Allwyn Results Presentation Deck

Q2 2021 highlights

■

I

M

4

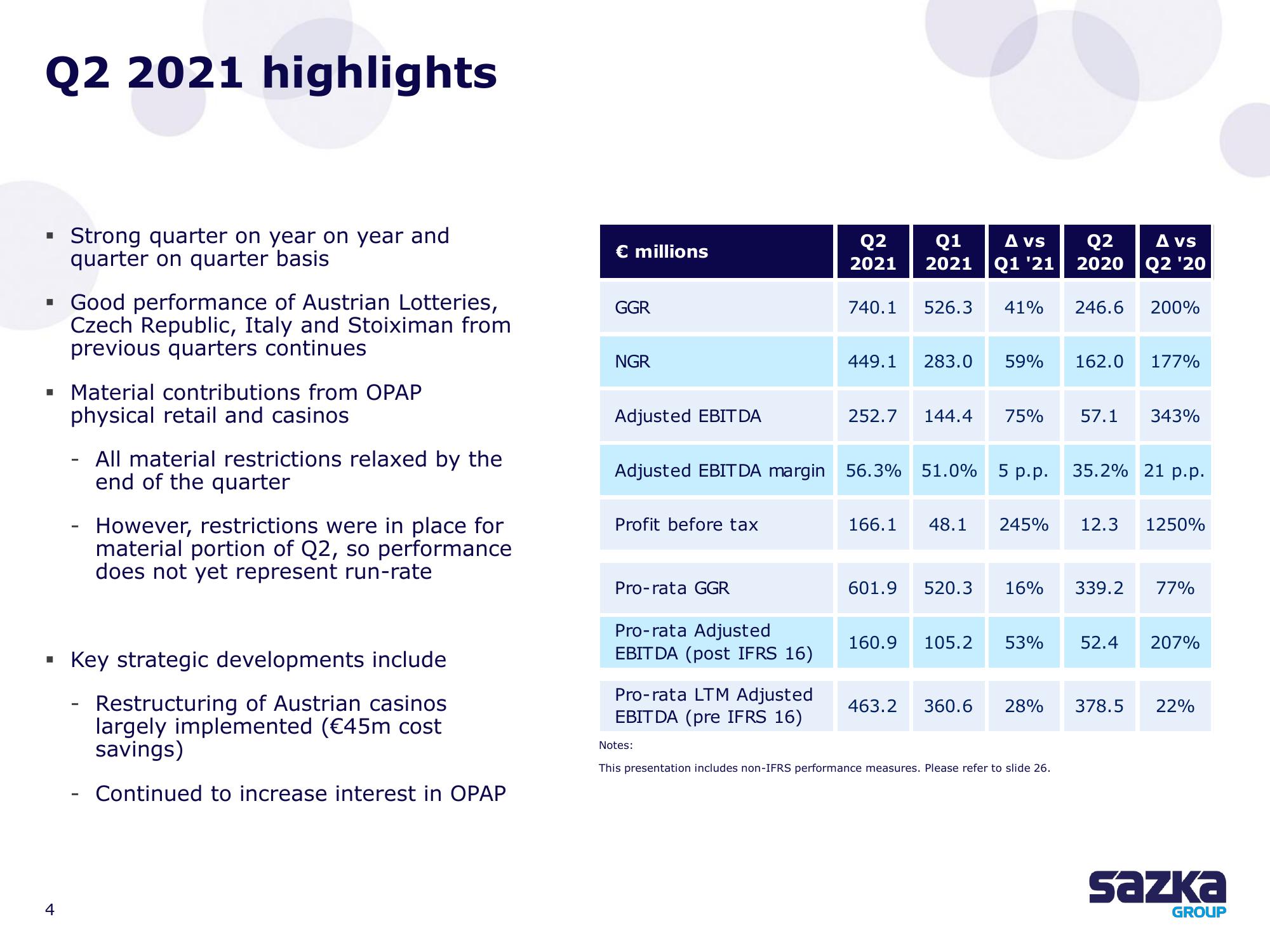

Strong quarter on year on year and

quarter on quarter basis

Good performance of Austrian Lotteries,

Czech Republic, Italy and Stoiximan from

previous quarters continues

Material contributions from OPAP

physical retail and casinos

All material restrictions relaxed by the

end of the quarter

However, restrictions were in place for

material portion of Q2, so performance

does not yet represent run-rate

Key strategic developments include.

Restructuring of Austrian casinos

largely implemented (€45m cost

savings)

Continued to increase interest in OPAP

€ millions

GGR

NGR

Adjusted EBIT DA

Profit before tax

Pro-rata GGR

Pro-rata Adjusted

EBITDA (post IFRS 16)

Q2

2021

Pro-rata LTM Adjusted

EBITDA (pre IFRS 16)

740.1

449.1

Q1

2021

A vs

Q1 '21

526.3 41%

Adjusted EBITDA margin 56.3% 51.0% 5 p.p.

283.0 59%

252.7 144.4

75%

166.1 48.1 245%

601.9 520.3 16%

160.9 105.2 53%

Q2

2020

Notes:

This presentation includes non-IFRS performance measures. Please refer to slide 26.

246.6

A vs

Q2 '20

162.0 177%

200%

57.1 343%

12.3

35.2% 21 p.p.

52.4

1250%

339.2 77%

207%

463.2 360.6 28% 378.5 22%

Sazka

GROUPView entire presentation