First Busey Results Presentation Deck

2Q23 Earnings Investor Presentation

1

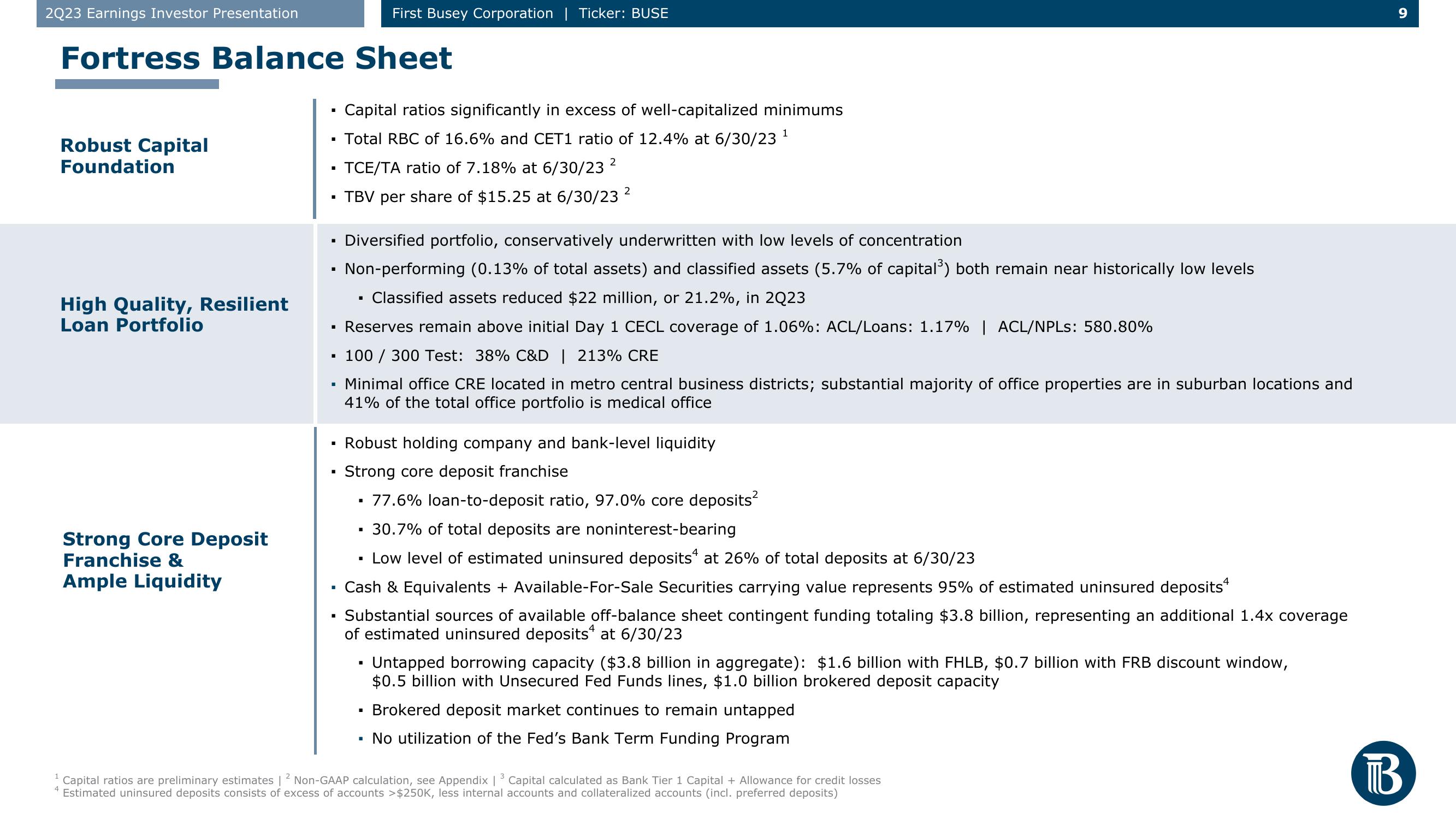

Fortress Balance Sheet

Robust Capital

Foundation

High Quality, Resilient

Loan Portfolio

Strong Core Deposit

Franchise &

Ample Liquidity

Capital ratios significantly in excess of well-capitalized minimums

▪ Total RBC of 16.6% and CET1 ratio of 12.4% at 6/30/23 ¹

1

▪ TCE/TA ratio of 7.18% at 6/30/23 ²

2

TBV per share of $15.25 at 6/30/23 ²

■

-

■

I

I

■

First Busey Corporation | Ticker: BUSE

■

Diversified portfolio, conservatively underwritten with low levels of concentration

Non-performing (0.13% of total assets) and classified assets (5.7% of capital³) both remain near historically low levels

Classified assets reduced $22 million, or 21.2%, in 2023

Reserves remain above initial Day 1 CECL coverage of 1.06%: ACL/Loans: 1.17% | ACL/NPLs: 580.80%

100 / 300 Test: 38% C&D | 213% CRE

Minimal office CRE located in metro central business districts; substantial majority of office properties are in suburban locations and

41% of the total office portfolio is medical office

Robust holding company and bank-level liquidity

Strong core deposit franchise

▪ 77.6% loan-to-deposit ratio, 97.0% core deposits²

▪ 30.7% of total deposits are noninterest-bearing

Low level of estimated uninsured deposits at 26% of total deposits at 6/30/23

Cash & Equivalents + Available-For-Sale Securities carrying value represents 95% of estimated uninsured deposits

Substantial sources of available off-balance sheet contingent funding totaling $3.8 billion, representing an additional 1.4x coverage

of estimated uninsured deposits at 6/30/23

4

■

Untapped borrowing capacity ($3.8 billion in aggregate): $1.6 billion with FHLB, $0.7 billion with FRB discount window,

$0.5 billion with Unsecured Fed Funds lines, $1.0 billion brokered deposit capacity

Brokered deposit market continues to remain untapped

▪ No utilization of the Fed's Bank Term Funding Program

2

Capital ratios are preliminary estimates | Non-GAAP calculation, see Appendix | Capital calculated as Bank Tier 1 Capital + Allowance for credit losses

Estimated uninsured deposits consists of excess of accounts >$250K, less internal accounts and collateralized accounts (incl. preferred deposits)

9

BView entire presentation