Ginkgo Investor Conference Presentation Deck

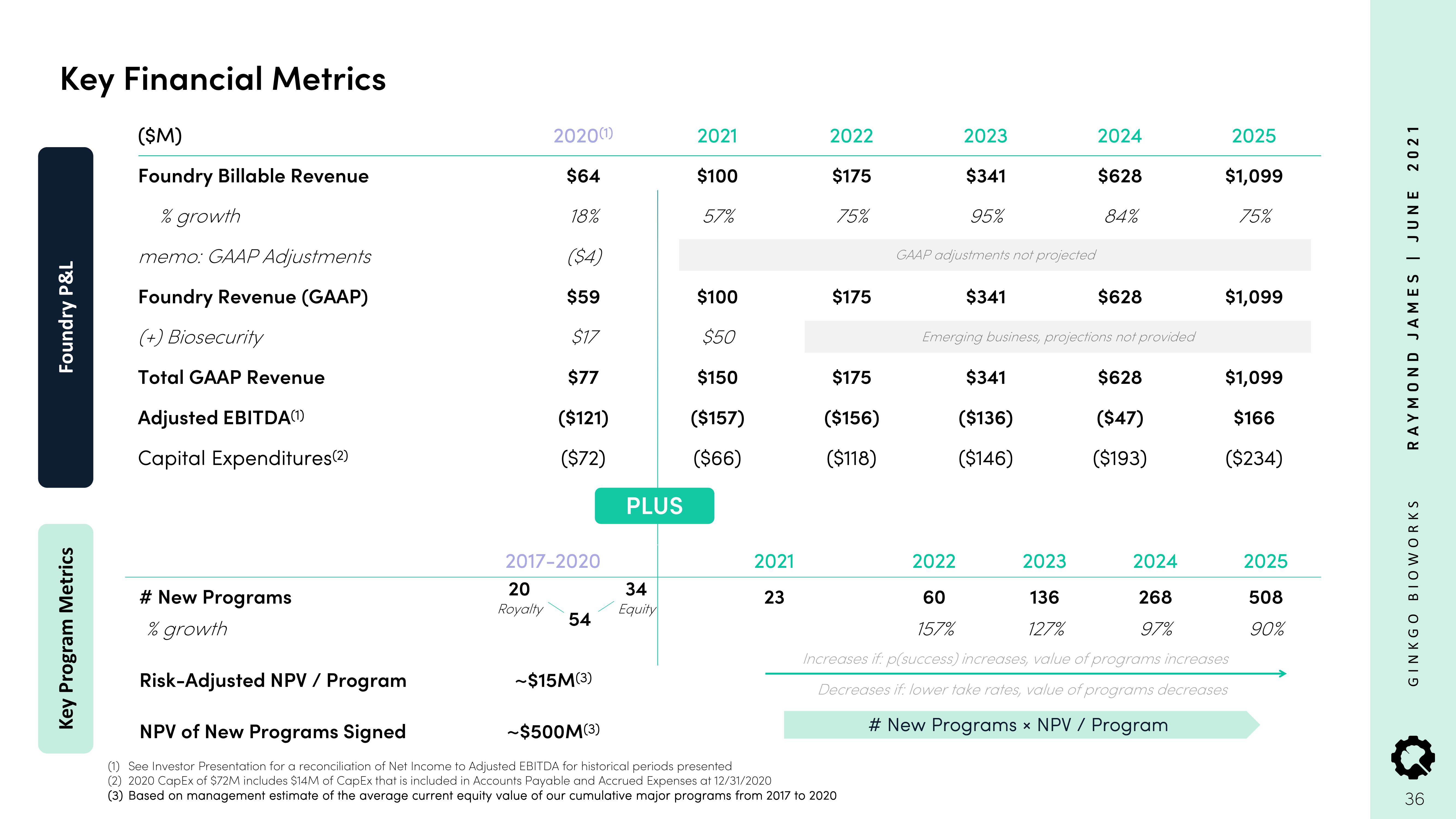

Key Financial Metrics

Foundry P&L

Key Program Metrics

($M)

Foundry Billable Revenue

% growth

memo: GAAP Adjustments

Foundry Revenue (GAAP)

(+) Biosecurity

Total GAAP Revenue

Adjusted EBITDA(1)

Capital Expenditures(2)

2020(1)

$64

18%

($4)

$59

$17

$77

($121)

($72)

2017-2020

20

Royalty

54

~$15M(3)

PLUS

~$500M(3)

34

Equity

2021

$100

57%

$100

$50

$150

($157)

($66)

2021

23

2022

$175

75%

$175

# New Programs

% growth

Risk-Adjusted NPV / Program

NPV of New Programs Signed

(1) See Investor Presentation for a reconciliation of Net Income to Adjusted EBITDA for historical periods presented

(2) 2020 CapEx of $72M includes $14M of CapEx that is included in Accounts Payable and Accrued Expenses at 12/31/2020

(3) Based on management estimate of the average current equity value of our cumulative major programs from 2017 to 2020

$175

($156)

($118)

2023

$341

95%

GAAP adjustments not projected

$341

2024

$628

84%

$628

Emerging business, projections not provided

$628

($47)

($193)

$341

($136)

($146)

2022

60

157%

2025

2024

268

97%

$1,099

75%

2023

136

127%

Increases if: p(success) increases, value of programs increases

Decreases if: lower take rates, value of programs decreases

# New Programs x NPV / Program

$1,099

$1,099

$166

($234)

2025

508

90%

2021

RAYMOND JAMES | JUNE

GINKGO BIOWORKS

36View entire presentation