Fast Radius SPAC Presentation Deck

Appendix A

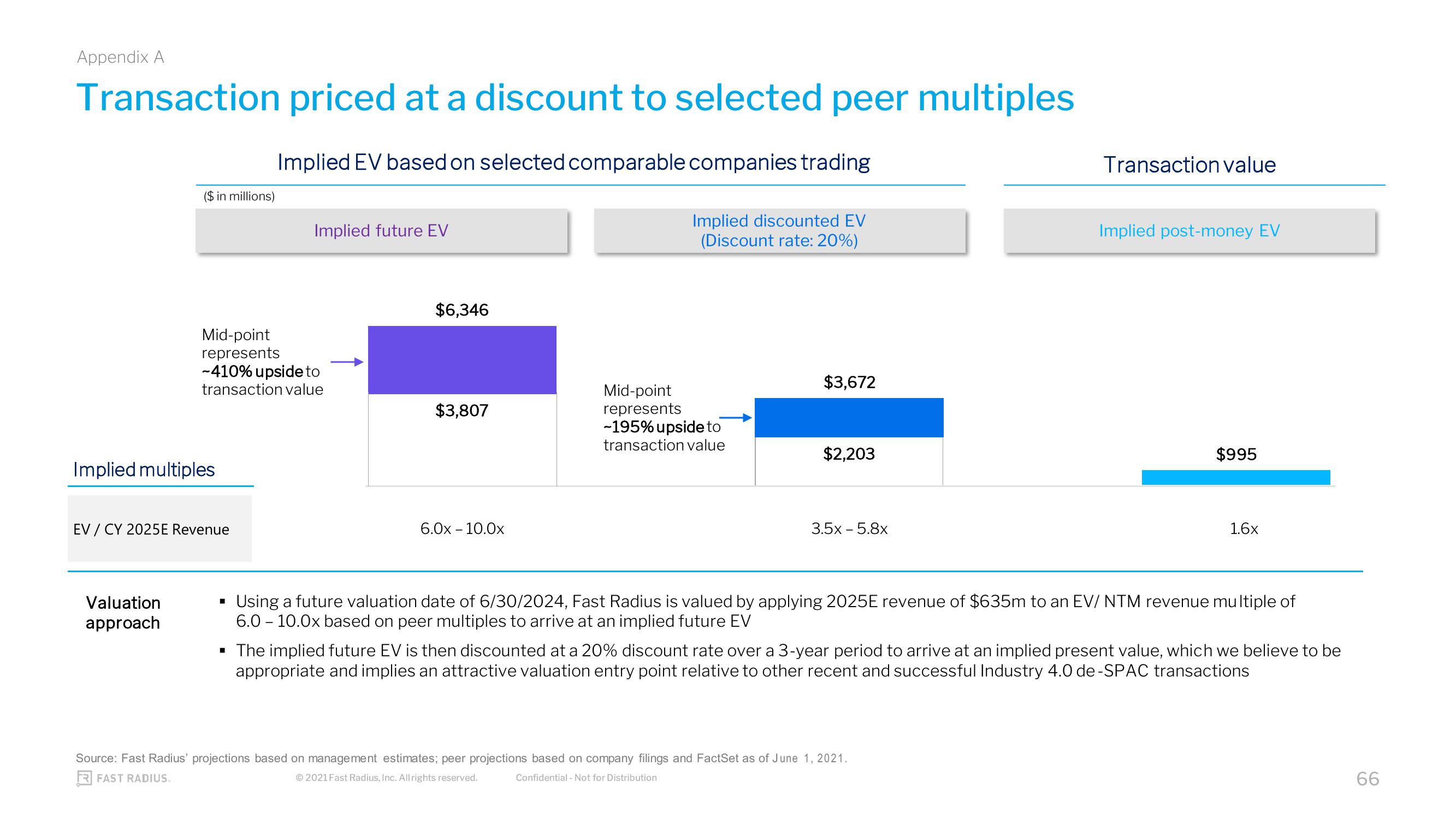

Transaction priced at a discount to selected peer multiples

Implied EV based on selected comparable companies trading

($ in millions)

Implied multiples

Valuation

approach

Mid-point

represents

-410% upside to

transaction value

EV / CY 2025E Revenue

Implied future EV

■

$6,346

$3,807

6.0x - 10.0x

Mid-point

represents

Implied discounted EV

(Discount rate: 20%)

-195% upside to

transaction value

$3,672

$2,203

3.5x − 5.8x

Transaction value

Implied post-money EV

Source: Fast Radius' projections based on management estimates; peer projections based on company filings and FactSet as of June 1, 2021.

FR FAST RADIUS.

© 2021 Fast Radius, Inc. All rights reserved.

Confidential - Not for Distribution

$995

1.6x

Using a future valuation date of 6/30/2024, Fast Radius is valued by applying 2025E revenue of $635m to an EV/ NTM revenue multiple of

6.0 10.0x based on peer multiples to arrive at an implied future EV

▪ The implied future EV is then discounted at a 20% discount rate over a 3-year period to arrive at an implied present value, which we believe to be

appropriate and implies an attractive valuation entry point relative to other recent and successful Industry 4.0 de-SPAC transactions

66View entire presentation