Main Street Capital Fixed Income Presentation Deck

Portfolio Highlights (1)

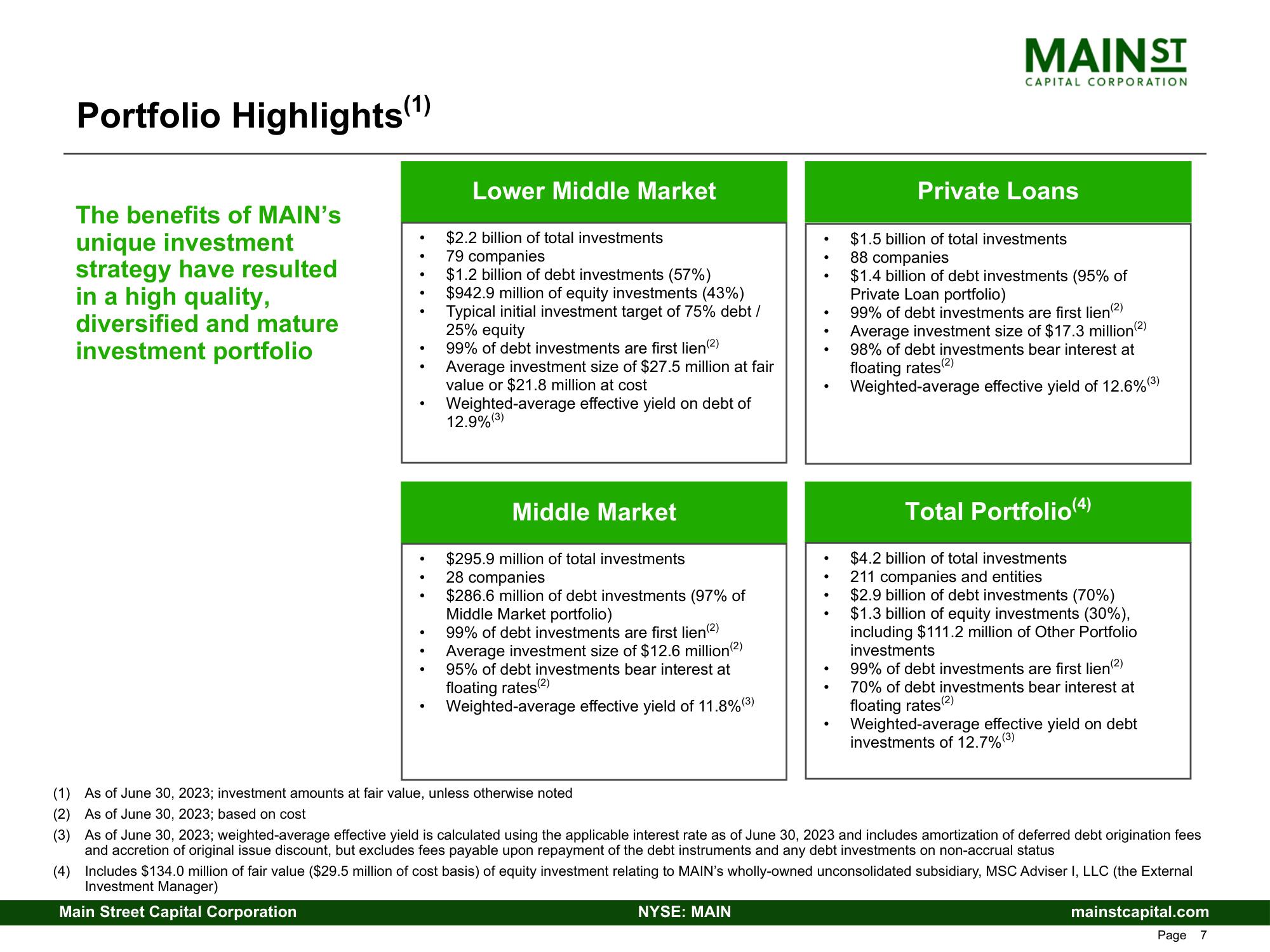

The benefits of MAIN's

unique investment

strategy have resulted

in a high quality,

diversified and mature

investment portfolio

●

●

●

.

Lower Middle Market

$2.2 billion of total investments

79 companies

$1.2 billion of debt investments (57%)

$942.9 million of equity investments (43%)

Typical initial investment target of 75% debt /

25% equity

99% of debt investments are first lien(²)

Average investment size of $27.5 million at fair

value or $21.8 million at cost

Weighted-average effective yield on debt of

12.9% (3)

Middle Market

$295.9 million of total investments

28 companies

$286.6 million of debt investments (97% of

Middle Market portfolio)

99% of debt investments are first lien(2)

Average investment size of $12.6 million (2)

95% of debt investments bear interest at

floating rates (2)

Weighted-average effective yield of 11.8% (³)

.

●

NYSE: MAIN

●

●

●

●

MAIN ST

CAPITAL CORPORATION

Private Loans

$1.5 billion of total investments

88 companies

$1.4 billion of debt investments (95% of

Private Loan portfolio)

99% of debt investments are first lien(²)

Average investment size of $17.3 million (2)

98% of debt investments bear interest at

floating rates (2)

Weighted-average effective yield of 12.6% (³)

Total Portfolio(4)

$4.2 billion of total investments

211 companies and entities

$2.9 billion of debt investments (70%)

$1.3 billion of equity investments (30%),

including $111.2 million of Other Portfolio

investments

99% of debt investments are first lien (²)

70% of debt investments bear interest at

floating rates (2)

Weighted-average effective yield on debt

investments of 12.7% (³)

(1) As of June 30, 2023; investment amounts at fair value, unless otherwise noted

(2) As of June 30, 2023; based on cost

(3) As of June 30, 2023; weighted-average effective yield is calculated using the applicable interest rate as of June 30, 2023 and includes amortization of deferred debt origination fees

and accretion of original issue discount, but excludes fees payable upon repayment of the debt instruments and any debt investments on non-accrual status

(4) Includes $134.0 million of fair value ($29.5 million of cost basis) of equity investment relating to MAIN's wholly-owned unconsolidated subsidiary, MSC Adviser I, LLC (the External

Investment Manager)

Main Street Capital Corporation

mainstcapital.com

Page 7View entire presentation