Spotify Results Presentation Deck

Gross Margin

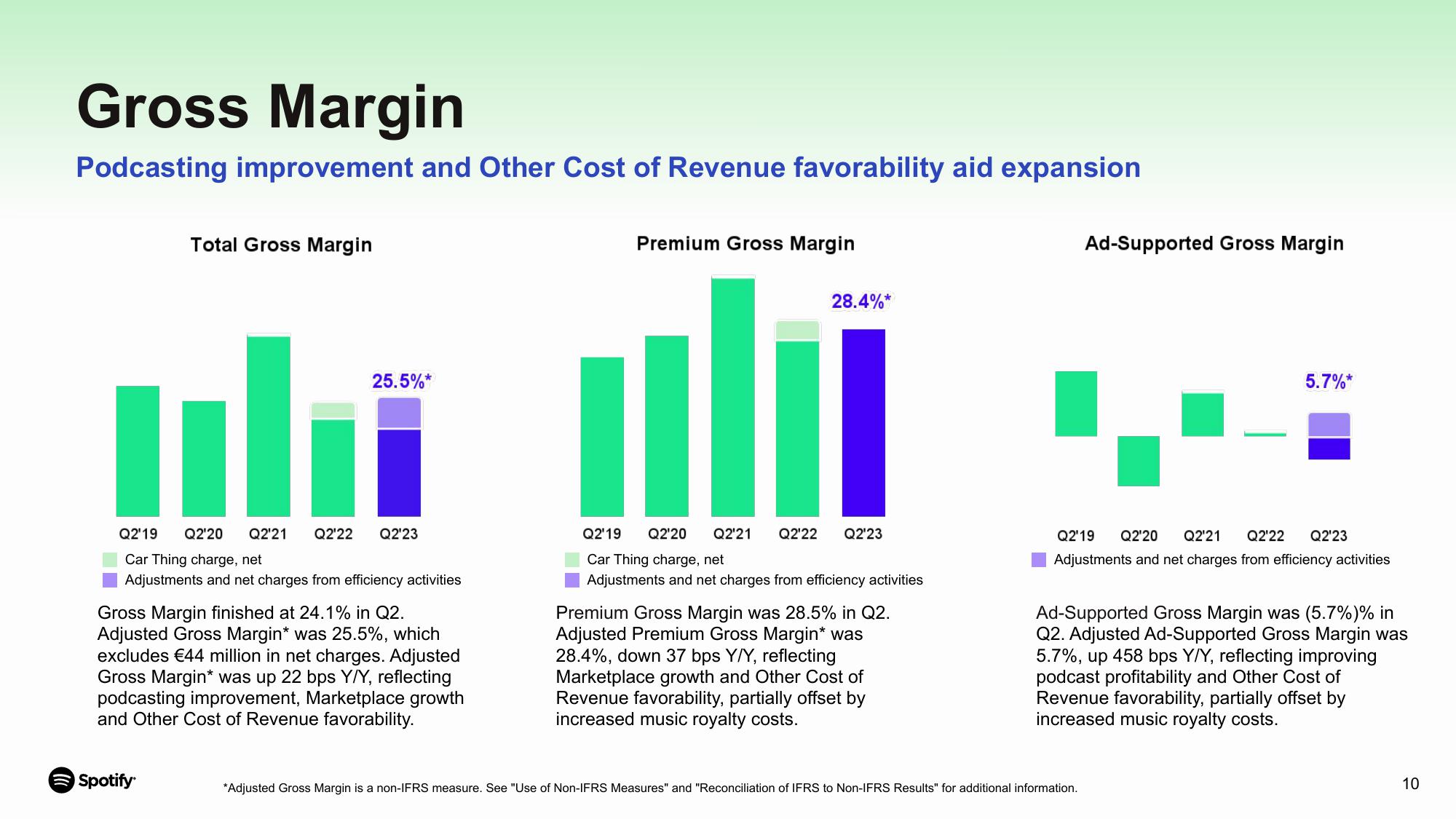

Podcasting improvement and Other Cost of Revenue favorability aid expansion

Total Gross Margin

25.5%*

Q2'19 Q2'20 Q2'21 Q2'22 Q2'23

Car Thing charge, net

Adjustments and net charges from efficiency activities

Spotify

Gross Margin finished at 24.1% in Q2.

Adjusted Gross Margin* was 25.5%, which

excludes €44 million in net charges. Adjusted

Gross Margin* was up 22 bps Y/Y, reflecting

podcasting improvement, Marketplace growth

and Other Cost of Revenue favorability.

Premium Gross Margin

28.4%*

Q2'19 Q2'20 Q2¹21 Q2'22

Car Thing charge, net

Adjustments and net charges from efficiency activities

Q2'23

Premium Gross Margin was 28.5% in Q2.

Adjusted Premium Gross Margin* was

28.4%, down 37 bps Y/Y, reflecting

Marketplace growth and Other Cost of

Revenue favorability, partially offset by

increased music royalty costs.

Ad-Supported Gross Margin

5.7%*

Q2'19 Q2'20 Q2¹21 Q2'22 Q2'23

Adjustments and net charges from efficiency activities

*Adjusted Gross Margin is a non-IFRS measure. See "Use of Non-IFRS Measures" and "Reconciliation of IFRS to Non-IFRS Results" for additional information.

Ad-Supported Gross Margin was (5.7%)% in

Q2. Adjusted Ad-Supported Gross Margin was

5.7%, up 458 bps Y/Y, reflecting improving

podcast profitability and Other Cost of

Revenue favorability, partially offset by

increased music royalty costs.

10View entire presentation