Cyxtera Investor Presentation Deck

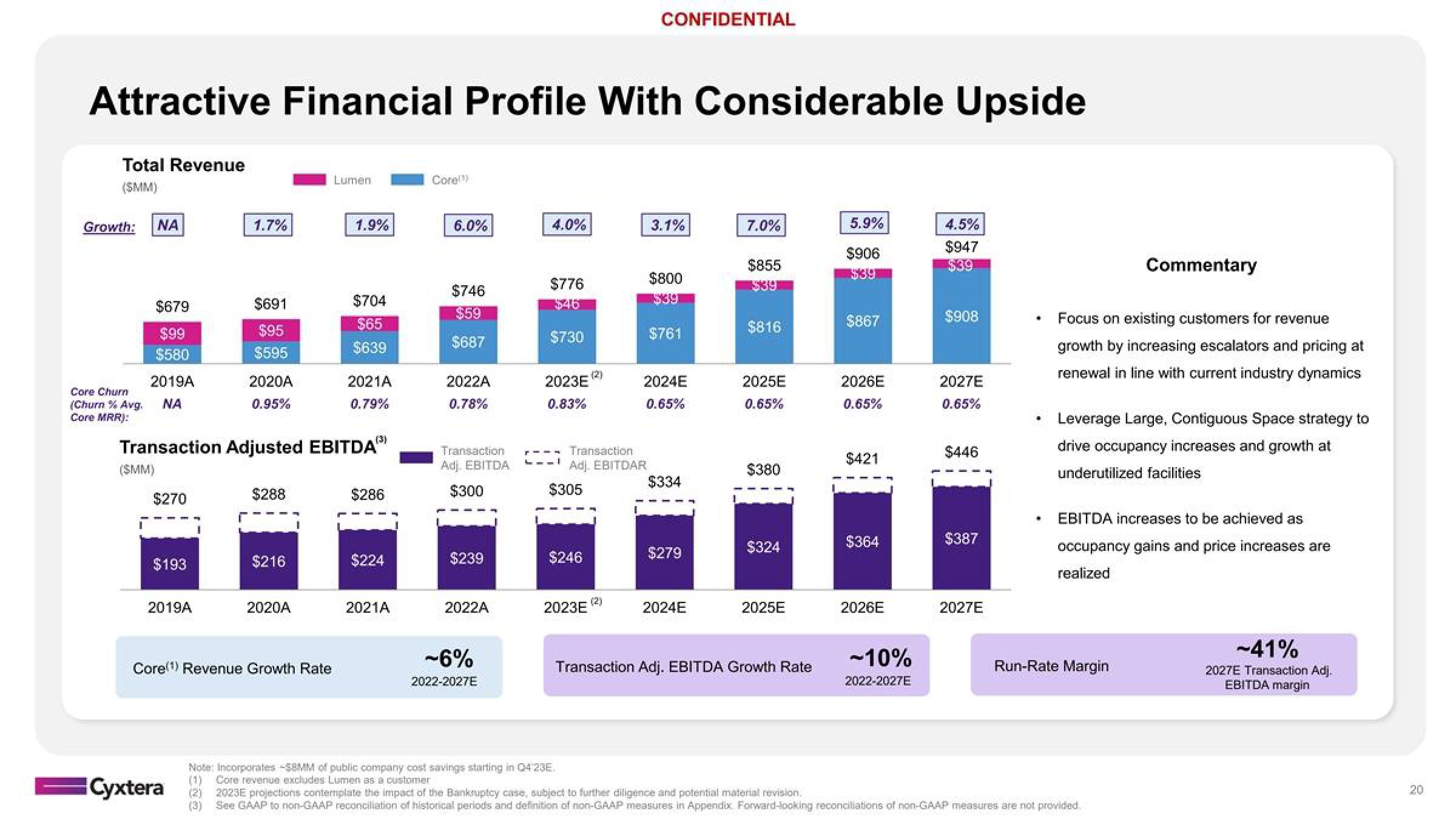

Attractive Financial Profile With Considerable Upside

Total Revenue

(SMM)

Growth: ΝΑ

$679

$99

$580

2019A

Core Churn

(Churn % Avg. ΝΑ

Core MRR):

(SMM)

$270

$193

2019A

1.7%

$691

$95

$595

Cyxtera

2020A

0.95%

Transaction Adjusted EBITDAⓇ)

$288

$216

2020A

Core(¹) Revenue Growth Rate

Lumen

1.9%

$704

$65

$639

2021A

0.79%

(3)

$286

$224

2021A

Core!

6.0%

$746

$59

$687

2022A

0.78%

Transaction

Adj. EBITDA

$300

$239

2022A

-6%

2022-2027E

4.0%

$776

$46

$730

2023E

0.83%

L__I

Transaction

Adj. EBITDAR

$305

$246

CONFIDENTIAL

2023E

3.1%

$800

$39

$761

2024E

0.65%

$334

$279

2024E

7.0%

$855

$816

2025E

0.65%

$380

$324

2025E

Transaction Adj. EBITDA Growth Rate

5.9%

$906

$39

$867

2026E

0.65%

$421

$364

2026E

-10%

2022-2027E

4.5%

$947

$908

2027E

0.65%

$446

$387

2027E

Focus on existing customers for revenue

growth by increasing escalators and pricing at

renewal in line with current industry dynamics

Commentary

Leverage Large, Contiguous Space strategy to

drive occupancy increases and growth at

underutilized facilities

EBITDA increases to be achieved as

occupancy gains and price increases are

realized

Run-Rate Margin

Note: Incorporates -S8MM of public company cost savings starting in Q4'23E.

(1) Core revenue excludes Lumen as a customer

2023E projections contemplate the impact of the Bankruptcy case, subject to further diligence and potential material revision.

See GAAP to non-GAAP reconciliation of historical periods and definition of non-GAAP measures in Appendix Forward-looking reconciliations of non-GAAP measures are not provided

-41%

2027E Transaction Adj.

EBITDA margin

20View entire presentation