AstraZeneca Investor Conference Presentation Deck

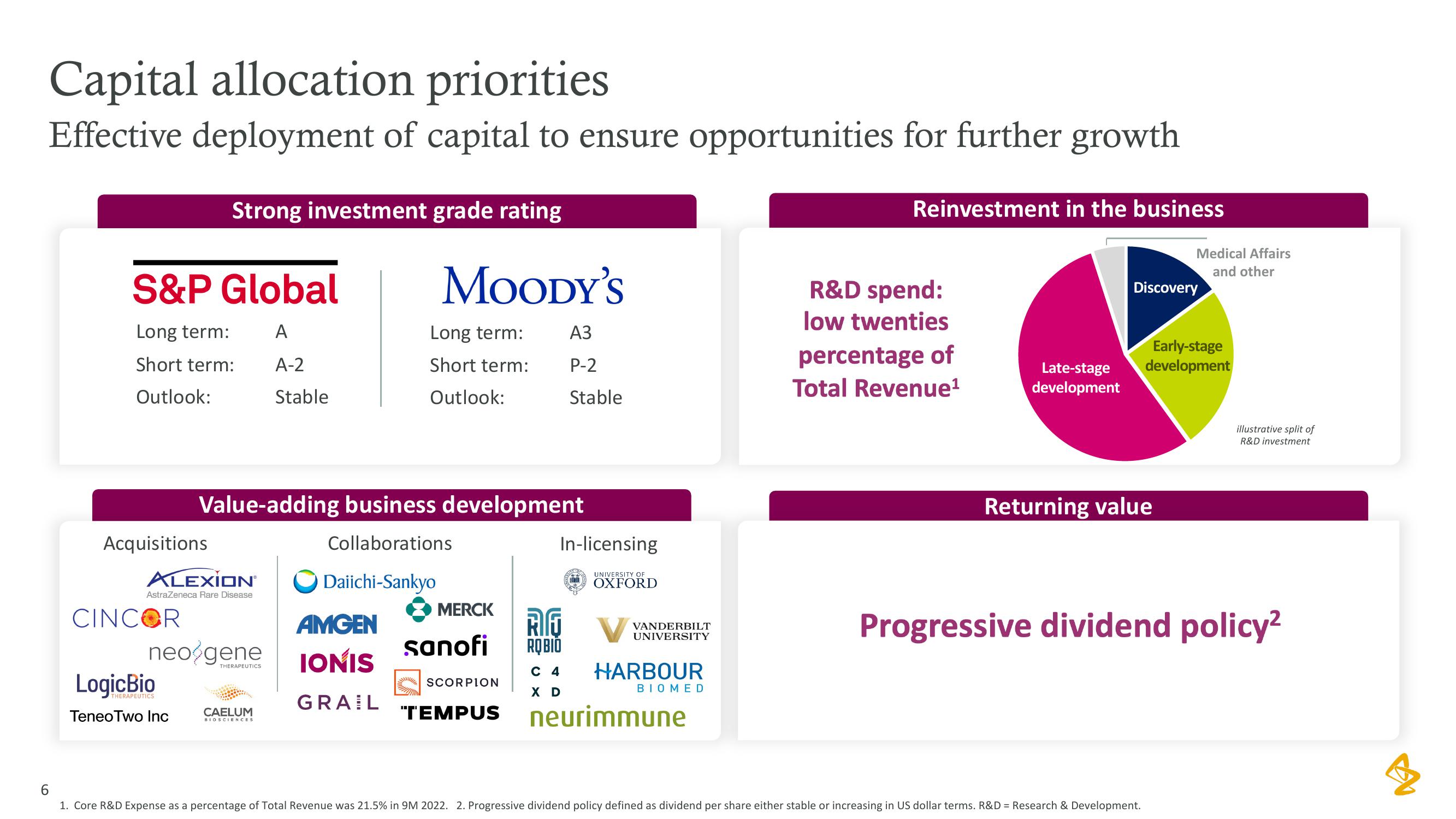

Capital allocation priorities

Effective deployment of capital to ensure opportunities for further growth

S&P Global

A

A-2

Stable

Long term:

Short term:

Outlook:

Acquisitions

Strong investment grade rating

CINCOR

ALEXION

AstraZeneca Rare Disease

THERAPEUTICS

neo gene

THERAPEUTICS

TeneoTwo Inc

Value-adding business development

Collaborations

Daiichi-Sankyo

CAELUM

BIOSCIENCES

AMGEN

IONIS

GRAIL

MOODY'S

Long term:

Short term:

Outlook:

mind

MERCK

AG

sanofi ROBIO

C 4

X D

SCORPION

A3

P-2

Stable

"T'EMPUS

In-licensing

UNIVERSITY OF

OXFORD

VANDERBILT

UNIVERSITY

HARBOUR

BIOMED

neurimmune

Reinvestment in the business

R&D spend:

low twenties

percentage of

Total Revenue¹

Late-stage

development

Discovery

Medical Affairs

and other

Returning value

Early-stage

development

6

1. Core R&D Expense as a percentage of Total Revenue was 21.5% in 9M 2022. 2. Progressive dividend policy defined as dividend per share either stable or increasing in US dollar terms. R&D = Research & Development.

illustrative split of

R&D investment

Progressive dividend policy²

3View entire presentation