J.P.Morgan 2Q23 Investor Results

JPMORGAN CHASE & CO.

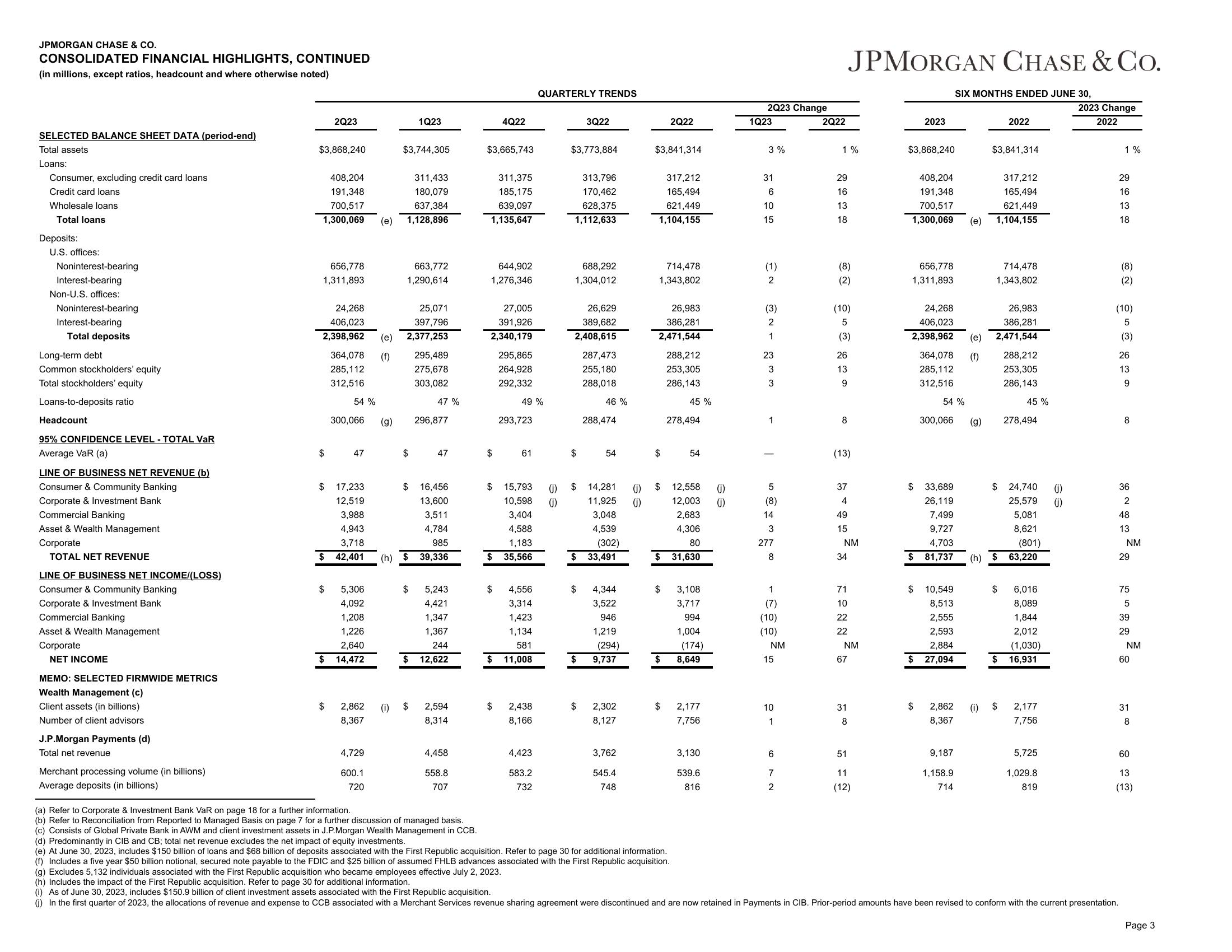

CONSOLIDATED FINANCIAL HIGHLIGHTS, CONTINUED

(in millions, except ratios, headcount and where otherwise noted)

SELECTED BALANCE SHEET DATA (period-end)

Total assets

Loans:

Consumer, excluding credit card loans

Credit card loans

Wholesale loans

Total loans

Deposits:

U.S. offices:

Noninterest-bearing

Interest-bearing

Non-U.S. offices:

Noninterest-bearing

Interest-bearing

Total deposits

Long-term debt

Common stockholders' equity

Total stockholders' equity

Loans-to-deposits ratio

Headcount

95% CONFIDENCE LEVEL - TOTAL VAR

Average VaR (a)

LINE OF BUSINESS NET REVENUE (b)

Consumer & Community Banking

Corporate & Investment Bank

Commercial Banking

Asset & Wealth Management

Corporate

TOTAL NET REVENUE

LINE OF BUSINESS NET INCOME/(LOSS)

Consumer & Community Banking

Corporate & Investment Bank

Commercial Banking

Asset & Wealth Management

Corporate

NET INCOME

MEMO: SELECTED FIRMWIDE METRICS

Wealth Management (c)

Client assets (in billions)

Numbe

J.P.Morgan Payments (d)

Total net revenue

Merchant processing volume (in billions)

Average deposits (in billions)

$3,868,240

2Q23

656,778

1,311,893

408,204

311,433

180,079

191,348

700,517

637,384

1,300,069 (e) 1,128,896

$

$

24,268

25,071

406,023

397,796

2,398,962 (e) 2,377,253

364,078 (f)

285,112

312,516

54%

300,066 (g)

47

17,233

12,519

3,988

4,943

3,718

$ 42,401 (h)

$ 5,306

4,092

1,208

1,226

2,640

14,472

$ 2,862 (1)

8,367

$3,744,305

4,729

600.1

720

1Q23

663,772

1,290,614

$

$

295,489

275,678

303,082

47 %

296,877

47

$ 16,456

13,600

3,511

4,784

985

39,336

5,243

4,421

1,347

1,367

244

$ 12,622

$ 2,594

4,458

558.8

707

(a) Refer to Corporate & Investment Bank VaR on page 18 for a further information.

(b) Refer to Reconciliation from Reported to Managed Basis on page 7 for a further discussion of managed basis.

(c) Consists of Global Private Bank in AWM and client investment assets in J.P.Morgan Wealth Management in CCB.

$3,665,743

4Q22

311,375

185,175

639,097

1,135,647

644,902

1,276,346

27,005

391,926

2,340,179

$

$

295,865

264,928

292,332

49 %

293,723

61

15,793

10,598 (j)

3,404

4,588

1,183

$ 35,566

4,556

3,314

1,423

1,134

581

$ 11,008

QUARTERLY TRENDS

$ 2,438

8,166

4,423

583.2

732

$3,773,884

313,796

170,462

628,375

1,112,633

3Q22

688,292

1,304,012

26,629

389,682

2,408,615

$

$

287,473

255,180

288,018

$

46 %

(j) $ 14,281

(j)

11,925 (j)

3,048

4,539

288,474

54

(302)

$ 33,491

4,344

3,522

946

1,219

(294)

9,737

2,302

8,127

3,762

545.4

748

$3,841,314

317,212

165,494

621,449

1,104,155

714,478

1,343,802

26,983

386,281

2,471,544

$

$

2Q22

$

$

$

$

288,212

253,305

286,143

45%

278,494

54

12,558

12,003

2,683

4,306

80

31,630

3,108

3,717

994

1,004

(174)

8,649

2,177

7,75

3,130

539.6

816

(j)

(j)

2Q23 Change

1Q23

3%

31

6

10

15

(1)

2

(3)

2

1

23

3

3

1

I

o + ෆ

5

(8)

277

8

1

(7)

(10)

(10)

NM

15

10

1

6

7

2

2Q22

1%

29

16

13

18

(8)

(2)

(10)

5

(3)

26

13

9

JPMORGAN CHASE & Co.

8

(13)

37

4

49

15

NM

34

71

10

22

22

NM

67

31

8

51

11

(12)

2023

$3,868,240

408,204

191,348

700,517

1,300,069

656,778

1,311,893

$

364,078 (f)

285,112

312,516

54%

300,066

SIX MONTHS ENDED JUNE 30,

$ 10,549

8,513

2,555

2,593

2,884

27,094

26,983

386,281

2,398,962 (e) 2,471,544

24,268

406,023

(e)

$ 33,689

26,119

7,499

9,727

4,703

$ 81,737 (h)

2,862

8,367

9,187

1,158.9

714

(g)

$3,841,314

2022

317,212

165,494

621,449

1,104,155

714,478

1,343,802

$

288,212

253,305

286,143

(i) $

45%

$ 24,740

25,579

5,081

8,621

(801)

63,220

278,494

6,016

8,089

1,844

2,012

(1,030)

$ 16,931

2,177

7,756

5,725

1,029.8

819

(j)

(j)

2023 Change

2022

1%

29

16

13

18

(d) Predominantly in CIB and CB; total net revenue excludes the net impact of equity investments.

(e) At June 30, 2023, includes $150 billion of loans and $68 billion of deposits associated with the First Republic acquisition. Refer to page 30 for additional information.

(f) Includes a five year $50 billion notional, secured note payable to the FDIC and $25 billion of assumed FHLB advances associated with the First Republic acquisition.

(g) Excludes 5,132 individuals associated with the First Republic acquisition who became employees effective July 2, 2023.

(h) Includes the impact of the First Republic acquisition. Refer to page 30 for additional information.

(i) As of June 30, 2023, includes $150.9 billion of client investment assets associated with the First Republic acquisition.

(j) In the first quarter of 2023, the allocations of revenue and expense to CCB associated with a Merchant Services revenue sharing agreement were discontinued and are now retained in Payments in CIB. Prior-period amounts have been revised to conform with the current presentation.

(8)

(2)

(10)

5

(3)

26

13

9

8

36

2

48

13

NM

60

29

75

5

39

29

NM

60

31

8

60

13

(13)

Page 3View entire presentation