Tudor, Pickering, Holt & Co Investment Banking

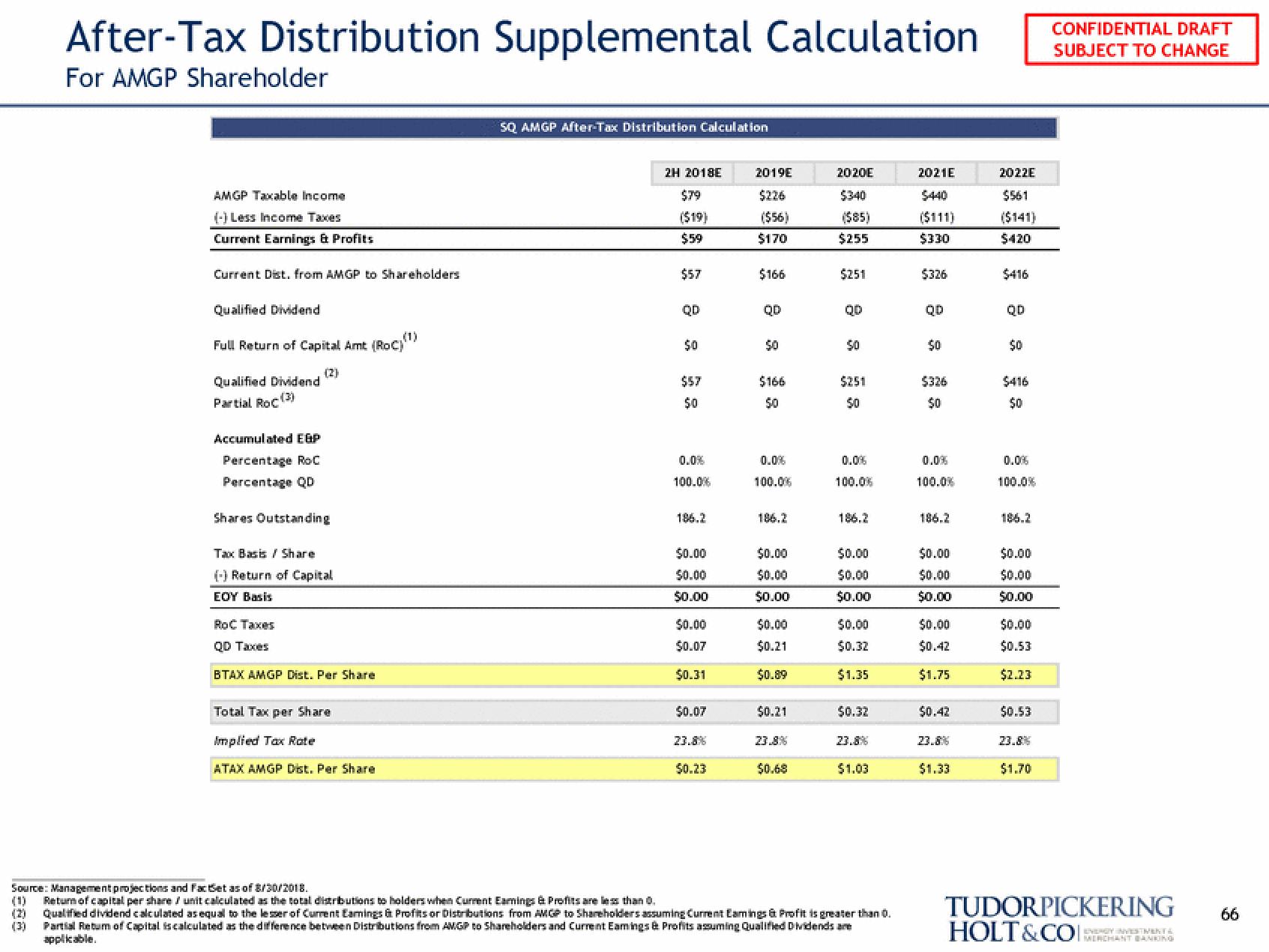

After-Tax Distribution Supplemental Calculation

For AMGP Shareholder

(3)

AMGP Taxable income

(-) Less Income Taxes

Current Earnings & Profits

Current Dist. from AMGP to Shareholders

Qualified Dividend

Full Return of Capital Amt (RoC)

Qualified Dividend

Partial RoC (3)

Accumulated EGP

Percentage RoC

Percentage QD

(2)

Shares Outstanding

Tax Basis / Share

(-) Return of Capital

EOY Basis

Roc Taxes

QD Taxes

BTAX AMGP Dist. Per Share

Total Tax per Share

Implied Tax Rate

ATAX AMGP Dist. Per Share

SQ AMGP After-Tax Distribution Calculation

2H 2018E

$79

($19)

$59

$57

QD

$0

$57

$0

0.0%

100.0%

186.2

$0.00

50.00

$0.00

$0.00

$0.07

$0.31

$0.07

$0.23

2019E

$226

($56)

$170

$166

QD

50

$166

50

0.0%

100.0%

186.2

$0.00

$0.00

$0.00

$0.00

$0.21

$0.89

$0.21

$0.68

2020E

$340

(585)

$255

$251

50

$251

50

0.0%

100.0%

186.2

$0.00

50.00

$0.00

$0.00

$0.32

$1.35

$0.32

23.8%

$1.03

Source: Management projections and Facet as of 8/30/2018.

Return of capital per share / unit calculated as the total distributions to holders when Current Earings & Profits are less than 0.

Qualified dividend calculated as equal to the lesser of Current Earings & Profits or Distributions from AMGP to Shareholders assuming Current Lamings & Profit is greater than 0.

Partial Return of Capital is calculated as the difference between Distributions from AMGP to Shareholders and Current Earings & Profits assuming Qualified Dividends are

applicable.

2021E

$440

($111)

$330

$326

QD

$0

$326

$0

100.0%

186.2

$0.00

$0.00

$0.00

$0.00

$0.42

$1.75

$0.42

$1.33

2022E

$561

($141)

$420

$416

QD

$0

$416

$0

0.0%

100.0%

186.2

$0.00

$0.00

$0.00

$0.00

$0.53

$2.23

$0.53

$1.70

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

TUDORPICKERING

HOLT&COCHANT BANKING

66View entire presentation