Vici Investor Presentation

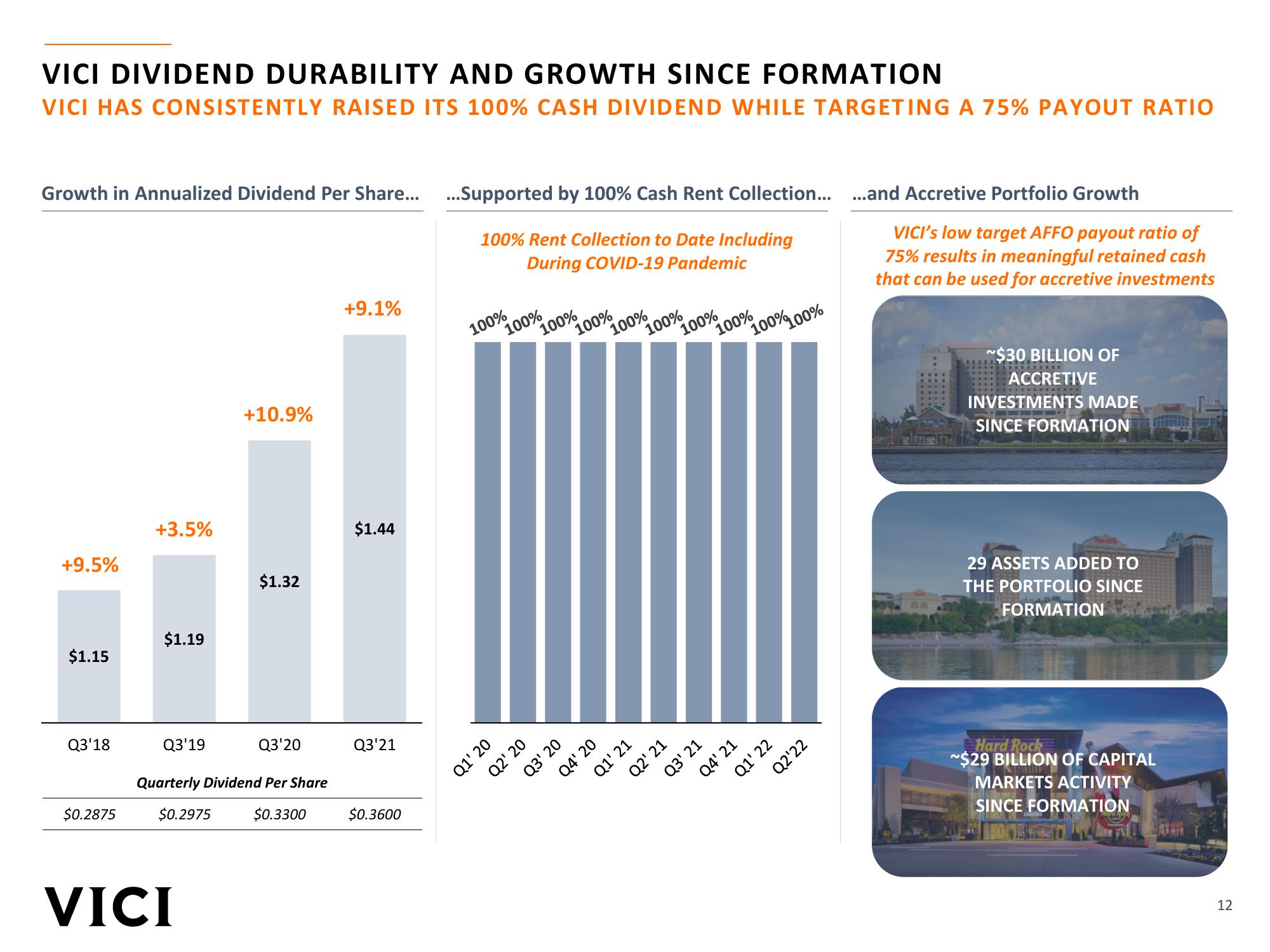

VICI DIVIDEND DURABILITY AND GROWTH SINCE FORMATION

VICI HAS CONSISTENTLY RAISED ITS 100% CASH DIVIDEND WHILE TARGETING A 75% PAYOUT RATIO

Growth in Annualized Dividend Per Share... ...Supported by 100% Cash Rent Collection... ...and Accretive Portfolio Growth

VICI's low target AFFO payout ratio of

75% results in meaningful retained cash

that can be used for accretive investments

+9.5%

$1.15

Q3'18

$0.2875

+3.5%

$1.19

Q3'19

+10.9%

VICI

$1.32

Q3'20

Quarterly Dividend Per Share

$0.2975

$0.3300

+9.1%

$1.44

Q3'21

$0.3600

100% Rent Collection to Date Including

During COVID-19 Pandemic

100%

100%

Q1' 20

Q2' 20

100%

100%

Q3' 20

Q4' 20

100%

Q1' 21

100%

100%

Q2' 21

Q3' 21

100%

100% 100%

Q4' 21

Q1' 22

Q2'22

~$30 BILLION OF

ACCRETIVE

INVESTMENTS MADE

SINCE FORMATION

29 ASSETS ADDED TO

THE PORTFOLIO SINCE

FORMATION

Hard Rock

~$29 BILLION OF CAPITAL

MARKETS ACTIVITY

SINCE FORMATION

play

12View entire presentation