Vivid Seats SPAC Presentation Deck

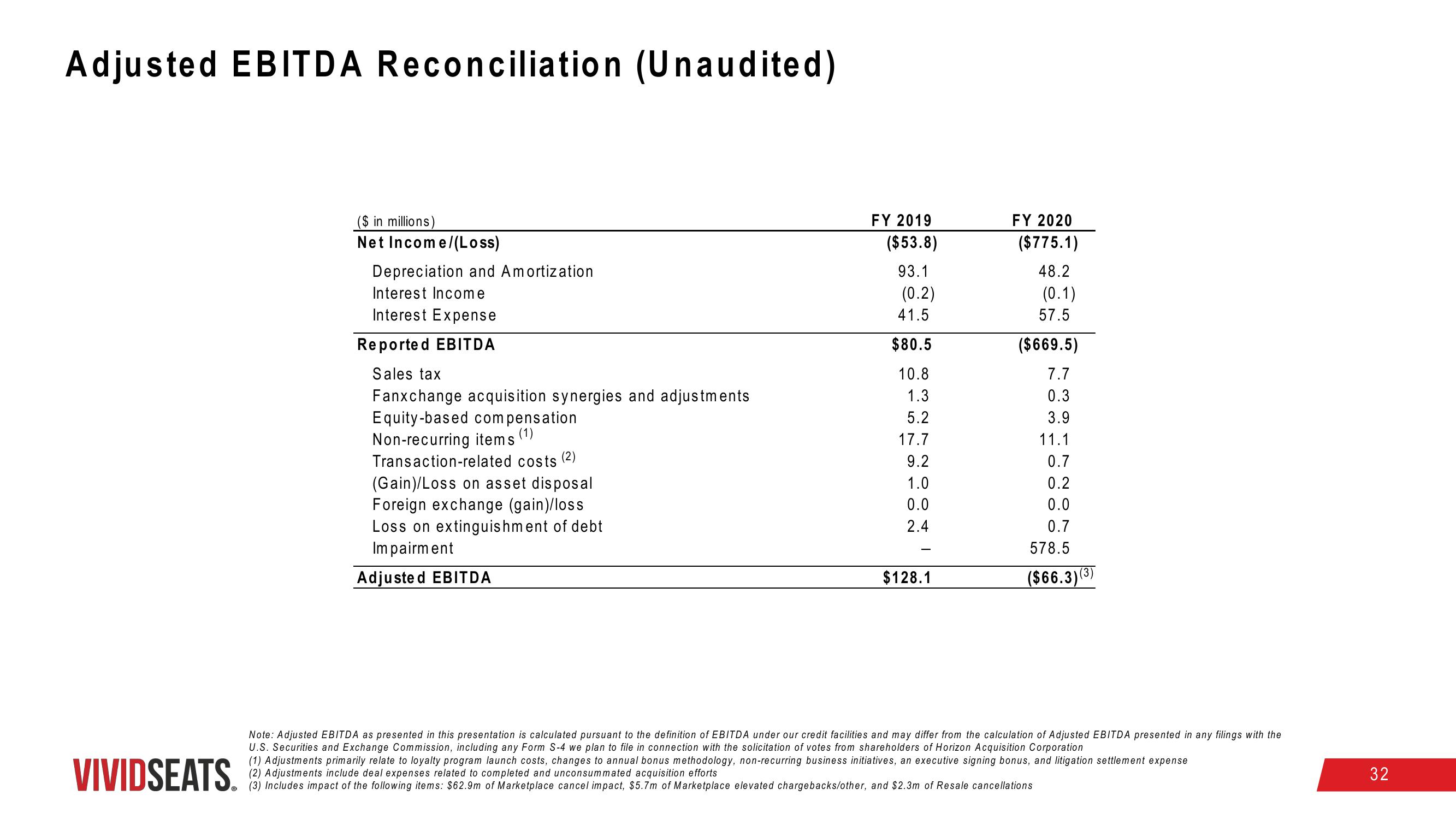

Adjusted EBITDA Reconciliation (Unaudited)

VIVIDSEATS.

($ in millions)

Net Income/(Loss)

Depreciation and Amortization

Interest Income

Interest Expense

Reported EBITDA

Sales tax

Fanxchange acquisition synergies and adjustments

Equity-based compensation

Non-recurring items

Transaction-related costs (2)

(Gain)/Loss on asset disposal

Foreign exchange (gain)/loss

Loss on extinguishment of debt

Impairment

Adjusted EBITDA

FY 2019

($53.8)

93.1

(0.2)

41.5

$80.5

10.8

1.3

5.2

17.7

9.2

1.0

0.0

2.4

-

$128.1

FY 2020

($775.1)

48.2

(0.1)

57.5

($669.5)

7.7

0.3

3.9

11.1

0.7

0.2

0.0

0.7

578.5

($66.3) (³)

Note: Adjusted EBITDA as presented in this presentation is calculated pursuant to the definition of EBITDA under our credit facilities and may differ from the calculation of Adjusted EBITDA presented in any filings with the

U.S. Securities and Exchange Commission, including any Form S-4 we plan to file in connection with the solicitation of votes from shareholders of Horizon Acquisition Corporation

(1) Adjustments primarily relate to loyalty program launch costs, changes to annual bonus methodology, non-recurring business initiatives, an executive signing bonus, and litigation settlement expense

(2) Adjustments include deal expenses related to completed and unconsummated acquisition efforts

(3) Includes impact of the following items: $62.9m of Marketplace cancel impact, $5.7m of Marketplace elevated chargebacks/other, and $2.3m of Resale cancellations

32View entire presentation