Summit Hotel Properties Investor Presentation Deck

26

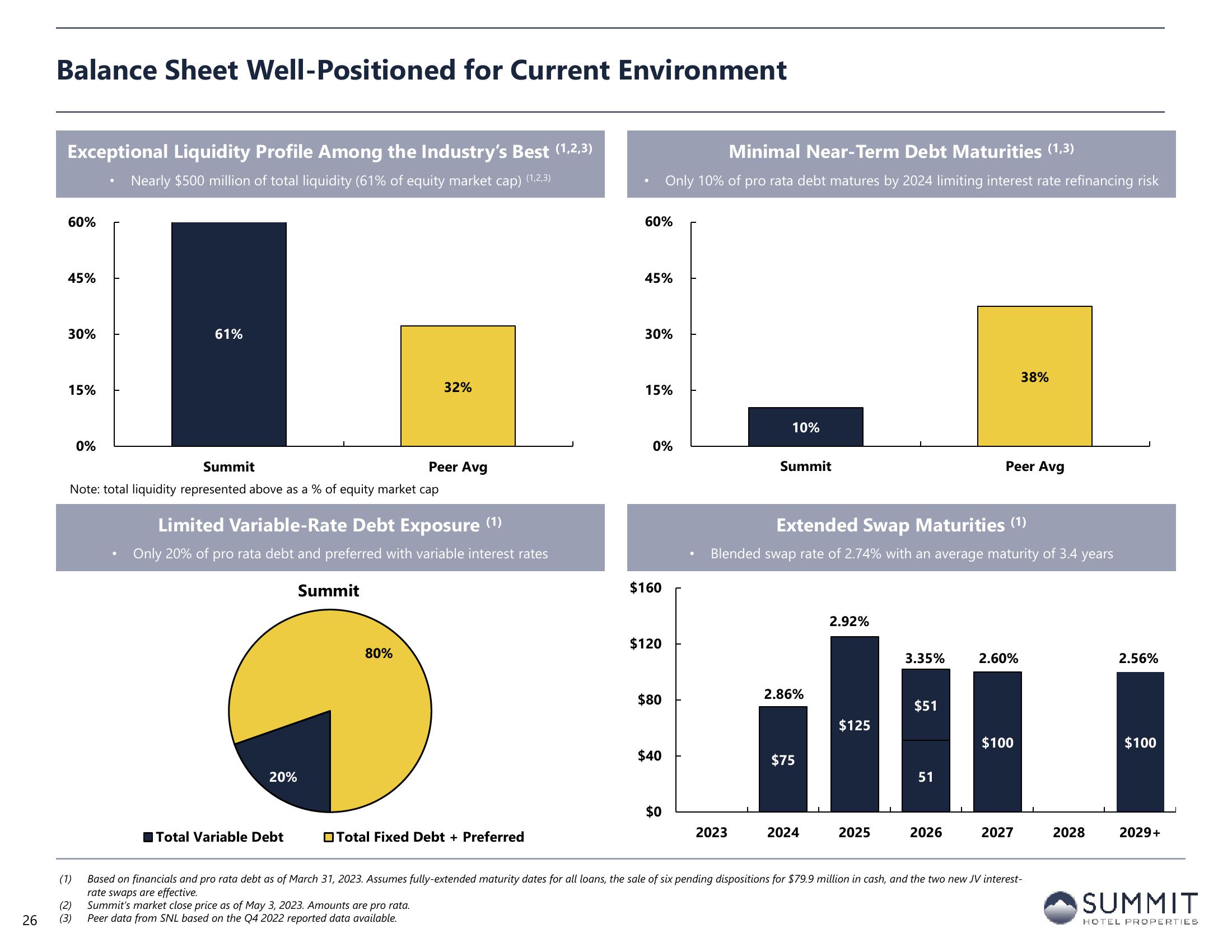

Balance Sheet Well-Positioned for Current Environment

Exceptional Liquidity Profile Among the Industry's Best (1,2,3)

Nearly $500 million of total liquidity (61% of equity market cap) (1,2,3)

60%

45%

30%

15%

0%

(1)

(2)

(3)

61%

Summit

Note: total liquidity represented above as a % of equity market cap

20%

Limited Variable-Rate Debt Exposure (1)

Only 20% of pro rata debt and preferred with variable interest rates

Total Variable Debt

Summit

32%

Peer Avg

80%

Total Fixed Debt + Preferred

60%

45%

30%

15%

Minimal Near-Term Debt Maturities (1,3)

Only 10% of pro rata debt matures by 2024 limiting interest rate refinancing risk

0%

$160

$120

$80

$40

$0

10%

2023

Summit

Extended Swap Maturities (¹)

Blended swap rate of 2.74% with an average maturity of 3.4 years

2.86%

$75

2024

2.92%

$125

2025

3.35%

$51

51

2026

Peer Avg

2.60%

38%

$100

2027

Based on financials and pro rata debt as of March 31, 2023. Assumes fully-extended maturity dates for all loans, the sale of six pending dispositions for $79.9 million in cash, and the two new JV interest-

rate swaps are effective.

Summit's market close price as of May 3, 2023. Amounts are pro rata.

Peer data from SNL based on the Q4 2022 reported data available.

2028

2.56%

-

$100

2029+

SUMMIT

HOTEL PROPERTIESView entire presentation