OppFi Results Presentation Deck

F

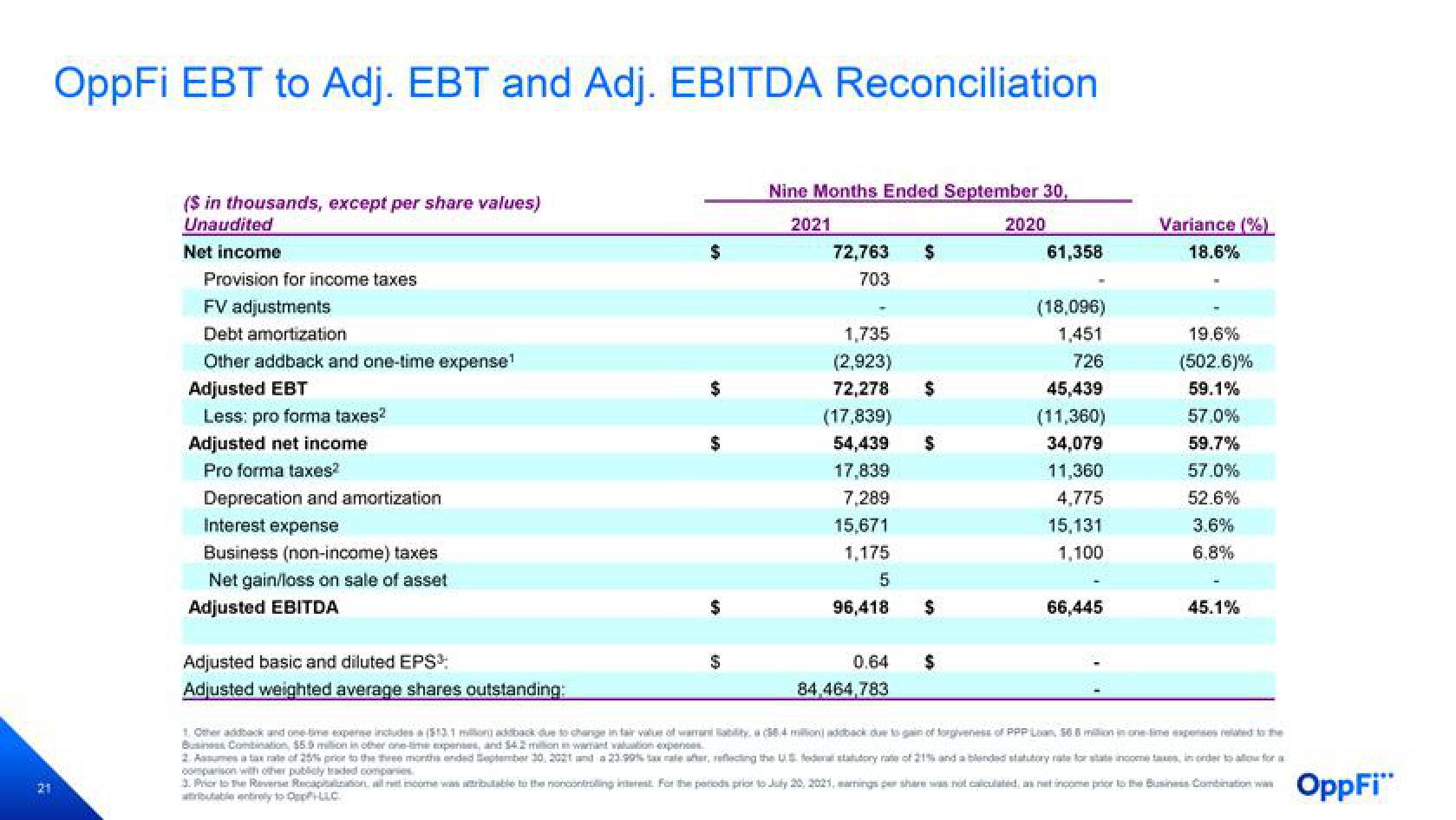

OppFi EBT to Adj. EBT and Adj. EBITDA Reconciliation

($ in thousands, except per share values)

Unaudited

Net income

Provision for income taxes

FV adjustments

Debt amortization

Other addback and one-time expense¹

Adjusted EBT

Less: pro forma taxes²

Adjusted net income

Pro forma taxes?

Deprecation and amortization

Interest expense

Business (non-income) taxes

Net gain/loss on sale of asset

Adjusted EBITDA

Adjusted basic and diluted EPS³:

Adjusted weighted average shares outstanding:

$

Nine Months Ended September 30,

2021

72,763 $

703

1,735

(2,923)

72,278

(17,839)

$

54,439 $

17,839

7,289

15,671

1,175

5

96,418

0.64

84,464,783

$

2020

61,358

(18,096)

1,451

726

45,439

(11,360)

34,079

11,360

4,775

15,131

1,100

66,445

Variance (%)

18.6%

19.6%

(502.6)%

59.1%

57.0%

59.7%

57.0%

52.6%

3.6%

6,8%

45.1%

1. Other addback and one time expense includes a (313,1 million addback due to change in fair value of wamant liability, a (884 million) addback due to gain of forgiveness of PPP Loan, 508 million in one-time expenses related to the

Business Combination, $59 million in other one-time expenses, and 54.2 million in warant valuation expenses

2 Astax rate of 25% prior to the three

a 23.99% tax rate aer, reflecting the U.S. federal stah

for a

3. Prior to the Reverse Recapitaination, all net income was attributable to the noncontrolling interest. For the poods prior to July 20, 2021, marings per share was not calculated as net income prior to the Business Combination was

atributable try to Opp/LLC

OppFi™View entire presentation