Polestar SPAC Presentation Deck

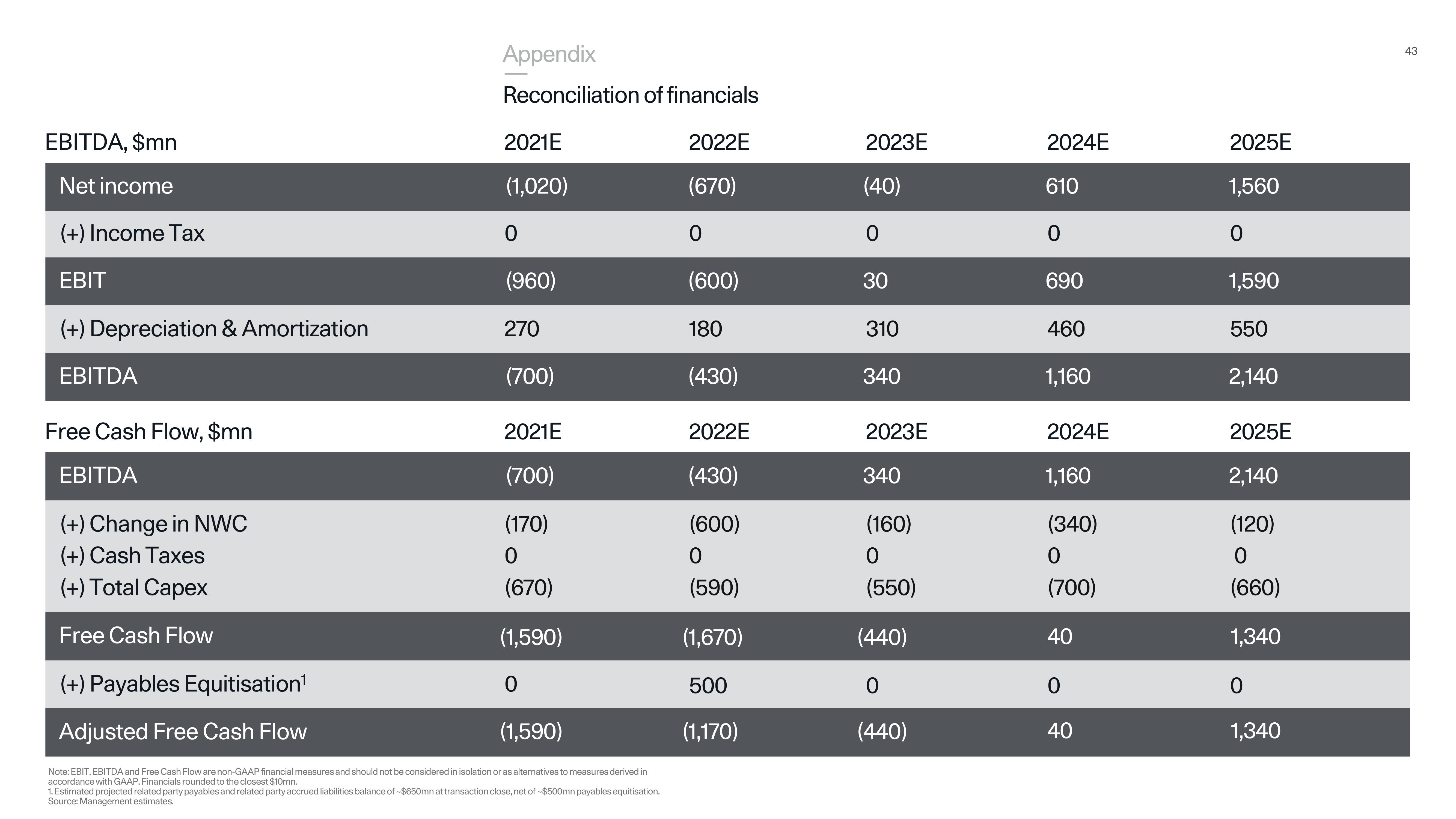

EBITDA, $mn

Net income

(+)Income Tax

EBIT

(+) Depreciation & Amortization

EBITDA

Free Cash Flow, $mn

EBITDA

(+) Change in NWC

(+) Cash Taxes

(+) Total Capex

Free Cash Flow

Appendix

Reconciliation of financials

2021E

(1,020)

0

(960)

270

(700)

2021E

(700)

(170)

0

(670)

(1,590)

(+) Payables Equitisation¹

Adjusted Free Cash Flow

(1,590)

Note: EBIT, EBITDA and Free Cash Flow are non-GAAP financial measures and should not be considered in isolation or as alternatives to measures derived in

accordance with GAAP. Financials rounded to the closest $10mn.

1. Estimated projected related party payables and related party accrued liabilities balance of ~$650mn at transaction close, net of -$500mn payables equitisation.

Source: Management estimates.

0

2022E

(670)

0

(600)

180

(430)

2022E

(430)

(600)

0

(590)

(1,670)

500

(1,170)

2023E

(40)

30

310

340

2023E

340

(160)

0

(550)

(440)

0

(440)

2024E

610

690

460

1,160

2024E

1,160

(340)

0

(700)

40

0

40

2025E

1,560

1,590

550

2,140

2025E

2,140

(120)

0

(660)

1,340

0

1,340

43View entire presentation