Credit Suisse Investment Banking Pitch Book

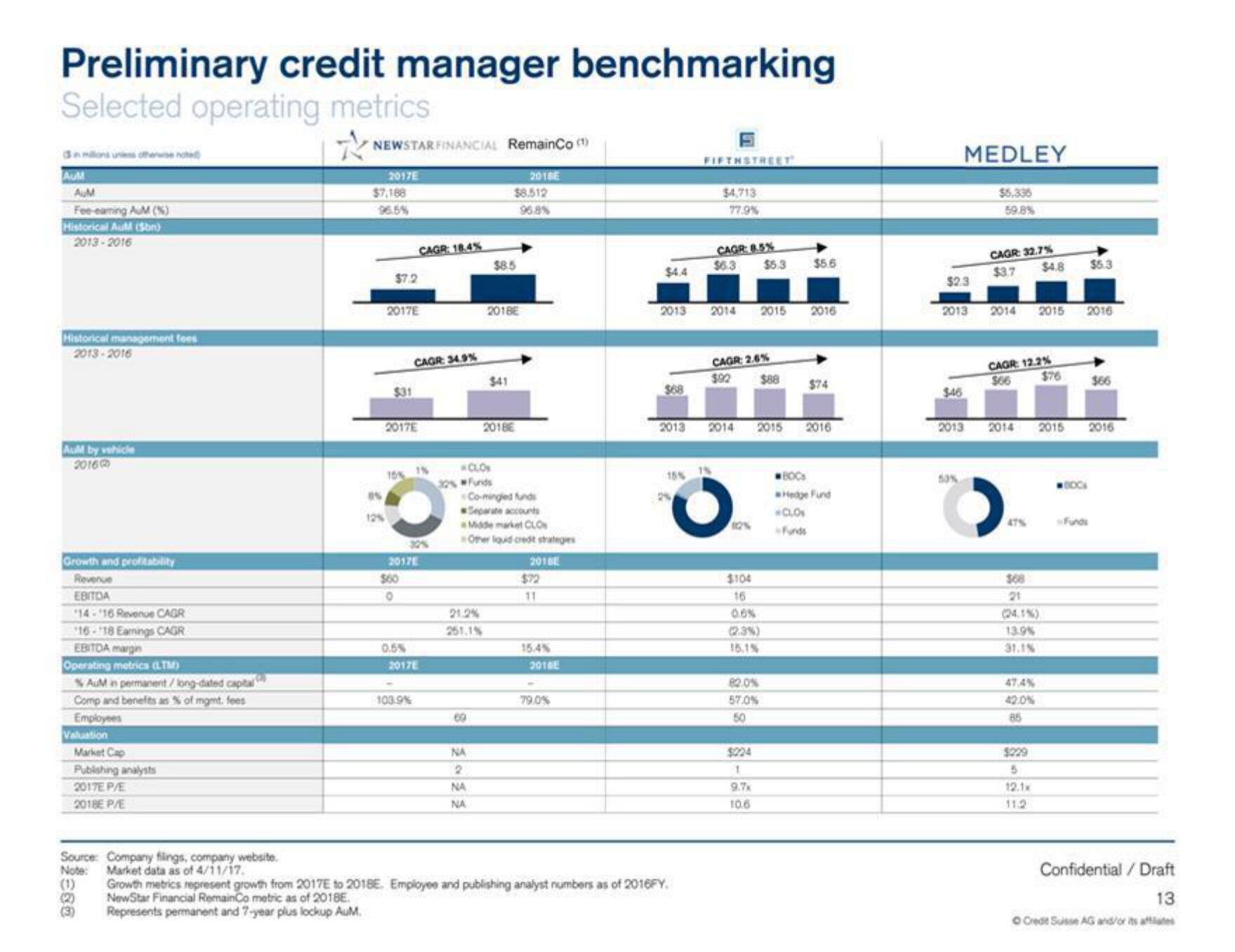

Preliminary credit manager benchmarking

Selected operating metrics

NEWSTAR FINANCIAL RemainCo (¹)

AUM

AUM

Fee-eaming AuM (%)

Historical AuM (bn)

2013-2016

Historical management fees

2013-2016

AuM by vehicle

2016

Growth and profitability

Revenue

EBITDA

14-16 Revenue CAGR

16-18 Earnings CAGR

EBITDA margin

Operating metrics (LTM)

% AuM in permanent/long-dated capital

Comp and benefits as % of mgmt. fees

Employees

Valuation

Market Cap

Publishing analysts

2017E P/E

2018EP/E

Source: Company filings, company website.

Note: Market data as of 4/11/17.

(1)

(2)

(3)

2017E

$7,168

96.5%

05

12%

$7.2

2017E

$31

2017E

16% 1%

2017E

O

CAGR: 18.4%

CAGR: 34.9%

0.5%

103.9%

2017E

69

21.2%

251.1%

CLO

NA

2

NA

NA

$8.512

96.8%

$8.5

2018E

2018E

2016E

Co-mingled funds

Separate accounts

Midde market CLO

Other liquid credit strateges

2018E

$72

11

15.4%

2016E

79.0%

2013

$68

2013

15%

2%

Growth metrics represent growth from 2017E to 2018E. Employee and publishing analyst numbers as of 2016FY.

NewStar Financial RemainCo metric as of 2018E.

Represents permanent and 7-year plus lockup AuM.

FIFTHSTREET

$4,713

77.9%

CAGR: 8.5%

$6.3 $5.3

2014

18

CAGR: 2.6%

$92 $88

$104

2014 2015 2016

16

0.6%

(2.3%)

15.1%

82.0%

57.0%

50

2015

$224

1

9.7x

10.6

$5.6

2016

$74

600s

Hedge Fund

CLOS

Funds

$46

MEDLEY

$6.336

59.8%

$2.3

2013 2014 2015 2016

50%

CAGR: 32.7%

$4.8 $5.3

$3.7

CAGR: 12.2%

$76

$66

2013 2014 2015 2016

47%

168

21

(24.1%

13.9%

31,1%

47.4%

42.0%

85

5

12.1x

BOCK

$66

Funds

Confidential / Draft

13

O Credit Suisse AG and/or its affiliatesView entire presentation