Nerdy SPAC Presentation Deck

1.

2

3.

TPG

PACE

TECH OPPORTUNITIES

Investment

Thesis for

Nerdy

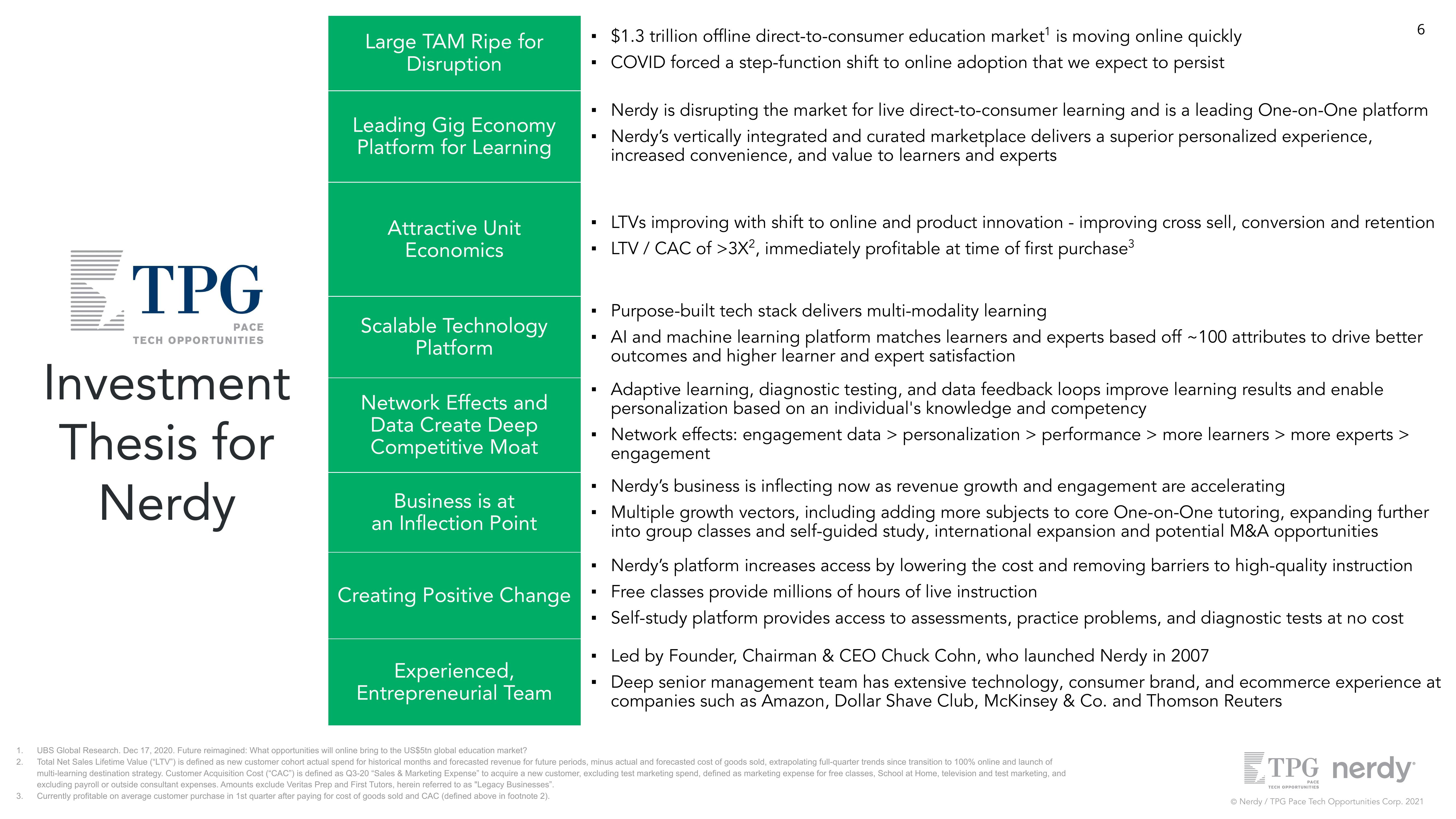

Large TAM Ripe for

Disruption

Leading Gig Economy

Platform for Learning

Attractive Unit

Economics

Scalable Technology

Platform

Network Effects and

Data Create Deep

Competitive Moat

Business is at

an Inflection Point

Creating Positive Change

Experienced,

Entrepreneurial Team

■

■

■

■

I

■

■

$1.3 trillion offline direct-to-consumer education market¹ is moving online quickly

COVID forced a step-function shift to online adoption that we expect to persist

Nerdy is disrupting the market for live direct-to-consumer learning and is a leading One-on-One platform

Nerdy's vertically integrated and curated marketplace delivers a superior personalized experience,

increased convenience, and value to learners and experts

LTVs improving with shift to online and product innovation - improving cross sell, conversion and retention

LTV / CAC of >3X², immediately profitable at time of first purchase³

Purpose-built tech stack delivers multi-modality learning

Al and machine learning platform matches learners and experts based off ~100 attributes to drive better

outcomes and higher learner and expert satisfaction

Adaptive learning, diagnostic testing, and data feedback loops improve learning results and enable

personalization based on an individual's knowledge and competency

Network effects: engagement data > personalization > performance > more learners > more experts >

engagement

6

Nerdy's business is inflecting now as revenue growth and engagement are accelerating

Multiple growth vectors, including adding more subjects to core One-on-One tutoring, expanding further

into group classes and self-guided study, international expansion and potential M&A opportunities

Nerdy's platform increases access by lowering the cost and removing barriers to high-quality instruction

Free classes provide millions of hours of live instruction

Self-study platform provides access to assessments, practice problems, and diagnostic tests at no cost

Led by Founder, Chairman & CEO Chuck Cohn, who launched Nerdy in 2007

Deep senior management team has extensive technology, consumer brand, and ecommerce experience at

companies such as Amazon, Dollar Shave Club, McKinsey & Co. and Thomson Reuters

UBS Global Research. Dec 17, 2020. Future reimagined: What opportunities will online bring to the US$5tn global education market?

Total Net Sales Lifetime Value ("LTV") is defined as new customer cohort actual spend for historical months and forecasted revenue for future periods, minus actual and forecasted cost of goods sold, extrapolating full-quarter trends since transition to 100% online and launch of

multi-learning destination strategy. Customer Acquisition Cost ("CAC") is defined as Q3-20 "Sales & Marketing Expense to acquire a new customer, excluding test marketing spend, defined as marketing expense for free classes, School at Home, television and test marketing, and

excluding payroll or outside consultant expenses. Amounts exclude Veritas Prep and First Tutors, herein referred to as "Legacy Businesses.

Currently profitable on average customer purchase in 1st quarter after paying for cost of goods sold and CAC (defined above in footnote 2).

TPG nerdy

TECH OPPORTUNITIES

Ⓒ Nerdy / TPG Pace Tech Opportunities Corp. 2021

PACEView entire presentation