AgroFresh SPAC Presentation Deck

Transaction Overview

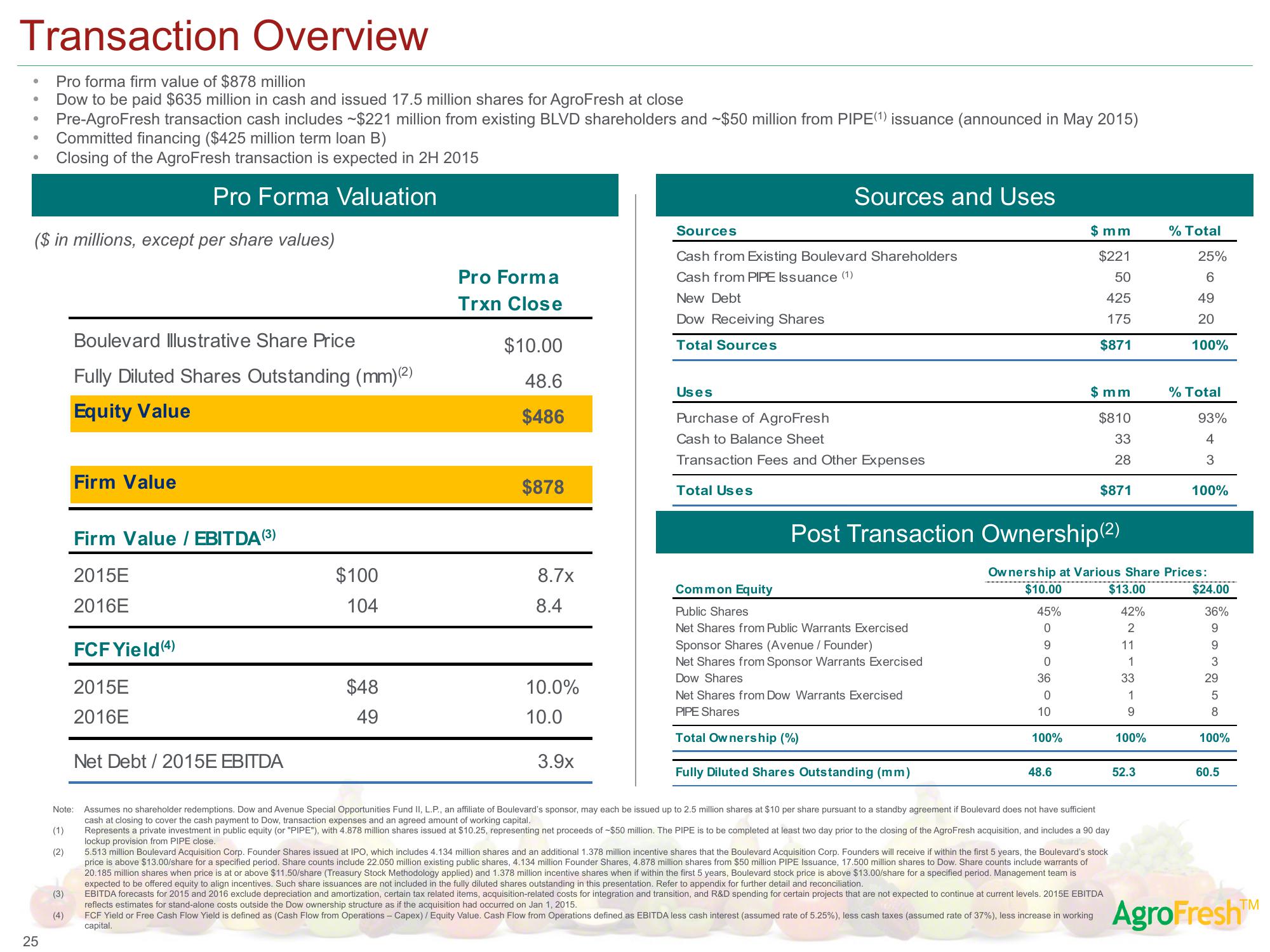

Pro forma firm value of $878 million

Dow to be paid $635 million in cash and issued 17.5 million shares for AgroFresh at close

Pre-AgroFresh transaction cash includes $221 million from existing BLVD shareholders and ~$50 million from PIPE (1) issuance (announced in May 2015)

Committed financing ($425 million term loan B)

Closing of the AgroFresh transaction is expected in 2H 2015

Pro Forma Valuation

●

●

($ in millions, except per share values)

25

Note:

(1)

(2)

(3)

(4)

Boulevard Illustrative Share Price

Fully Diluted Shares Outstanding (mm) (²)

Equity Value

Firm Value

Firm Value / EBITDA (³)

2015E

2016E

FCF Yield (4)

2015E

2016E

Net Debt / 2015E EBITDA

$100

104

$48

49

Pro Forma

Trxn Close

$10.00

48.6

$486

$878

8.7x

8.4

10.0%

10.0

3.9x

Sources and Uses

Sources

Cash from Existing Boulevard Shareholders

Cash from PIPE Issuance (1)

New Debt

Dow Receiving Shares

Total Sources

Uses

Purchase of AgroFresh

Cash to Balance Sheet

Transaction Fees and Other Expenses

Total Uses

Common Equity

Public Shares

Net Shares from Public Warrants Exercised

Sponsor Shares (Avenue / Founder)

Net Shares from Sponsor Warrants Exercised

Dow Shares

Net Shares from Dow Warrants Exercised

PIPE Shares

Total Ownership (%)

Fully Diluted Shares Outstanding (mm)

$mm

$221

50

425

175

$871

$mm

$810

33

28

Post Transaction Ownership(2)

48.6

$871

Assumes no shareholder redemptions. Dow and Avenue Special Opportunities Fund II, L.P., an affiliate of Boulevard's sponsor, may each be issued up to 2.5 million shares at $10 per share pursuant to a standby agreement if Boulevard does not have sufficient

cash at closing to cover the cash payment to Dow, transaction expenses and an agreed amount of working capital.

Represents a private investment in public equity (or "PIPE"), with 4.878 million shares issued at $10.25, representing net proceeds of -$50 million. The PIPE is to be completed at least two day prior to the closing of the AgroFresh acquisition, and includes a 90 day

lockup provision from PIPE close.

5.513 million Boulevard Acquisition Corp. Founder Shares issued at IPO, which includes 4.134 million shares and an additional 1.378 million incentive shares that the Boulevard Acquisition Corp. Founders will receive if within the first 5 years, the Boulevard's stock

price is above $13.00/share for a specified period. Share counts include 22.050 million existing public shares, 4.134 million Founder Shares, 4.878 million shares from $50 million PIPE Issuance, 17.500 million shares to Dow. Share counts include warrants of

20.185 million shares when price is at or above $11.50/share (Treasury Stock Methodology applied) and 1.378 million incentive shares when if within the first 5 years, Boulevard stock price is above $13.00/share for a specified period. Management team is

expected to be offered equity to align incentives. Such share issuances are not included in the fully diluted shares outstanding in this presentation. Refer to appendix for further detail and reconciliation.

EBITDA forecasts for 2015 and 2016 exclude depreciation and amortization, certain tax related items, acquisition-related costs for integration and transition, and R&D spending for certain projects that are not expected to continue at current levels. 2015E EBITDA

reflects estimates for stand-alone costs outside the Dow ownership structure as if the acquisition had occurred on Jan 1, 2015.

FCF Yield or Free Cash Flow Yield is defined as (Cash Flow from Operations - Capex) / Equity Value. Cash Flow from Operations defined as EBITDA less cash interest (assumed rate of 5.25%), less cash taxes (assumed rate of 37%), less increase in working

capital.

% Total

25%

6

49

20

100%

Ownership at Various Share Prices:

$10.00

$13.00

45%

42%

0

2

9

11

0

1

36

33

0

1

10

9

100%

100%

52.3

% Total

93%

4

3

100%

$24.00

36%

9

9

3.

29

5

8

100%

60.5

AgroFresh™View entire presentation