Hertz Investor Presentation Deck

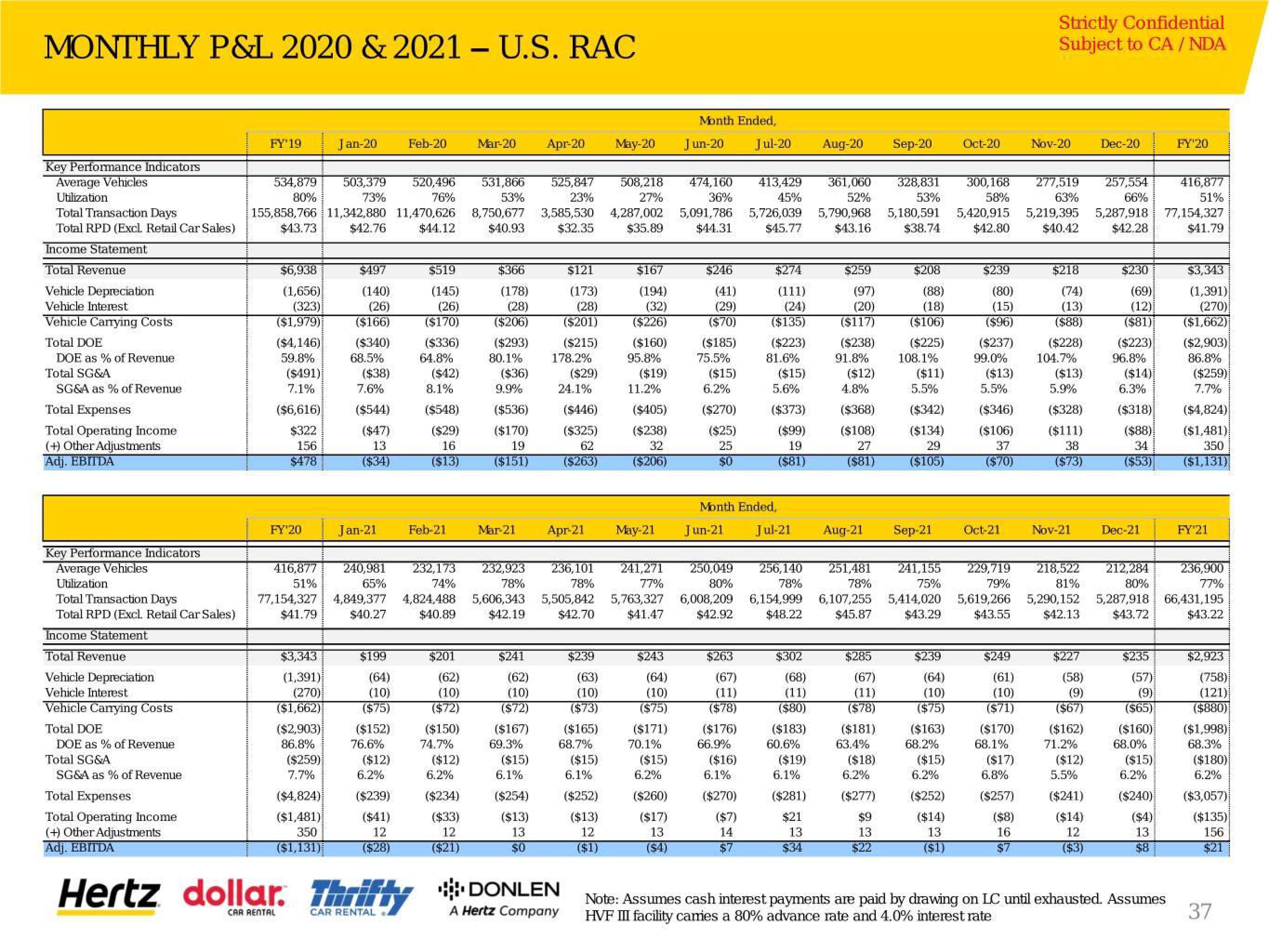

MONTHLY P&L 2020 & 2021 - U.S. RAC

Key Performance Indicators

Average Vehicles

Utilization

Total Transaction Days

Total RPD (Excl. Retail Car Sales)

Income Statement

Total Revenue

Vehicle Depreciation

Vehicle Interest

Vehicle Carrying Costs

Total DOE

DOE as % of Revenue

Total SG&A

SG&A as % of Revenue

Total Expenses

Total Operating Income

(+) Other Adjustments

Adj. EBITDA

Key Performance Indicators

Average Vehicles

Utilization

Total Transaction Days

Total RPD (Excl. Retail Car Sales)

Income Statement

Total Revenue

Vehicle Depreciation

Vehicle Interest

Vehicle Carrying Costs

Total DOE

DOE as % of Revenue

Total SG&A

SG&A as % of Revenue

Total Expenses

Total Operating Income

(+) Other Adjustments

Adj. EBITDA

FY'19

534,879

80%

$6,938

(1,656)

(323)

($1,979)

503,379 520,496 531,866

73%

76%

53%

155,858,766 11,342,880 11,470,626 8,750,677

$43.73 $42.76 $44.12 $40.93

($4,146)

59.8%

($491)

7.1%

($6,616)

$322

156

$478

FY'20

416,877

51%

77,154,327

$41.79

$3,343

(1,391)

(270)

($1,662)

($2,903)

86.8%

($259)

7.7%

($4,824)

($1,481)

350

($1,131)

Jan-20

Hertz dollar.

$497

(140)

(26)

($166)

($340)

68.5%

($38)

7.6%

($544)

($47)

13

($34)

$199

(64)

(10)

($75)

($152)

Feb-20

76.6%

Jan-21 Feb-21

($12)

$519

(145)

(26)

($170)

6.2%

($239)

($41)

12

($28)

($336)

64.8%

($42)

8.1%

($548)

($29)

16

($13)

$201

(62)

(10)

($72)

($150)

74.7%

($12)

Mar-20 Apr-20

6.2%

($234)

($33)

12

($21)

$366

(178)

(28)

($206)

240,981 232,173 232,923 236,101

65%

74%

78%

78%

4,849,377 4,824,488 5,606,343 5,505,842

$40.27 $40.89 $42.19 $42.70

($293)

80.1%

($36)

9.9%

($536)

($170)

19

($151)

$241

(62)

(10)

($72)

($167)

69.3%

($15)

Mar-21 Apr-21

6.1%

($254)

($13)

13

$0

525,847 508,218 474,160

23%

27%

36%

3,585,530 4,287,002 5,091,786

$32.35 $35.89 $44.31

$121

(173)

(28)

($201)

($215)

178.2%

($29)

24.1%

dollar. Thrifty DONLEN

CAR RENTAL

CAR RENTAL

A Hertz Company

($446)

($325)

62

($263)

$239

(63)

(10)

($73)

($165)

68.7%

($15)

6.1%

May-20

($252)

($13)

12

($1)

$167

(194)

(32)

($226)

($160)

95.8%

($19)

11.2%

($405)

($238)

32

($206)

May-21

$243

(64)

(10)

($75)

($171)

70.1%

($15)

Month Ended,

Jun-20 Jul-20 Aug-20 Sep-20 Oct-20

6.2%

($260)

($17)

13

($4)

$246

(41)

(29)

($70)

($185)

75.5%

($15)

6.2%

($270)

($25)

25

$0

$263

(67)

(11)

($78)

($176)

66.9%

($16)

$274

(111)

(24)

($135)

6.1%

($270)

($7)

14

$7

($223)

413,429 361,060 328,831 300,168 277,519 257,554

45%

52%

53%

58%

63%

66%

5,726,039 5,790,968 5,180,591 5,420,915 5,219,395 5,287,918

$45.77 $43.16 $38.74

$42.80

$40.42

$42.28

81.6%

($15)

Month Ended,

Jun-21 Jul-21 Aug-21

5.6%

($373)

($99)

19

($81)

$302

(68)

(11)

($80)

($183)

60.6%

($19)

$259

(97)

(20)

($117)

($238)

6.1%

91.8%

($281)

$21

13

$34

($12)

4.8%

($368)

($108)

27

($81)

$285

(67)

(11)

($78)

($181)

63.4%

($18)

6.2%

($277)

$208

(88)

(18)

($106)

241,271 250,049 256,140 251,481 241,155 229,719 218,522 212,284 236,900

77%

80%

78%

78%

75%

79%

81%

80%

77%

5,763,327 6,008,209 6,154,999 6,107,255 5,414,020 5,619,266 5,290,152 5,287,918 66,431,195

$41.47 $42.92 $48.22 $45.87 $43.29 $43.55

$42.13

$43.72

$43.22

$9

13

$22

($225)

108.1%

Sep-21

($11)

5.5%

($13)

5.5%

($342)

($346)

($134) ($106)

29

37

($70)

($105)

$239

(64)

(10)

($75)

($163)

68.2%

($15)

$239

(80)

(15)

($96)

($237)

6.2%

99.0%

($252)

($14)

13

($1)

Oct-21

$249

(61)

(10)

($71)

($170)

68.1%

Strictly Confidential

Subject to CA/ NDA

($17)

Nov-20

6.8%

($257)

($8)

16

$7

$218

(74)

(13)

($88)

($228)

104.7%

($13)

5.9%

($328)

($111)

38

($73)

Nov-21

$227

(58)

(9)

($67)

($162)

71.2%

($12)

Dec-20

5.5%

($241)

($14)

12

($3)

$230

(69)

(12)

($81)

($223)

96.8%

($14)

6.3%

($318)

($88)

34

($53)

Dec-21

$235

(57)

(9)

($65)

($160)

68.0%

($15)

6.2%

($240)

($4)

13

$8

FY'20

416,877

51%

77,154,327

$41.79

Note: Assumes cash interest payments are paid by drawing on LC until exhausted. Assumes

HVF III facility cames a 80% advance rate and 4.0% interest rate

$3,343

(1,391)

(270)

($1,662)

($2,903)

86.8%

($259)

7.7%

($4,824)

($1,481)

350

($1,131)

FY 21

$2,923

(758)

(121)

($880)

($1,998)

68.3%

($180)

6.2%

($3,057)

($135)

156

$21

37View entire presentation