J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

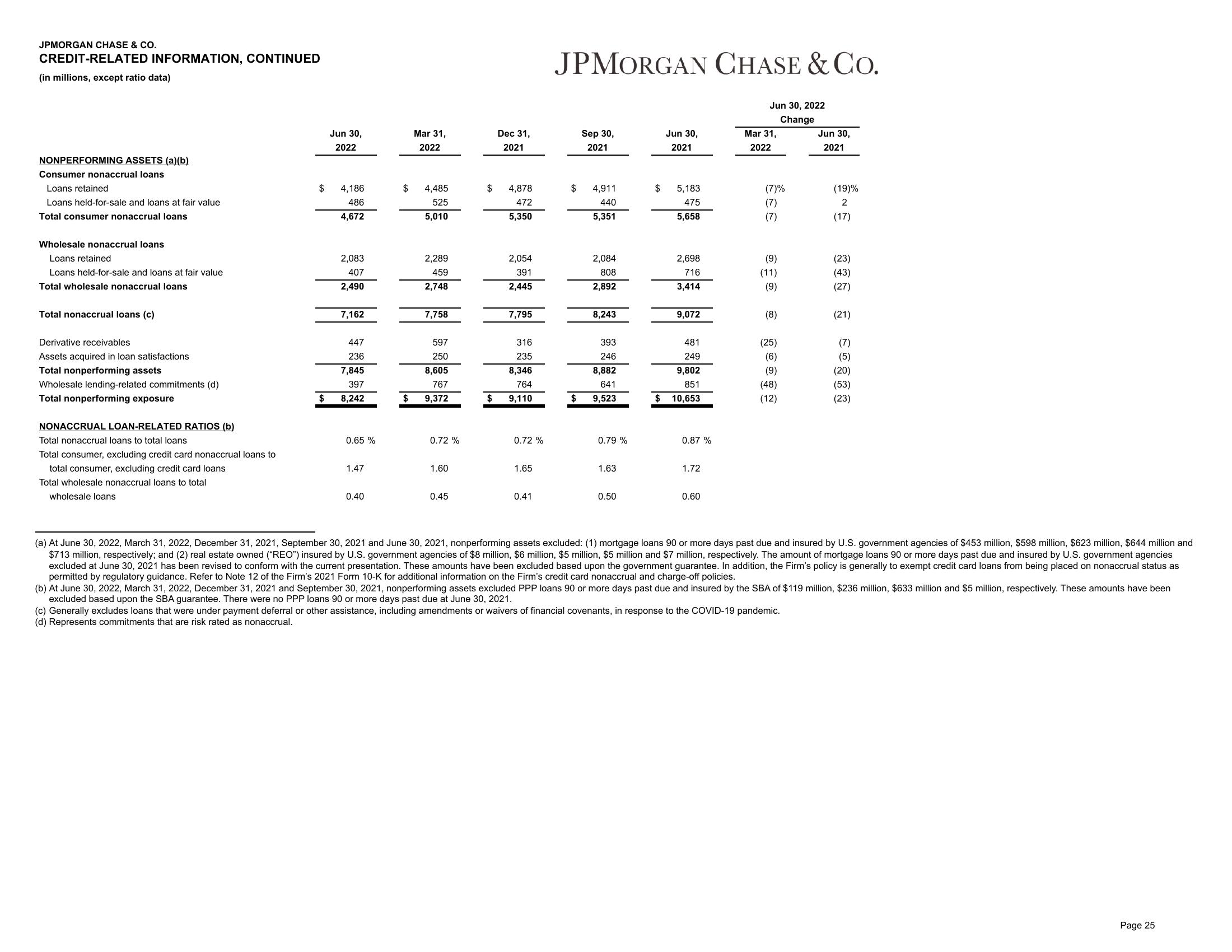

CREDIT-RELATED INFORMATION, CONTINUED

(in millions, except ratio data)

NONPERFORMING ASSETS (a)(b)

Consumer nonaccrual loans

Loans retained

Loans held-for-sale and loans at fair value

Total consumer nonaccrual loans

Wholesale nonaccrual loans

Loans retained

Loans held-for-sale and loans at fair value

Total wholesale nonaccrual loans

Total nonaccrual loans (c)

Derivative receivables

Assets acquired in loan satisfactions

Total nonperforming assets

Wholesale lending-related commitments (d)

Total nonperforming exposure

NONACCRUAL LOAN-RELATED RATIOS (b)

Total nonaccrual loans to total loans

Total consumer, excluding credit card nonaccrual loans to

total consumer, excluding credit card loans

Total wholesale nonaccrual loans to total

wholesale loans

$

$

Jun 30,

2022

4,186

486

4,672

2,083

407

2,490

7,162

447

236

7,845

397

8,242

0.65 %

1.47

0.40

Mar 31,

2022

4,485

525

5,010

2,289

459

2,748

7,758

597

250

8,605

767

$ 9,372

0.72%

1.60

0.45

Dec 31,

2021

4,878

472

5,350

2,054

391

2,445

7,795

316

235

8,346

764

$ 9,110

0.72%

1.65

0.41

JPMORGAN CHASE & CO.

$

Sep 30,

2021

4,911

440

5,351

2,084

808

2,892

8,243

393

246

8,882

641

$ 9,523

0.79%

1.63

0.50

$

$

Jun 30,

2021

5,183

475

5,658

2,698

716

3,414

9,072

481

249

9,802

851

10,653

0.87%

1.72

0.60

Jun 30, 2022

Change

Mar 31,

2022

(7)%

(7)

(7)

(9)

(11)

(9)

(8)

(25)

(6)

(9)

(48)

(12)

Jun 30,

2021

(19)%

2

(17)

(c) Generally excludes loans that were under payment deferral or other assistance, including amendments or waivers of financial covenants, in response to the COVID-19 pandemic.

(d) Represents commitments that are risk rated as nonaccrual.

(23)

(43)

(27)

(21)

(7)

(5)

(20)

(53)

(23)

(a) At June 30, 2022, March 31, 2022, December 31, 2021, September 30, 2021 and June 30, 2021, nonperforming assets excluded: (1) mortgage loans 90 or more days past due and insured by U.S. government agencies of $453 million, $598 million, $623 million, $644 million and

$713 million, respectively; and (2) real estate owned ("REO") insured by U.S. government agencies of $8 million, $6 million, $5 million, $5 million and $7 million, respectively. The amount of mortgage loans 90 or more days past due and insured by U.S. government agencies

excluded at June 30, 2021 has been revised to conform with the current presentation. These amounts have been excluded based upon the government guarantee. In addition, the Firm's policy is generally to exempt credit card loans from being placed on nonaccrual status as

permitted by regulatory guidance. Refer to Note 12 of the Firm's 2021 Form 10-K for additional information on the Firm's credit card nonaccrual and charge-off policies.

(b) At June 30, 2022, March 31, 2022, December 31, 2021 and September 30, 2021, nonperforming assets excluded PPP loans 90 or more days past due and insured by the SBA of $119 million, $236 million, $633 million and $5 million, respectively. These amounts have been

excluded based upon the SBA guarantee. There were no PPP loans 90 or more days past due at June 30, 2021.

Page 25View entire presentation