Melrose Investor Presentation Deck

Overview

Melrose

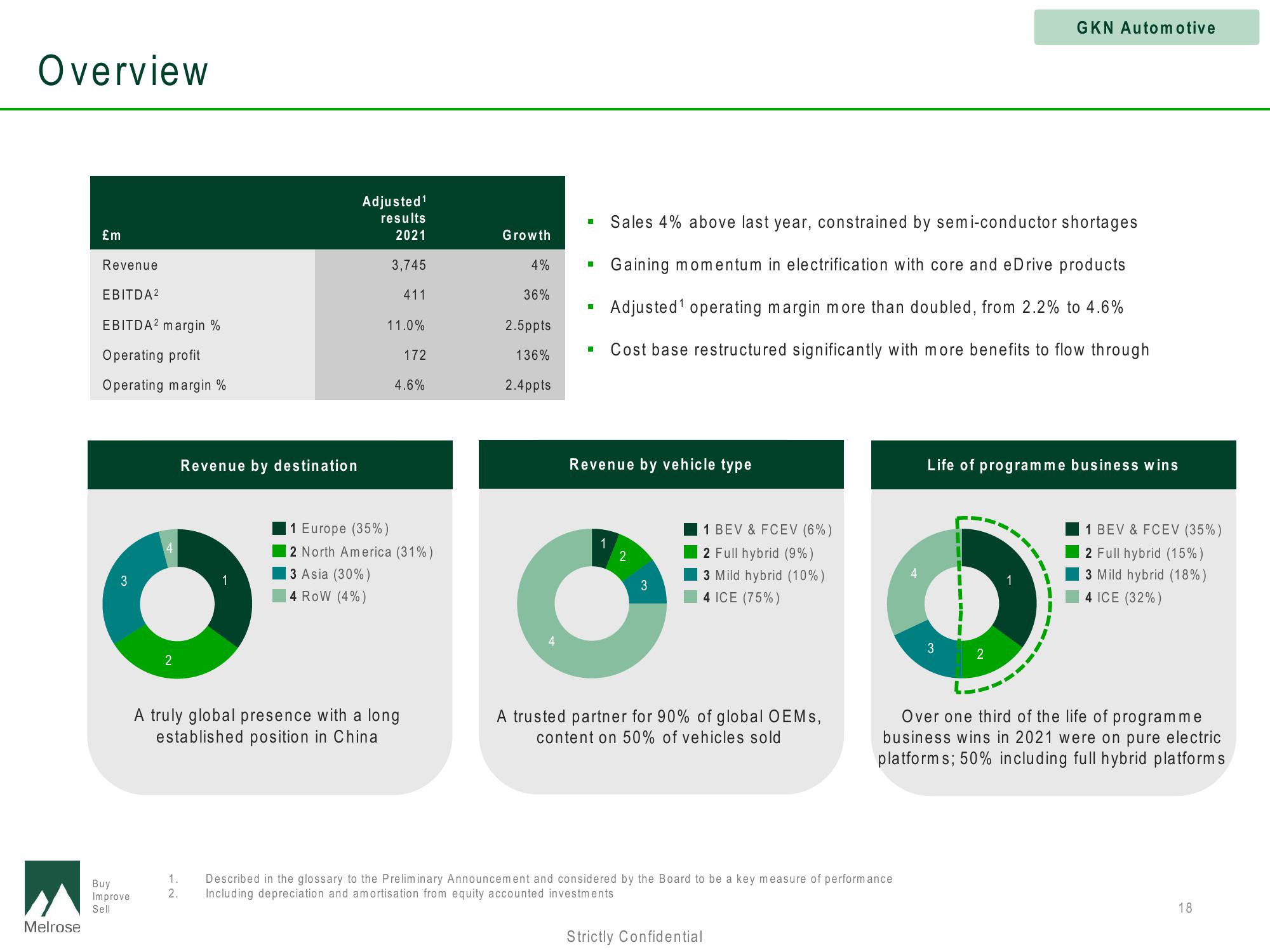

£m

Revenue

EBITDA²

EBITDA² margin %

Operating profit

Operating margin %

3

Buy

Improve

Sell

2

Revenue by destination

1.

2.

Adjusted¹

results

2021

3,745

411

11.0%

A truly global presence with a long

established position in China

172

4.6%

1 Europe (35%)

2 North America (31%)

3 Asia (30%)

4 ROW (4%)

Growth

4%

36%

2.5ppts

136%

2.4ppts

H

Sales 4% above last year, constrained by semi-conductor shortages

Gaining momentum in electrification with core and eDrive products

Adjusted¹ operating margin more than doubled, from 2.2% to 4.6%

Cost base restructured significantly with more benefits to flow through

Revenue by vehicle type

2

3

1 BEV & FCEV (6%)

2 Full hybrid (9%)

3 Mild hybrid (10%)

4 ICE (75%)

A trusted partner for 90% of global OEMs,

content on 50% of vehicles sold

Strictly Confidential

Described in the glossary to the Preliminary Announcement and considered by the Board to be a key measure of performance

Including depreciation and amortisation from equity accounted investments

GKN Automotive

Life of programme business wins

3

2

1 BEV & FCEV (35%)

2 Full hybrid (15%)

3 Mild hybrid (18%)

4 ICE (32%)

Over one third of the life of programme

business wins in 2021 were on pure electric

platforms; 50% including full hybrid platforms

18View entire presentation