Melrose Results Presentation Deck

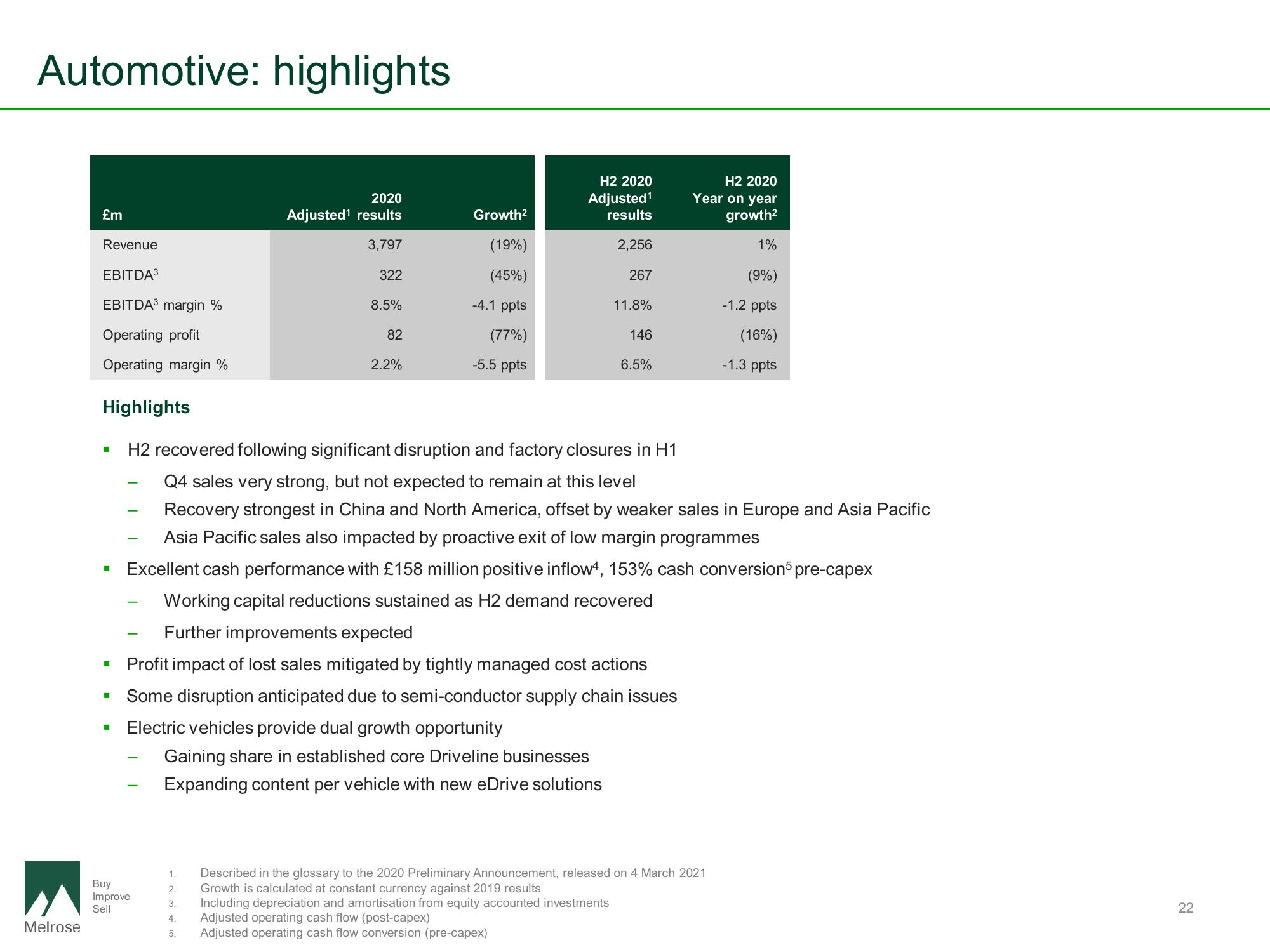

Automotive: highlights

Melrose

£m

Revenue

EBITDA³

EBITDA³ margin %

Operating profit

Operating margin %

■

■

■

■

-

Buy

Improve

Sell

2020

Adjusted¹ results

3,797

322

8.5%

1.

2.

3.

4.

5.

82

2.2%

Highlights

H2 recovered following significant disruption and factory closures in H1

Q4 sales very strong, but not expected to remain at this level

Recovery strongest in China and North America, offset by weaker sales in Europe and Asia Pacific

Asia Pacific sales also impacted by proactive exit of low margin programmes

Excellent cash performance with £158 million positive inflow4, 153% cash conversion5 pre-capex

Working capital reductions sustained as H2 demand recovered

Further improvements expected

▪ Profit impact of lost sales mitigated by tightly managed cost actions

Some disruption anticipated due to semi-conductor supply chain issues

Electric vehicles provide dual growth opportunity

Gaining share in established core Driveline businesses

Expanding content per vehicle with new eDrive solutions

Growth²

(19%)

(45%)

-4.1 ppts

(77%)

-5.5 ppts

H2 2020

Adjusted¹

results

2,256

267

11.8%

146

6.5%

H2 2020

Year on year

growth²

1%

(9%)

-1.2 ppts

(16%)

-1.3 ppts

Described in the glossary to the 2020 Preliminary Announcement, released on 4 March 2021

Growth is calculated at constant currency against 2019 results

Including depreciation and amortisation from equity accounted investments

Adjusted operating cash flow (post-capex)

Adjusted operating cash flow conversion (pre-capex)

22View entire presentation