BenevolentAI Results Presentation Deck

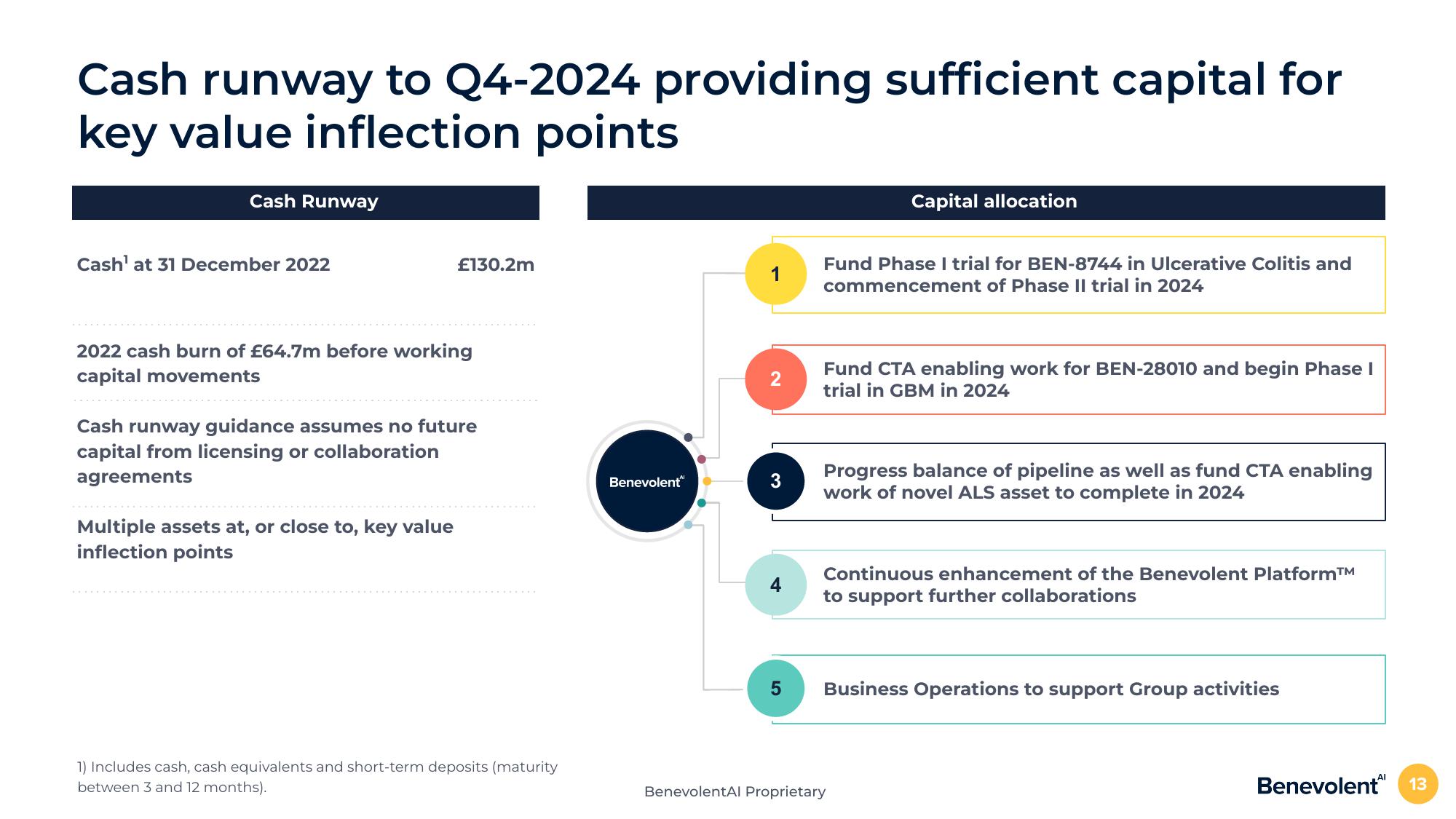

Cash runway to Q4-2024 providing sufficient capital for

key value inflection points

Cash Runway

Cash¹ at 31 December 2022

£130.2m

2022 cash burn of £64.7m before working

capital movements

Cash runway guidance assumes no future

capital from licensing or collaboration

agreements

Multiple assets at, or close to, key value

inflection points

1) Includes cash, cash equivalents and short-term deposits (maturity

between 3 and 12 months).

Benevolent

3

5

Capital allocation

Fund Phase I trial for BEN-8744 in Ulcerative Colitis and

commencement of Phase II trial in 2024

Fund CTA enabling work for BEN-28010 and begin Phase I

trial in GBM in 2024

Progress balance of pipeline as well as fund CTA enabling

work of novel ALS asset to complete in 2024

Continuous enhancement of the Benevolent Platform™

to support further collaborations

Business Operations to support Group activities

BenevolentAl Proprietary

Benevolent 13View entire presentation