Cerberus Global NPL Fund, L.P.

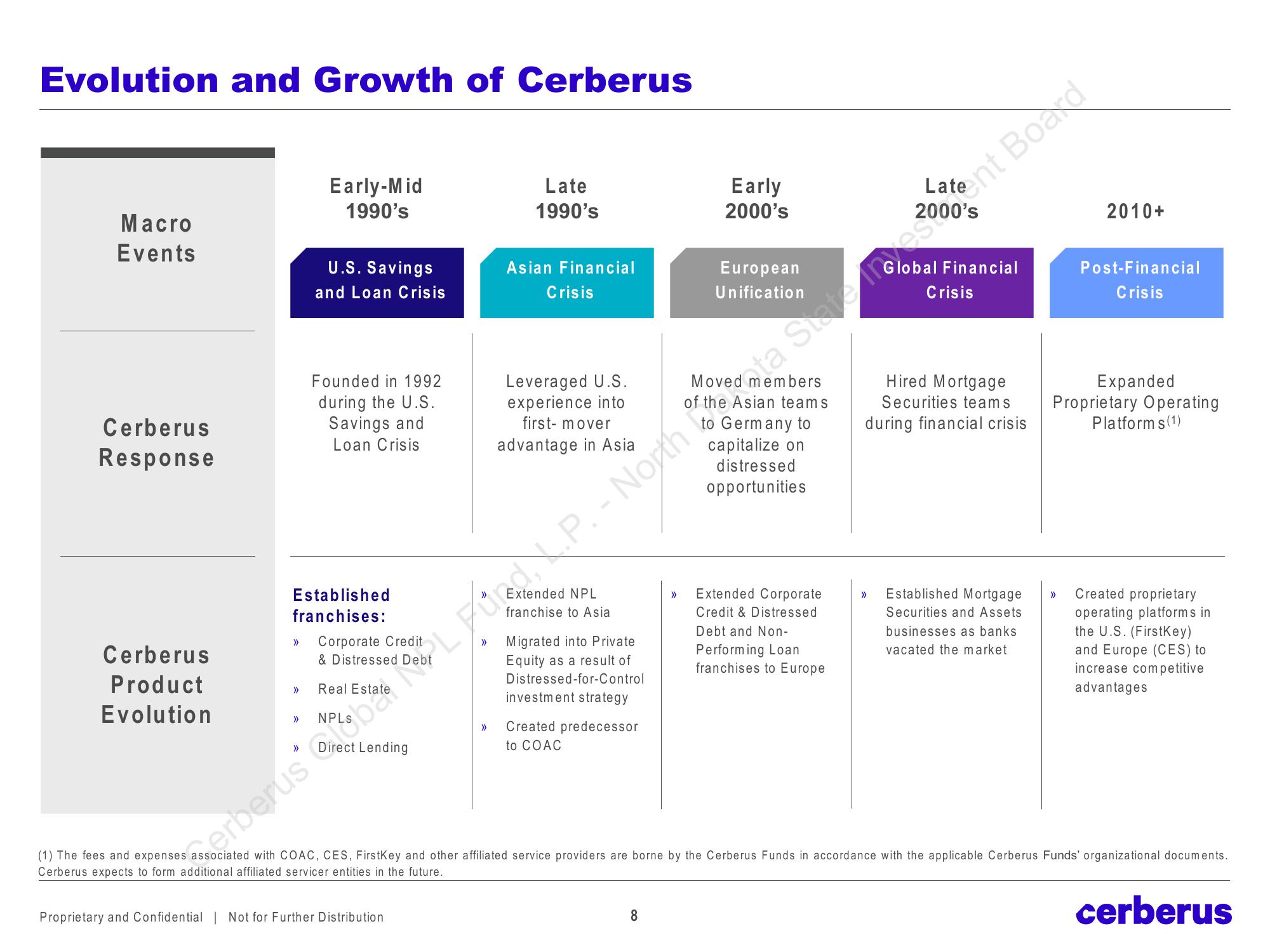

Evolution and Growth of Cerberus

Macro

Events

Cerberus

Response

Cerberus

Product

Evolution

>>>

Early-Mid

1990's

>>>

U.S. Savings

and Loan Crisis

Established

franchises:

>> Corporate Credit

Founded in 1992

during the U.S.

Savings and

Loan Crisis

Direct Lending

>>>

Late

1990's

Proprietary and Confidential | Not for Further Distribution

Asian Financial

Crisis

Leveraged U.S.

experience into

first-mover

advantage in Asia

Extended NPL

franchise to Asia

Migrated into Private

Equity as a result of

Distressed-for-Control

investment strategy

Created predecessor

to COAC

>>>

Early

2000's

8

European

Unification

embers

Asian teams

to Germany to

capitalize on

distressed

opportunities

Extended Corporate

Credit & Distressed

Debt and Non-

Performing Loan

franchises to Europe

Global Financial

Crisis

Hired Mortgage

Securities teams

during financial crisis

Established Mortgage

Securities and Assets

businesses as banks

vacated the market

2010+

>>>

Post-Financial

Crisis

Expanded

Proprietary Operating

Platforms (1)

erberus och Lund LP. - North Pota Suresent Board

Created proprietary

operating platforms in

the U.S. (FirstKey)

and Europe (CES) to

increase competitive

advantages

(1) The fees and expenses associated with COAC, CES, FirstKey and other affiliated service providers are borne by the Cerberus Funds in accordance with the applicable Cerberus Funds' organizational documents.

Cerberus expects to form additional affiliated servicer entities in the future.

cerberusView entire presentation