eToro SPAC Presentation Deck

48

етого

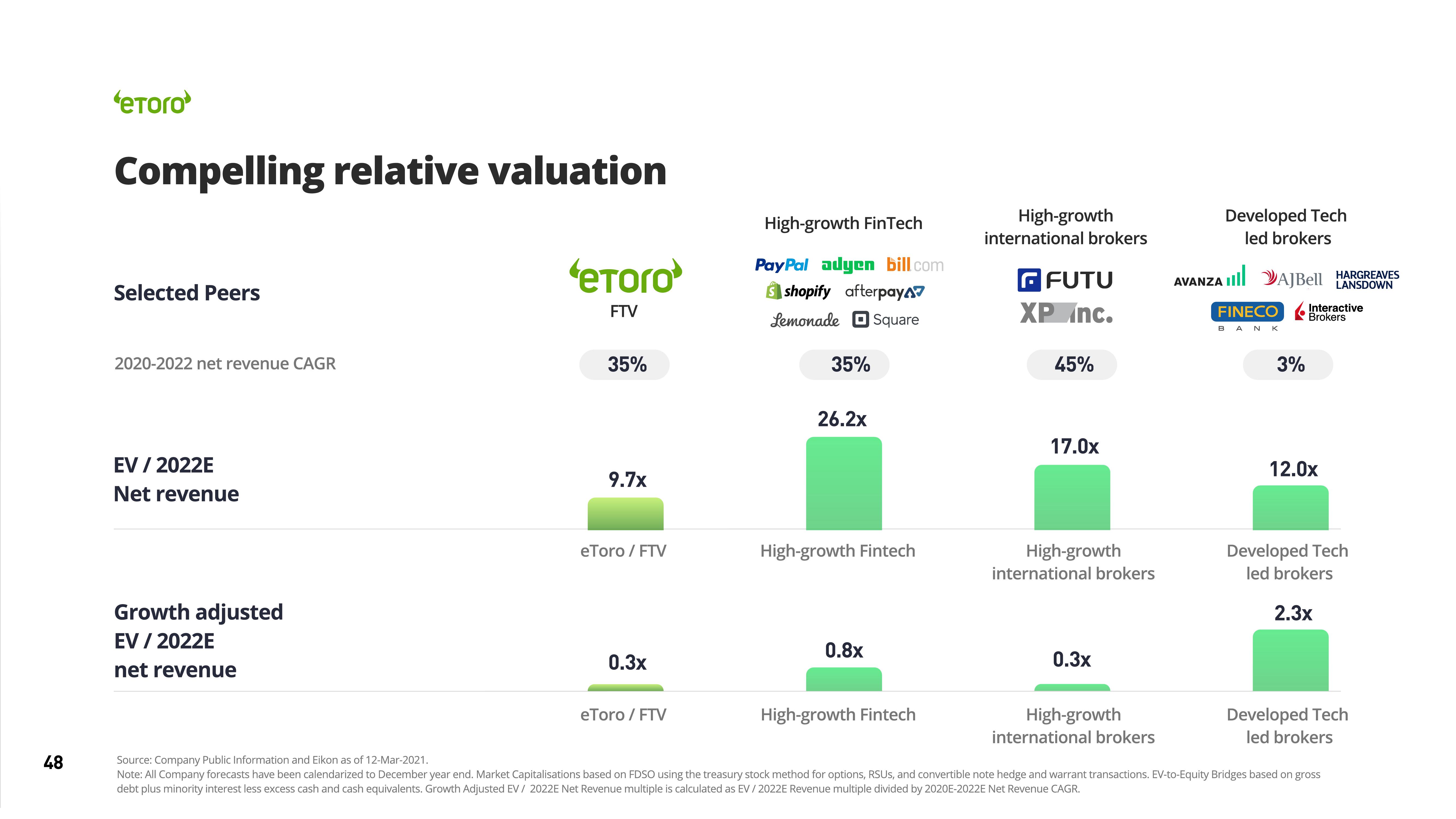

Compelling relative valuation

Selected Peers

2020-2022 net revenue CAGR

EV/ 2022E

Net revenue

Growth adjusted

EV / 2022E

net revenue

етого

FTV

35%

9.7x

eToro / FTV

0.3x

High-growth FinTech

PayPal adyen bill.com

shopify afterpay

Lemonade Square

eToro / FTV

35%

26.2x

High-growth Fintech

0.8x

High-growth

international brokers

High-growth Fintech

GFUTU

XP Inc.

45%

17.0x

High-growth

international brokers

0.3x

Developed Tech

led brokers

AVANZA II AJBell HARGREAVES

LANSDOWN

FINECO

BANK

3%

Interactive

Brokers

12.0x

High-growth

international brokers

Source: Company Public Information and Eikon as of 12-Mar-2021.

Note: All Company forecasts have been calendarized to December year end. Market Capitalisations based on FDSO using the treasury stock method for options, RSUS, and convertible note hedge and warrant transactions. EV-to-Equity Bridges based on gross

debt plus minority interest less excess cash and cash equivalents. Growth Adjusted EV/ 2022E Net Revenue multiple is calculated as EV / 2022E Revenue multiple divided by 2020E-2022E Net Revenue CAGR.

Developed Tech

led brokers

2.3x

Developed Tech

led brokersView entire presentation