Inovalon Mergers and Acquisitions Presentation Deck

Financial Table

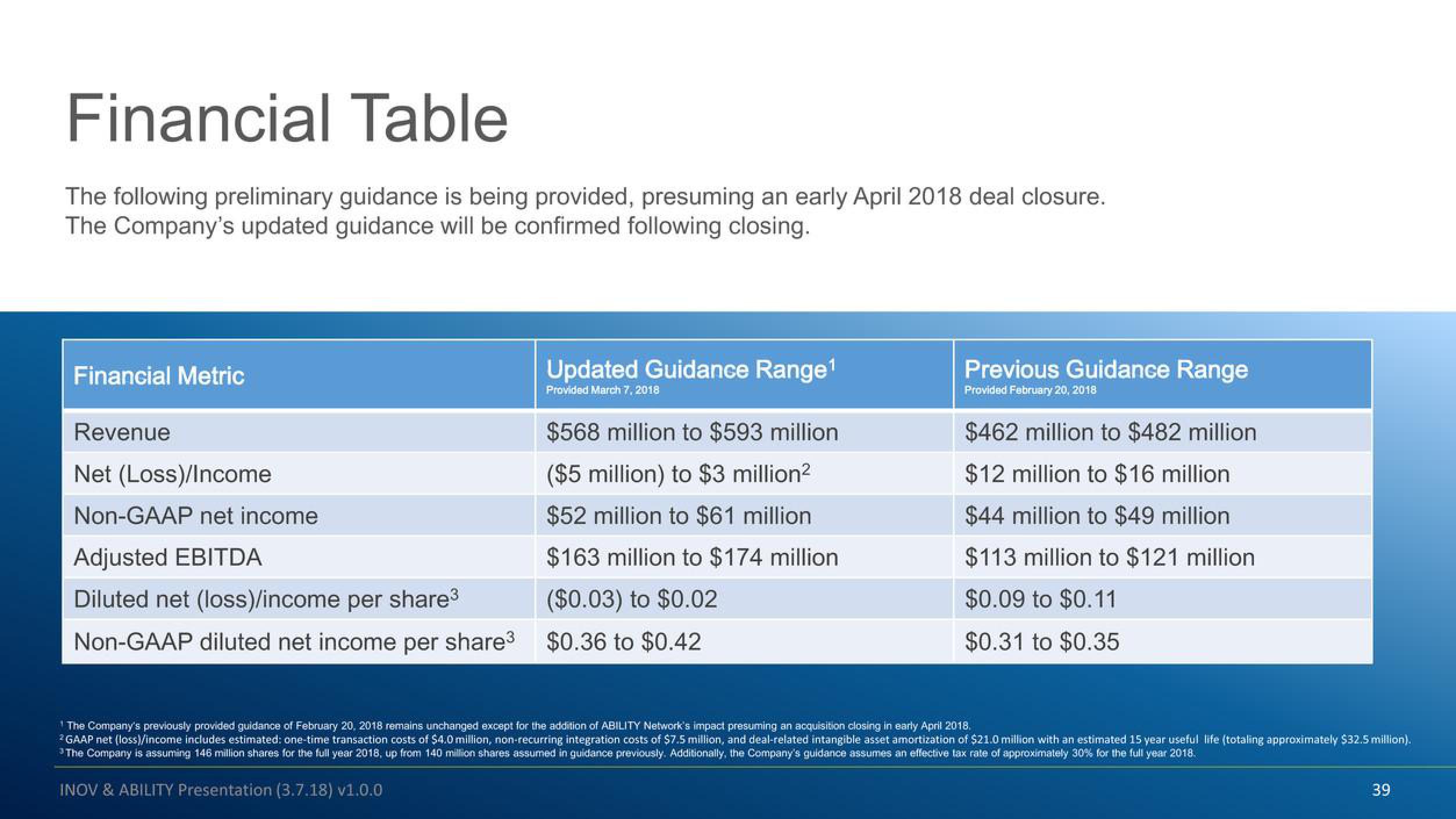

The following preliminary guidance is being provided, presuming an early April 2018 deal closure.

The Company's updated guidance will be confirmed following closing.

Financial Metric

Revenue

Net (Loss)/Income

Non-GAAP net income

Adjusted EBITDA

Diluted net (loss)/income per share³

Non-GAAP diluted net income per share³

Updated Guidance Range¹

Provided March 7, 2018

$568 million to $593 million

($5 million) to $3 million²

$52 million to $61 million

$163 million to $174 million

($0.03) to $0.02

$0.36 to $0.42

Previous Guidance Range

Provided February 20, 2018

$462 million to $482 million

$12 million to $16 million

$44 million to $49 million

$113 million to $121 million

$0.09 to $0.11

$0.31 to $0.35

¹ The Company's previously provided guidance of February 20, 2018 remains unchanged except for the addition of ABILITY Network's impact presuming an acquisition closing in early April 2018.

* GAAP net (loss)/income includes estimated: one-time transaction costs of $4.0 million, non-recurring integration costs of $7.5 million, and deal-related intangible asset amortization of $21.0 million with an estimated 15 year useful life (totaling approximately $32.5 million).

The Company is assuming 146 million shares for the full year 2018, up from 140 million shares assumed in guidance previously. Additionally, the Company's guidance assumes an effective tax rate of approximately 30% for the full year 2018.

INOV & ABILITY Presentation (3.7.18) v1.0.0

39View entire presentation