Sezzle Results Presentation Deck

PROVISION FOR CREDIT LOSSES

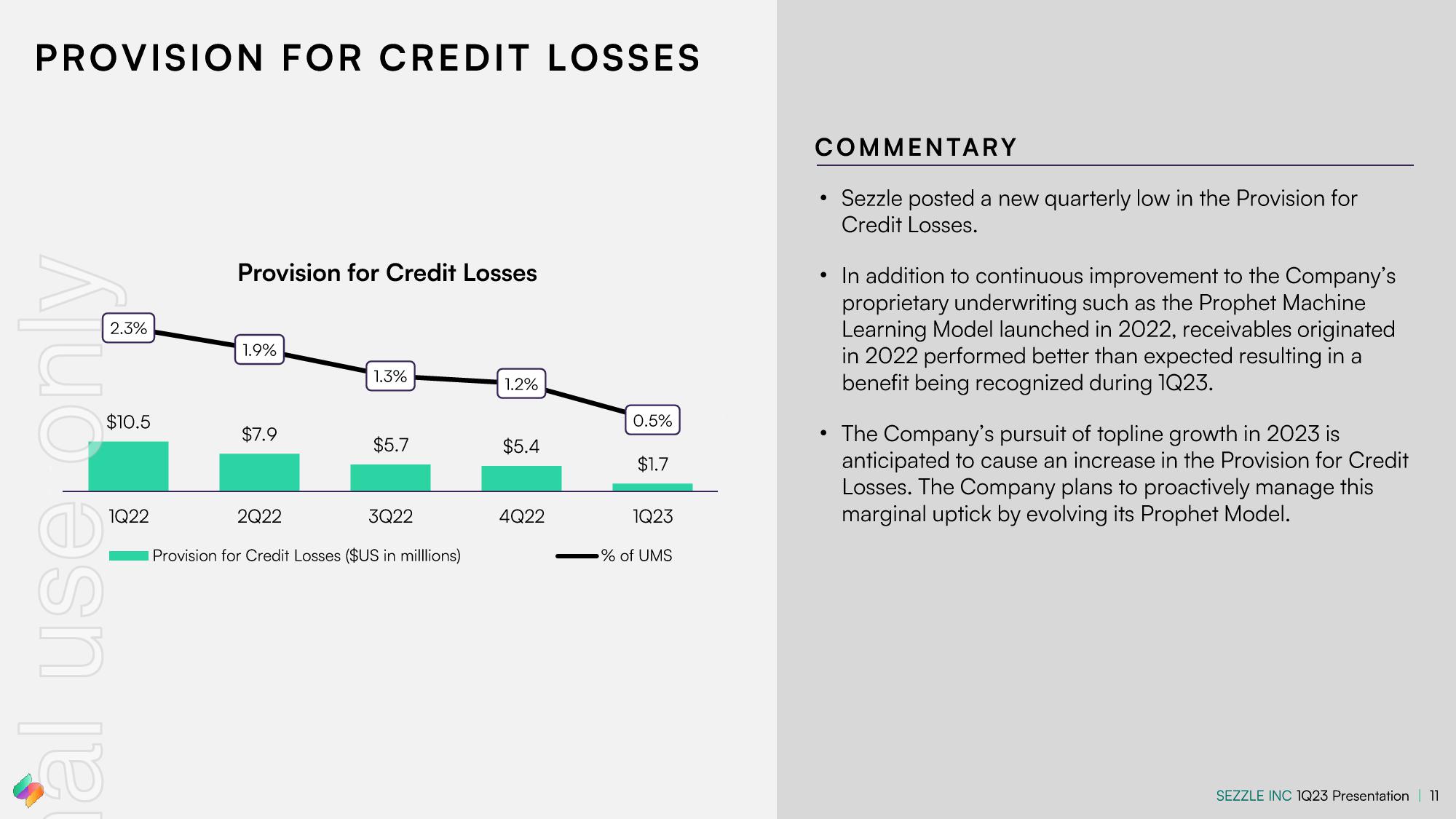

2.3%

$10.5

osn je

1Q22

Provision

Provision for Credit Losses

1.9%

$7.9

1.3%

$5.7

2Q22

3Q22

for Credit Losses ($US in milllions)

1.2%

$5.4

4Q22

0.5%

$1.7

1Q23

% of UMS

COMMENTARY

●

●

Sezzle posted a new quarterly low in the Provision for

Credit Losses.

In addition to continuous improvement to the Company's

proprietary underwriting such as the Prophet Machine

Learning Model launched in 2022, receivables originated

in 2022 performed better than expected resulting in a

benefit being recognized during 1Q23.

The Company's pursuit of topline growth in 2023 is

anticipated to cause an increase in the Provision for Credit

Losses. The Company plans to proactively manage this

marginal uptick by evolving its Prophet Model.

SEZZLE INC 1Q23 Presentation 11View entire presentation