MariaDB SPAC Presentation Deck

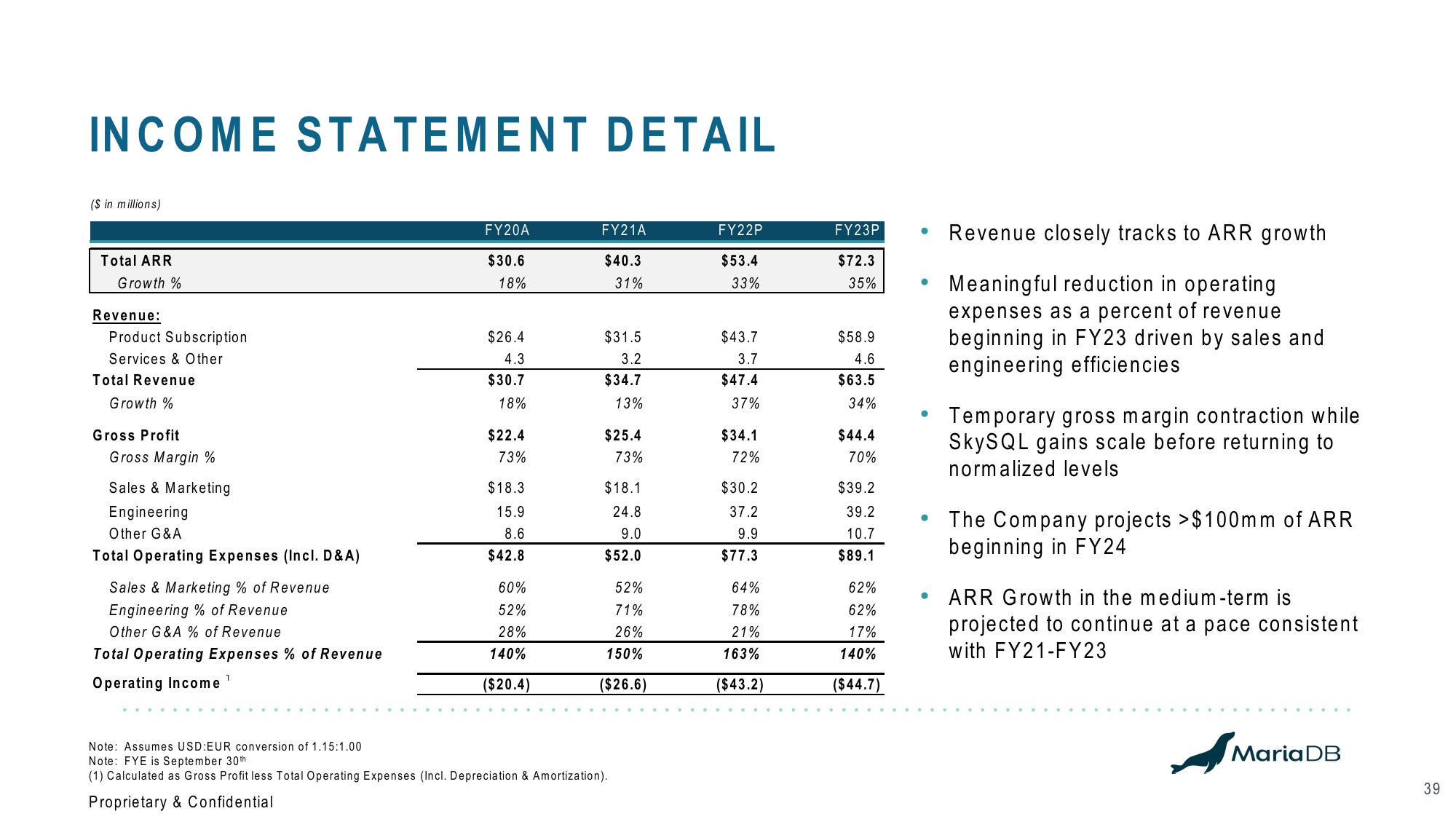

INCOME STATEMENT DETAIL

($ in millions)

Total ARR

Growth %

Revenue:

Product Subscription

Services & Other

Total Revenue

Growth %

Gross Profit

Gross Margin %

Sales & Marketing

Engineering

Other G&A

Total Operating Expenses (Incl. D&A)

Sales & Marketing % of Revenue

Engineering % of Revenue

Other G&A % of Revenue

Total Operating Expenses % of Revenue

Operating Income

1

FY20A

$30.6

18%

$26.4

4.3

$30.7

18%

$22.4

73%

$18.3

15.9

8.6

$42.8

60%

52%

28%

140%

($20.4)

FY21A

$40.3

31%

$31.5

3.2

$34.7

13%

$25.4

73%

$18.1

24.8

9.0

$52.0

52%

71%

26%

150%

($26.6)

Note: Assumes USD:EUR conversion of 1.15:1.00

Note: FYE is September 30th

(1) Calculated as Gross Profit less Total Operating Expenses (Incl. Depreciation & Amortization).

Proprietary & Confidential

FY22P

$53.4

33%

$43.7

3.7

$47.4

37%

$34.1

72%

$30.2

37.2

9.9

$77.3

64%

78%

21%

163%

($43.2)

FY23P

$72.3

35%

$58.9

4.6

$63.5

34%

$44.4

70%

$39.2

39.2

10.7

$89.1

62%

62%

17%

140%

($44.7)

●

•

●

●

Revenue closely tracks to ARR growth

Meaningful reduction in operating

expenses as a percent of revenue

beginning in FY23 driven by sales and

engineering efficiencies

Temporary gross margin contraction while

SkySQL gains scale before returning to

normalized levels

The Company projects >$100mm of ARR

beginning in FY24

ARR Growth in the medium-term is

projected to continue at a pace consistent

with FY21-FY23

MariaDB

39View entire presentation