Crocs Investor Presentation Deck

NON-GAAP RECONCILIATION (cont'd)

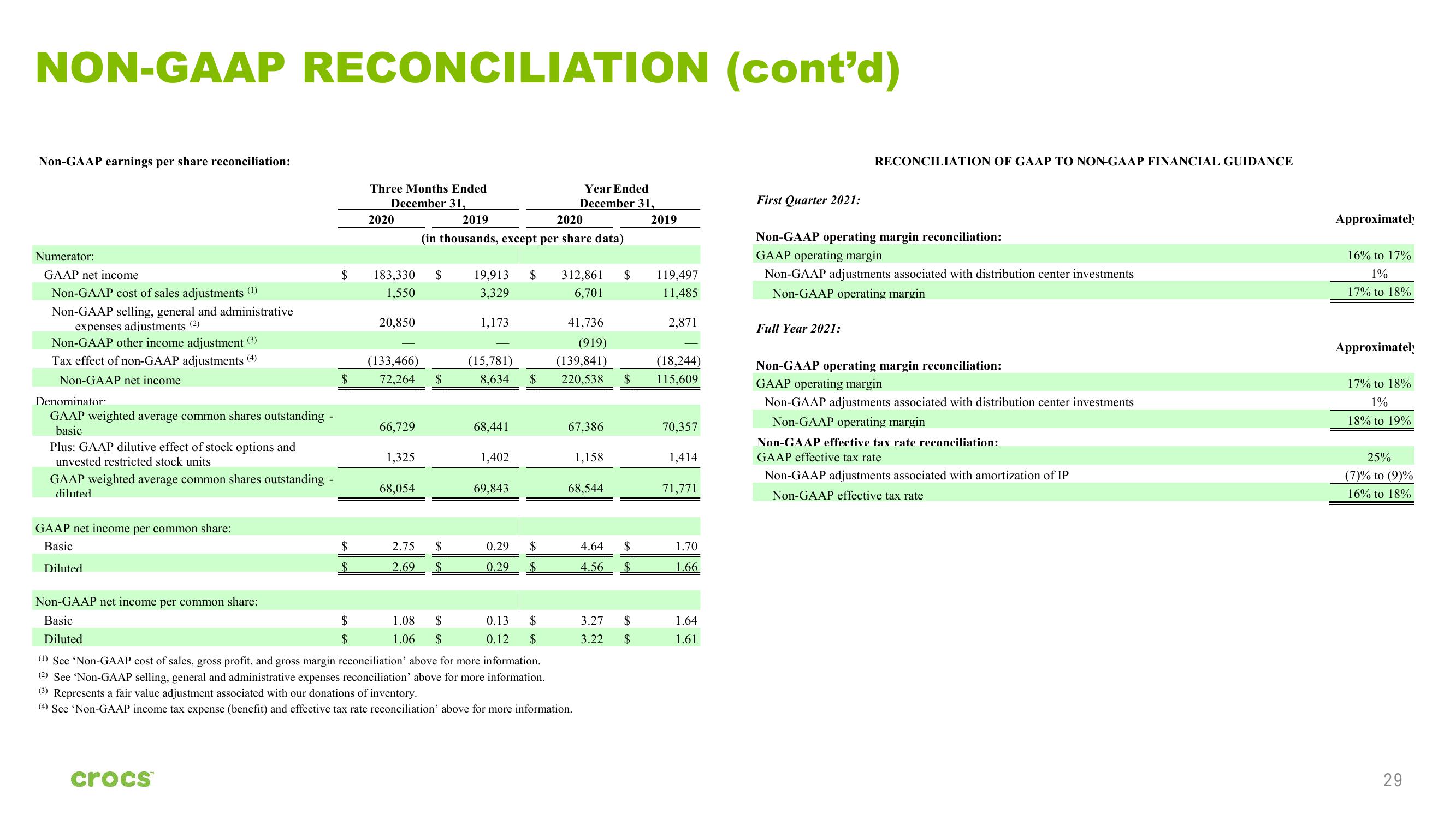

Non-GAAP earnings per share reconciliation:

Numerator:

GAAP net income

Non-GAAP cost of sales adjustments (¹)

Non-GAAP selling, general and administrative

expenses adjustments (2)

Non-GAAP other income adjustment (3)

Tax effect of non-GAAP adjustments (4)

Non-GAAP net income

Denominator:

GAAP weighted average common shares outstanding

basic

Plus: GAAP dilutive effect of stock options and

unvested restricted stock units

GAAP weighted average common shares outstanding -

diluted

GAAP net income per common share:

Basic

Diluted

Non-GAAP net income per common share:

Basic

Diluted

$

crocs™

$

$

$

$

$

Three Months Ended

December 31,

2020

183,330 $

1,550

20,850

(133,466)

72,264 $

66,729

1,325

2020

2019

(in thousands, except per share data)

68,054

2.75 $

2.69

1.08 $

1.06 $

19,913 $ 312,861

3,329

6,701

1,173

(15,781)

8,634

68,441

1,402

69,843

$

0.29 $

0.29 $

Year Ended

December 31,

0.13 $

0.12 $

41,736

(919)

(139,841)

220,538 $

67,386

(1) See 'Non-GAAP cost of sales, gross profit, and gross margin reconciliation' above for more information.

(2) See 'Non-GAAP selling, general and administrative expenses reconciliation' above for more information.

(3) Represents a fair value adjustment associated with our donations of inventory.

(4) See 'Non-GAAP income tax expense (benefit) and effective tax rate reconciliation' above for more information.

1,158

68,544

$

4.64 $

4.56

$

3.27 $

EA SA

3.22 $

2019

119,497

11,485

2,871

(18,244)

115,609

70,357

1,414

71,771

1.70

1.66

1.64

1.61

First Quarter 2021:

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL GUIDANCE

Non-GAAP operating margin reconciliation:

GAAP operating margin

Non-GAAP adjustments associated with distribution center investments

Non-GAAP operating margin

Full Year 2021:

Non-GAAP operating margin reconciliation:

GAAP operating margin

Non-GAAP adjustments associated with distribution center investments

Non-GAAP operating margin

Non-GAAP effective tax rate reconciliation:

GAAP effective tax rate

Non-GAAP adjustments associated with amortization of IP

Non-GAAP effective tax rate

Approximately

16% to 17%

1%

17% to 18%

Approximately

17% to 18%

1%

18% to 19%

25%

(7)% to (9)%

16% to 18%

29View entire presentation