WeWork SPAC Presentation Deck

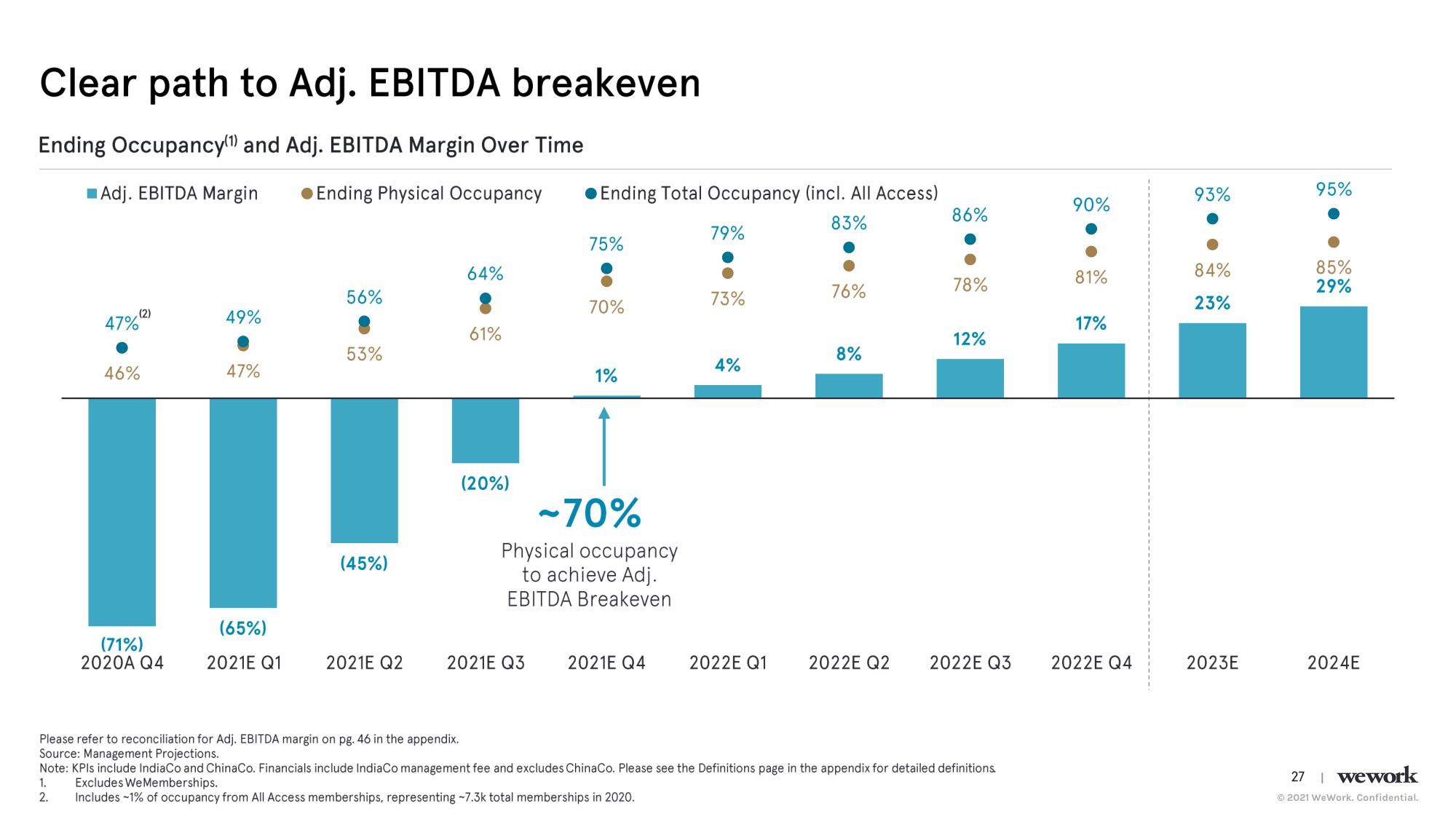

Clear path to Adj. EBITDA breakeven

Ending Occupancy(1) and Adj. EBITDA Margin Over Time

Adj. EBITDA Margin

Ending Physical Occupancy

(2)

47%2

46%

(71%)

2020A Q4

49%

47%

(65%)

2021E Q1

56%

53%

(45%)

2021E Q2

64%

61%

(20%)

Ending Total Occupancy (incl. All Access)

83%

2021E Q3

75%

70%

1%

-70%

Physical occupancy

to achieve Adj.

EBITDA Breakeven

2021E Q4

79%

73%

4%

2022E Q1

76%

8%

2022E Q2

86%

78%

12%

2022E Q3

Please refer to reconciliation for Adj. EBITDA margin on pg. 46 in the appendix.

Source: Management Projections.

Note: KPIs include IndiaCo and ChinaCo. Financials include IndiaCo management fee and excludes ChinaCo. Please see the Definitions page in the appendix for detailed definitions.

Excludes We Memberships.

1.

2.

Includes -1% of occupancy from All Access memberships, representing -7.3k total memberships in 2020.

90%

81%

17%

2022E Q4

93%

84%

23%

2023E

95%

85%

29%

2024E

27 | wework

Ⓒ2021 WeWork. Confidential.View entire presentation