Evercore Investment Banking Pitch Book

Situation Analysis

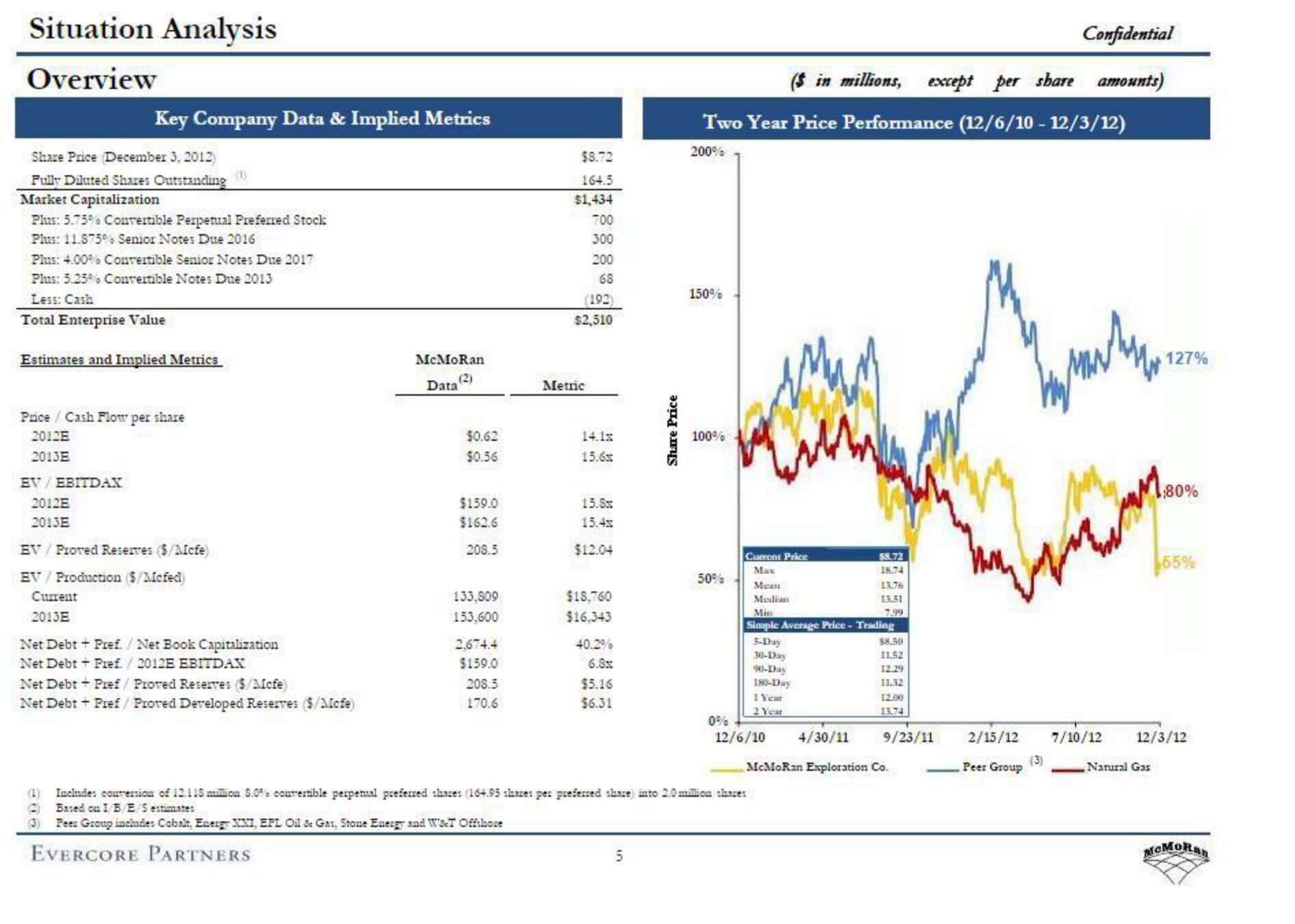

Overview

Share Price (December 3, 2012)

Fully Diluted Shares Outstanding

Market Capitalization

Plus: 5.75% Convertible Perpetual Preferred Stock

Plus: 11.875% Senior Notes Due 2016

Plus: 4.00% Convertible Senior Notes Due 2017

Plus: 5.25% Convertible Notes Due 2013

Less: Cash

Total Enterprise Value

Key Company Data & Implied Metrics

Estimates and Implied Metrics

Price Cash Flow per share

2012E

2013E

EV/EBITDAX

2012E

2013E

EV Proved Reserves ($/Mcfe)

EV/ Production ($/Mcfed)

Current

2013E

Net Debt + Pref. / Net Book Capitalization

Net Debt + Pref. / 2012E EBITDAX

Net Debt + Pref/ Proved Reserves ($/Mcfe)

Net Debt + Pref/ Proved Developed Reserves ($/Mofe)

(2)

(3)

McMoRan

(2)

Data

$0.62

$0.56

$159.0

$162.6

208.5

133,809

153,600

2,674.4

$159.0

208.5

170.6

$8.72

164.5

$1,434

700

300

200

68

(192)

$2,510

Metric

14.1x

15.6x

15.8x

15.4x

$12.04

$18,760

$16.343

40.2%

6.8x

$5.16

$6.31

in

Share Price

5

Confidential

(in millions, except per share amounts)

Two Year Price Performance (12/6/10 - 12/3/12)

200%

150%

by

100%

50%

Current Price

Max

Includes conversion of 12.115 million 5.0% convertible perpetual preferred shares (164.95 shares per preferred share) into 2.0 million shares

Based on 1/B/E/S estimates

Peer Group includes Cobalt, Energy XXI, EPL Oil & Gas, Stone Energy and W&T Offshore

EVERCORE PARTNERS

Mean

Median

$8.72

18.74

Min

Simple Average Price - Trading

5-Day

30-Day

90-Day

180-Day

1 Year

2 Year

13.76

13.51

7.99

$8.50

11.52

12.29

11.32

12.00

13.74

0%

12/6/10 4/30/11

McMoRan Exploration Co.

9/23/11

Herste

2/15/12 7/10/12

Peer Group

(3)

127%

Natural Gas

:80%

55%

12/3/12

MCMORanView entire presentation