Bank of America Investment Banking Pitch Book

SIRE Situation Overview

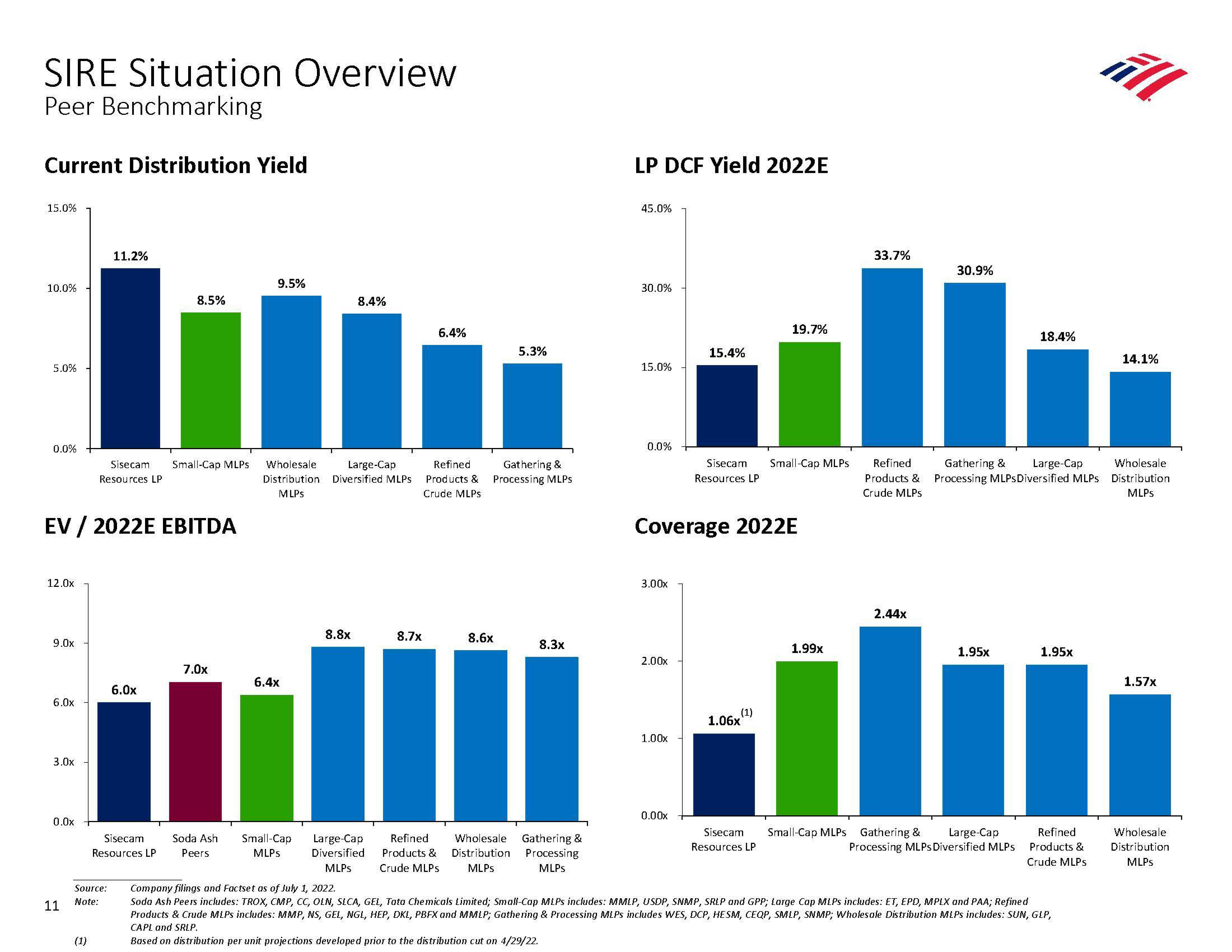

Peer Benchmarking

Current Distribution Yield

15.0%

10.0%

5.0%

0.0%

12.0x

9.0x

EV / 2022E EBITDA

6.0x

3.0x

0.0x

11

11.2%

(1)

Source:

Note:

Sisecam Small-Cap MLPs Wholesale

Resources LP

8.5%

6.0x

Sisecam

Resources LP

7.0x

9.5%

Soda Ash

Peers

Large-Cap

Distribution Diversified MLPs

MLPs

6.4x

Small-Cap

MLPS

8.4%

8.8x

8.7x

6.4%

Refined

Products &

Crude MLPs

5.3%

Gathering &

Processing MLPs

8.6x

8.3x

LP DCF Yield 2022E

Wholesale Gathering &

Distribution Processing

MLPs

MLPs

45.0%

30.0%

15.0%

0.0%

3.00x

2.00x

Coverage 2022E

1.00x

15.4%

0.00x

Sisecam Small-Cap MLPs

Resources LP

1.06x

19.7%

(1)

Sisecam

Resources LP

1.99x

33.7%

Refined

Products &

Crude MLPs

2.44x

30.9%

1.95x

18.4%

Small-Cap MLPs Gathering & Large-Cap

Processing MLPs Diversified MLPs

Large-Cap Refined

Diversified Products &

MLPs Crude MLPs

Company filings and Factset as of July 1, 2022.

Soda Ash Peers includes: TROX, CMP, CC, OLN, SLCA, GEL, Tata Chemicals Limited; Small-Cap MLPs includes: MMLP, USDP, SNMP, SRLP and GPP; Large Cap MLPS includes: ET, EPD, MPLX and PAA; Refined

Products & Crude MLPS includes: MMP, NS, GEL, NGL, HEP, DKL, PBFX and MMLP; Gathering & Processing MLPS includes WES, DCP, HESM, CEQP, SMLP, SNMP; Wholesale Distribution MLPS includes: SUN, GLP,

CAPL and SRLP.

Based on distribution per unit projections developed prior to the distribution cut on 4/29/22.

Wholesale

Gathering & Large-Cap

Processing MLPs Diversified MLPs Distribution

MLPs

1.95x

Refined

Products &

Crude MLPs

ill

14.1%

1.57x

Wholesale

Distribution

MLPsView entire presentation