Credit Suisse Investment Banking Pitch Book

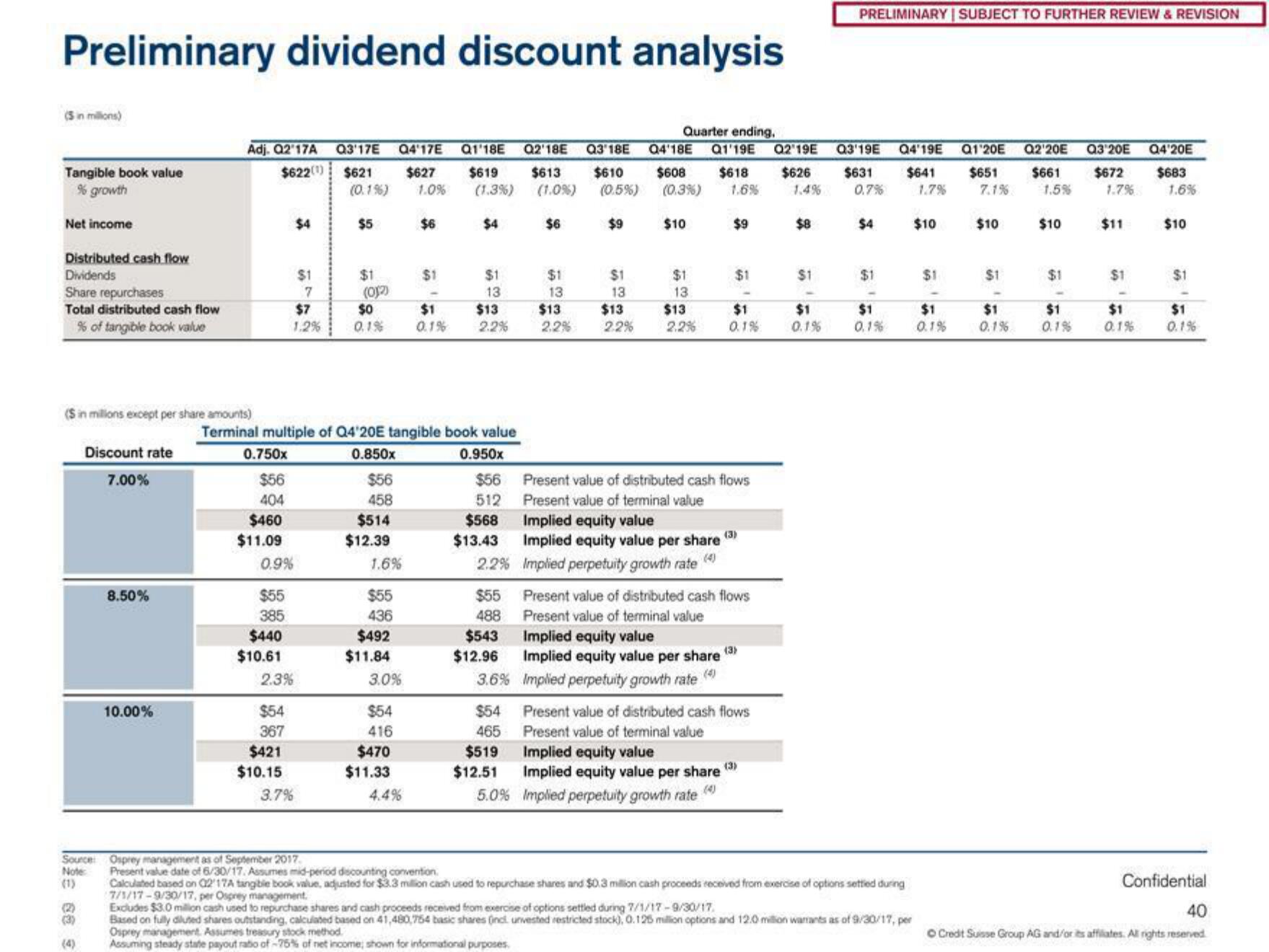

Preliminary dividend discount analysis

(5 in millions)

Tangible book value

% growth

Net income

Distributed cash flow

Dividends

Share repurchases

Total distributed cash flow

% of tangible book value

($ in millions except per share amounts)

Discount rate

7.00%

(3)

(4)

8.50%

Quarter ending.

Adj. Q2'17A Q3'17E Q4'17E Q1'18E Q2'18E Q3'18E Q4'18E Q1'19E Q2 19E

$622(¹) $621

$610 $608 $618

$626

$627

1.0%

$619 $613

(1.3%) (1.0%)

(0.1%)

(0.5%)

(0.3%)

1.6%

10.00%

0.750x

$56

404

$460

$11.09

0.9%

$55

385

$440

$10.61

$7

1.2%

$4

2.3%

$1

7

$54

367

$421

$10.15

3.7%

Source: Osprey management as of September 2017.

Note:

(1)

$5

$1

(0)2)

$0

0.1%

Terminal multiple of Q4'20E tangible book value

0.850x

0.950x

$56

512

$56

458

$514

$12.39

1.6%

$55

436

$492

$11.84

3.0%

$54

416

$470

$11.33

$6

4.4%

$1

$1

0.1%

$4

$1

13

$13

2.2%

$568

$13.43

2.2%

$55

488

$543

$12.96

$6

$54

465

$519

$12.51

$1

13

$13

2.2%

$9

$1

13

$13

2.2%

$10

$1

13

$13

2.2%

$9

$1

$1

0.1%

Present value of distributed cash flows

Present value of terminal value

Present value of distributed cash flows

Present value of terminal value

Implied equity value

Implied equity value per share

3.6% Implied perpetuity growth rate (4)

Implied equity value

Implied equity value per share (3)

Implied perpetuity growth rate

Implied equity value

Implied equity value per share

5.0% Implied perpetuity growth rate()

(3)

Present value of distributed cash flows

Present value of terminal value

(3)

$8

$1

$1

0.1%

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

Q3'19E Q4'19E Q1'20E Q2'20E Q3'20E Q4'20E

$683

$631

0.7%

$641

1.7%

$651

7.1%

$661

1.5%

$672

1.7%

$4

$1

$1

0.1%

Present value date of 6/30/17. Assumes mid-period discounting convention

Calculated based on 0217A tangible book value, adjusted for $3.3 million cash used to repurchase shares and $0.3 million cash proceeds received from exercise of options settled during

7/1/17-9/30/17, per Osprey management.

Excludes $3.0 million cash used to repurchase shares and cash proceeds received from exercise of options settled during 7/1/17-9/30/17,

Based on fully diluted shares outstanding, calculated based on 41,480,754 basic shares (incl. unvested restricted stock), 0.125 million options and 12.0 million warrants as of 9/30/17, per

Osprey management. Assumes treasury stock method.

Assuming steady state payout rabo of -75% of net income; shown for informational purposes.

$10

$1

$1

0.1%

$10

$1

$1

0.1%

$10

$1

$1

0.1%

$11

$1

$1

0.1%

1.6%

$10

$1

$1

0.1%

Confidential

40

Ⓒ Credit Suisse Group AG and/or its affiliates. All rights reservedView entire presentation