First Citizens BancShares Results Presentation Deck

Net interest income and margin rate sensitivity

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

(5.0)%

(10.0)% (9.0)%

(15.0)%

(20.0) (18.9)%

(25.0)%

Down

200

(4.5)%

(9.4)%

Down

100

(1.1)%

4Q23

(2.3)%

Down 25

Shock

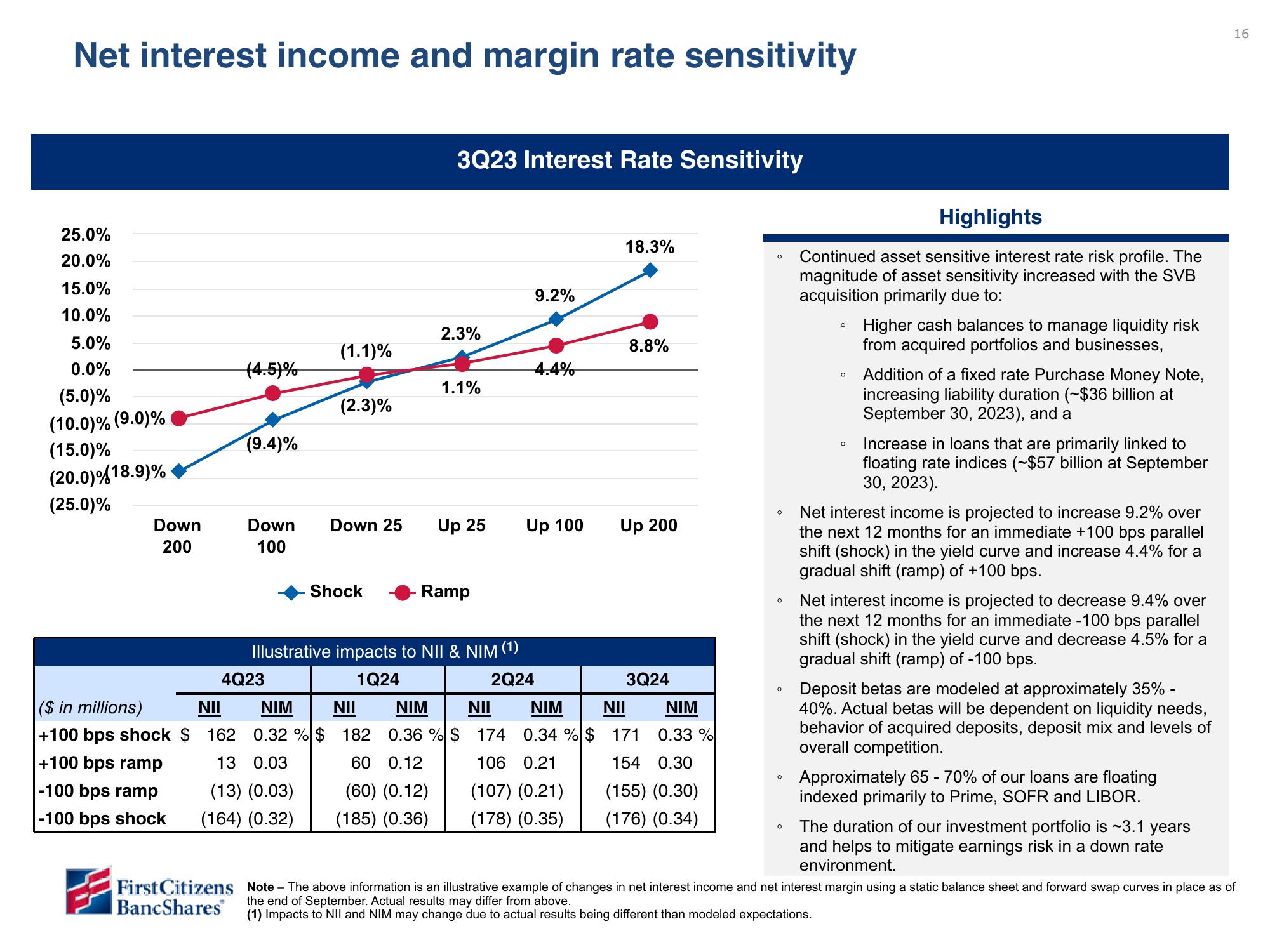

3Q23 Interest Rate Sensitivity

($ in millions)

NII NIM NII

+100 bps shock $ 162 0.32 %$ 182

+100 bps ramp

-100 bps ramp

-100 bps shock

13

0.03

(13) (0.03)

(164) (0.32)

2.3%

1.1%

Up 25

Ramp

Illustrative impacts to NII & NIM (1)

1Q24

2Q24

9.2%

4.4%

NIM NII

0.36 % $ 174

60 0.12

(60) (0.12)

(185) (0.36)

Up 100

18.3%

8.8%

Up 200

3Q24

NIM NII

0.34 %$ 171

106 0.21

(107) (0.21)

(178) (0.35)

NIM

0.33%

154 0.30

(155) (0.30)

(176) (0.34)

0

O

O

O

O

Highlights

Continued asset sensitive interest rate risk profile. The

magnitude of asset sensitivity increased with the SVB

acquisition primarily due to:

O

O

O

O

Higher cash balances to manage liquidity risk

from acquired portfolios and businesses,

Addition of a fixed rate Purchase Money Note,

increasing liability duration (-$36 billion at

September 30, 2023), and a

Increase in loans that are primarily linked to

floating rate indices (~$57 billion at September

30, 2023).

Net interest income is projected to increase 9.2% over

the next 12 months for an immediate +100 bps parallel

shift (shock) in the yield curve and increase 4.4% for a

gradual shift (ramp) of +100 bps.

Net interest income is projected to decrease 9.4% over

the next 12 months for an immediate -100 bps parallel

shift (shock) in the yield curve and decrease 4.5% for a

gradual shift (ramp) of -100 bps.

Deposit betas are modeled at approximately 35% -

40%. Actual betas will be dependent on liquidity needs,

behavior of acquired deposits, deposit mix and levels of

overall competition.

Approximately 65 - 70% of our loans are floating

indexed primarily to Prime, SOFR and LIBOR.

16

The duration of our investment portfolio is ~3.1 years

and helps to mitigate earnings risk in a down rate

environment.

First Citizens Note - The above information is an illustrative example of changes in net interest income and net interest margin using a static balance sheet and forward swap curves in place as of

BancShares

the end of September. Actual results may differ from above.

(1) Impacts to NII and NIM may change due to actual results being different than modeled expectations.View entire presentation