.6%

$316.32

5.9%

80.8%

0.5%

1,116

1,201

600

2,917

$3,452

8.8%

$258

8.2%

72.2%

26.8%

27.7%

18.9%

31.7%

40.6%

30.9%

0.3%

$284.38

5.0%

$205.18

4.9%

$76.09

5.2%

$11.85

2009E

78.8%

(0.0%)

$269.02

5.2%

$328.80

3.9%

81.8%

1.0%

1,116

1,201

600

2,917

$3,587

3.9%

$268

4.0%

72.2%

26.8%

27.7%

18.9%

31.7%

40.7%

30.9%

(0.0%)

$298.60

5.0%

$215.45

5.0%

$79.89

5.0%

$12.20

2010E

78.8%

0.0%

$279.77

4.0%

$341.94

4.0%

81.8%

0.0%

1,116

1,201

600

2,917

$3,694

3.0%

$276

3.0%

72.2%

26.8%

27.7%

18.9%

31.7%

40.7%

30.9%

0.0%

$313.53

5.0%

$226.22

5.0%

$83.88

5.0%

$12.56

PROJECT PLATO 31View entire presentation