NioCorp Investor Presentation Deck

Niobium

ThyssenKrupp

Metallurgical

Products²

50% of NioCorp's

planned ferroniobium

production for first

10 yrs.¹

Pricing set at 3.75%

discount to Argus

Metals index pricing

for ferroniobium

NioCorp

Critical Mineral Security

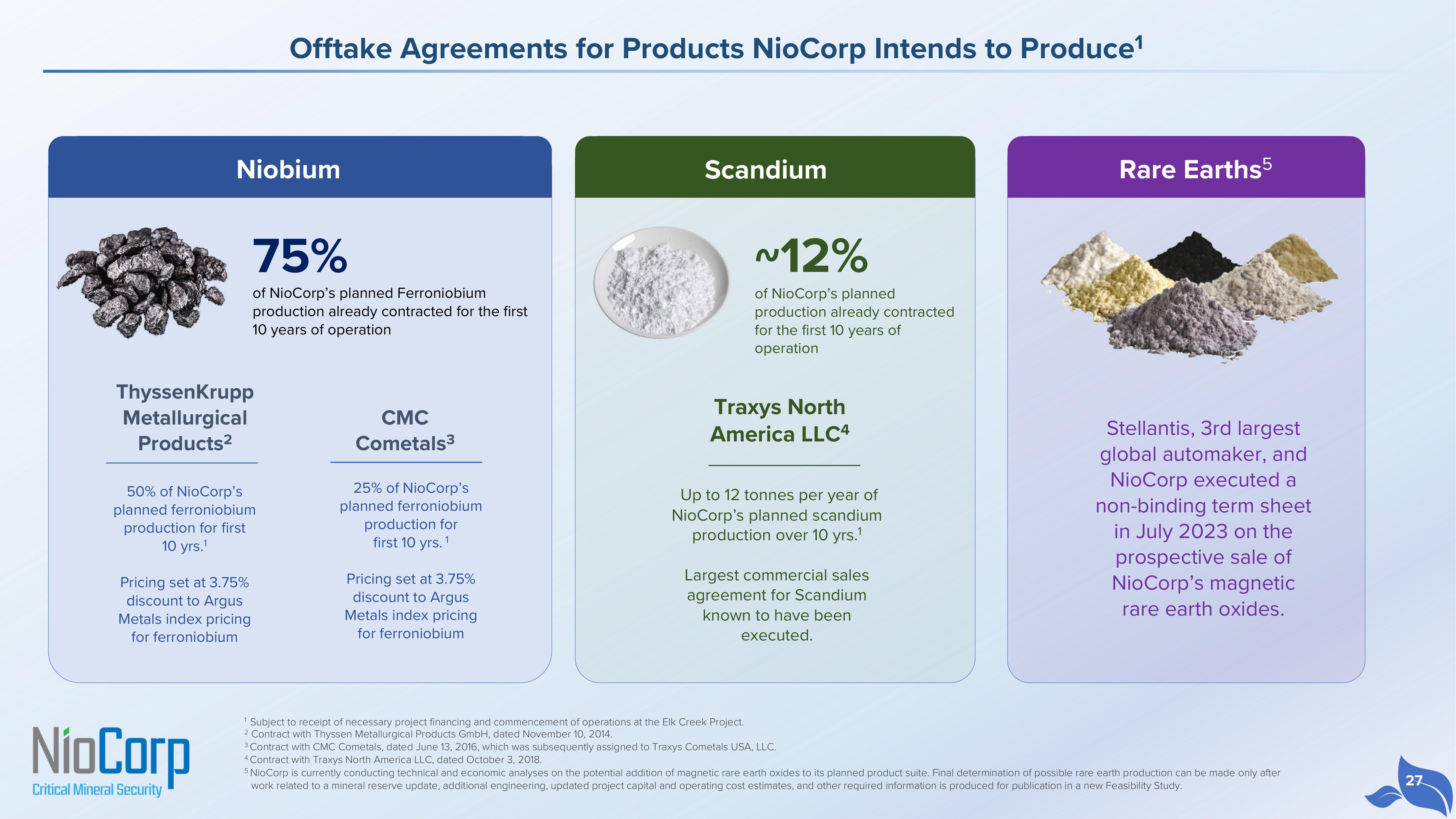

Offtake Agreements for Products NioCorp Intends to Produce¹

75%

of NioCorp's planned Ferroniobium

production already contracted for the first

10 years of operation

CMC

Cometals³

25% of NioCorp's

planned ferroniobium

production for

first 10 yrs. ¹

Pricing set at 3.75%

discount to Argus

Metals index pricing

for ferroniobium

Scandium

~12%

of NioCorp's planned

production already contracted

for the first 10 years of

operation

Traxys North

America LLC4

Up to 12 tonnes per year of

NioCorp's planned scandium

production over 10 yrs.¹

Largest commercial sales

agreement for Scandium

known to have been

executed.

Rare Earths5

Stellantis, 3rd largest

global automaker, and

NioCorp executed a

non-binding term sheet

in July 2023 on the

prospective sale of

NioCorp's magnetic

rare earth oxides.

¹ Subject to receipt of necessary project financing and commencement of operations at the Elk Creek Project.

2 Contract with Thyssen Metallurgical Products GmbH, dated November 10, 2014.

3 Contract with CMC Cometals, dated June 13, 2016, which was subsequently assigned to Traxys Cometals USA, LLC.

4 Contract with Traxys North America LLC, dated October 3, 2018.

5 NioCorp is currently conducting technical and economic analyses on the potential addition of magnetic rare earth oxides to its planned product suite. Final determination of possible rare earth production can be made only after

work related to a mineral reserve update, additional engineering, updated project capital and operating cost estimates, and other required information is produced for publication in a new Feasibility Study.

27View entire presentation