Terran Orbital SPAC Presentation Deck

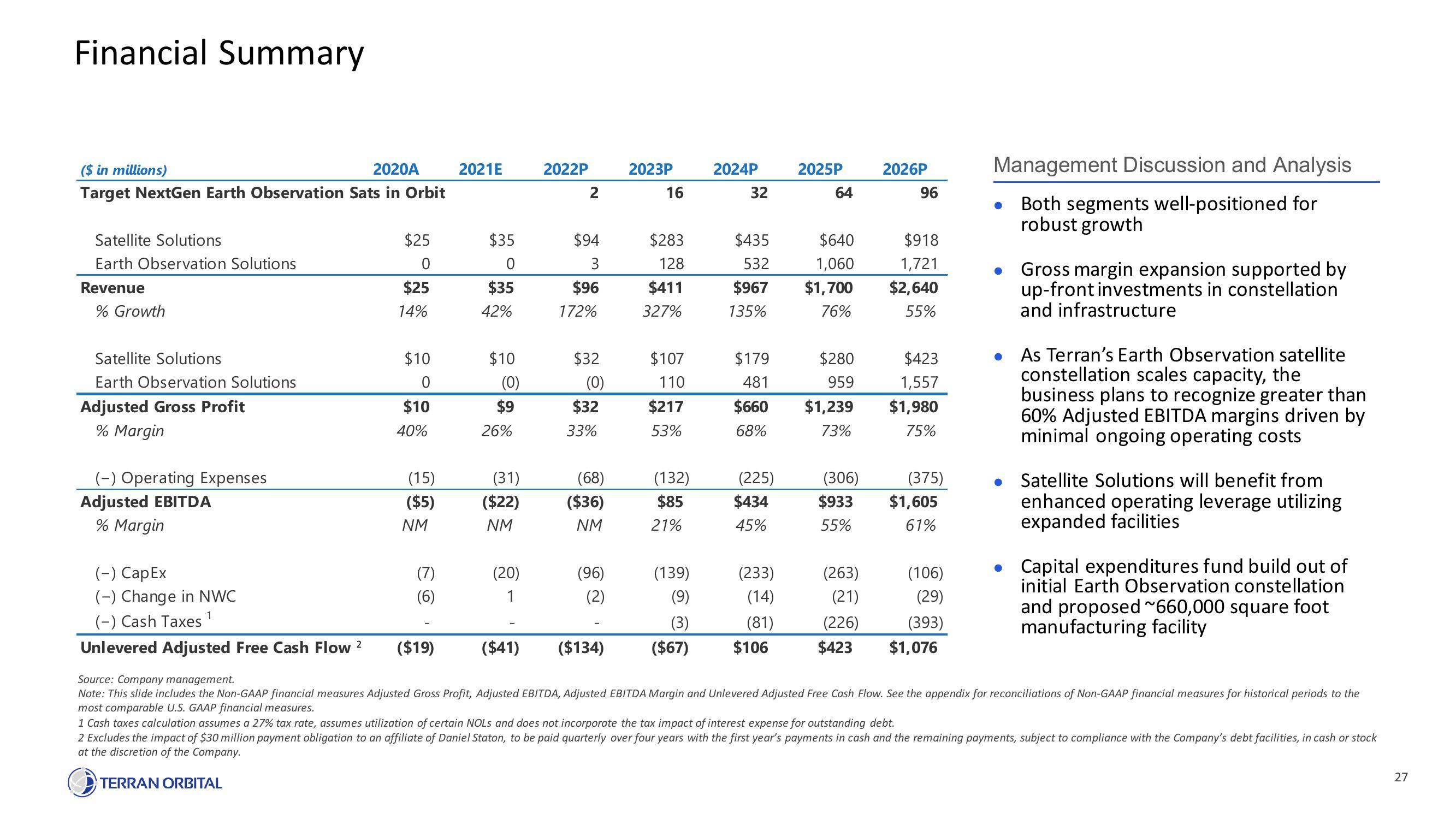

Financial Summary

($ in millions)

2020A

Target NextGen Earth Observation Sats in Orbit

Satellite Solutions

Earth Observation Solutions

Revenue

% Growth

Satellite Solutions

Earth Observation Solutions

Adjusted Gross Profit

% Margin

(-) Operating Expenses

Adjusted EBITDA

% Margin

(-) Cap Ex

(-) Change in NWC

(-) Cash Taxes 1

Unlevered Adjusted Free Cash Flow 2

$25

0

$25

14%

$10

0

$10

40%

(15)

($5)

NM

(7)

(6)

($19)

2021E

$35

0

$35

42%

$10

(0)

$9

26%

(31)

($22)

NM

(20)

1

2022P

$94

3

$96

172%

$32

(0)

$32

33%

(68)

($36)

NM

(96)

(2)

($41) ($134)

2023P

16

$283

128

$411

327%

$107

110

$217

53%

(132)

$85

21%

(139)

(9)

(3)

($67)

2024P

32

$435

532

$967

135%

$179

481

$660

68%

(225)

$434

45%

(233)

(14)

(81)

$106

2025P

64

$640

1,060

$1,700

76%

$280

959

$1,239

73%

(306)

$933

55%

(263)

(21)

(226)

$423

2026P

96

$918

1,721

$2,640

55%

$423

1,557

$1,980

75%

(375)

$1,605

61%

(106)

(29)

(393)

$1,076

Management Discussion and Analysis

Both segments well-positioned for

robust growth

Gross margin expansion supported by

up-front investments in constellation

and infrastructure

As Terran's Earth Observation satellite

constellation scales capacity, the

business plans to recognize greater than

60% Adjusted EBITDA margins driven by

minimal ongoing operating costs

Satellite Solutions will benefit from

enhanced operating leverage utilizing

expanded facilities

Capital expenditures fund build out of

initial Earth Observation constellation

and proposed ~660,000 square foot

manufacturing facility

Source: Company management.

Note: This slide includes the Non-GAAP financial measures Adjusted Gross Profit, Adjusted EBITDA, Adjusted EBITDA Margin and Unlevered Adjusted Free Cash Flow. See the appendix for reconciliations of Non-GAAP financial measures for historical periods to the

most comparable U.S. GAAP financial measures.

1 Cash taxes calculation assumes a 27% tax rate, assumes utilization of certain NOLS and does not incorporate the tax impact of interest expense for outstanding debt.

2 Excludes the impact of $30 million payment obligation to an affiliate of Daniel Staton, to be paid quarterly over four years with the first year's payments in cash and the remaining payments, subject to compliance with the Company's debt facilities, in cash or stock

at the discretion of the Company.

TERRAN ORBITAL

27View entire presentation