Apollo Global Management Investor Day Presentation Deck

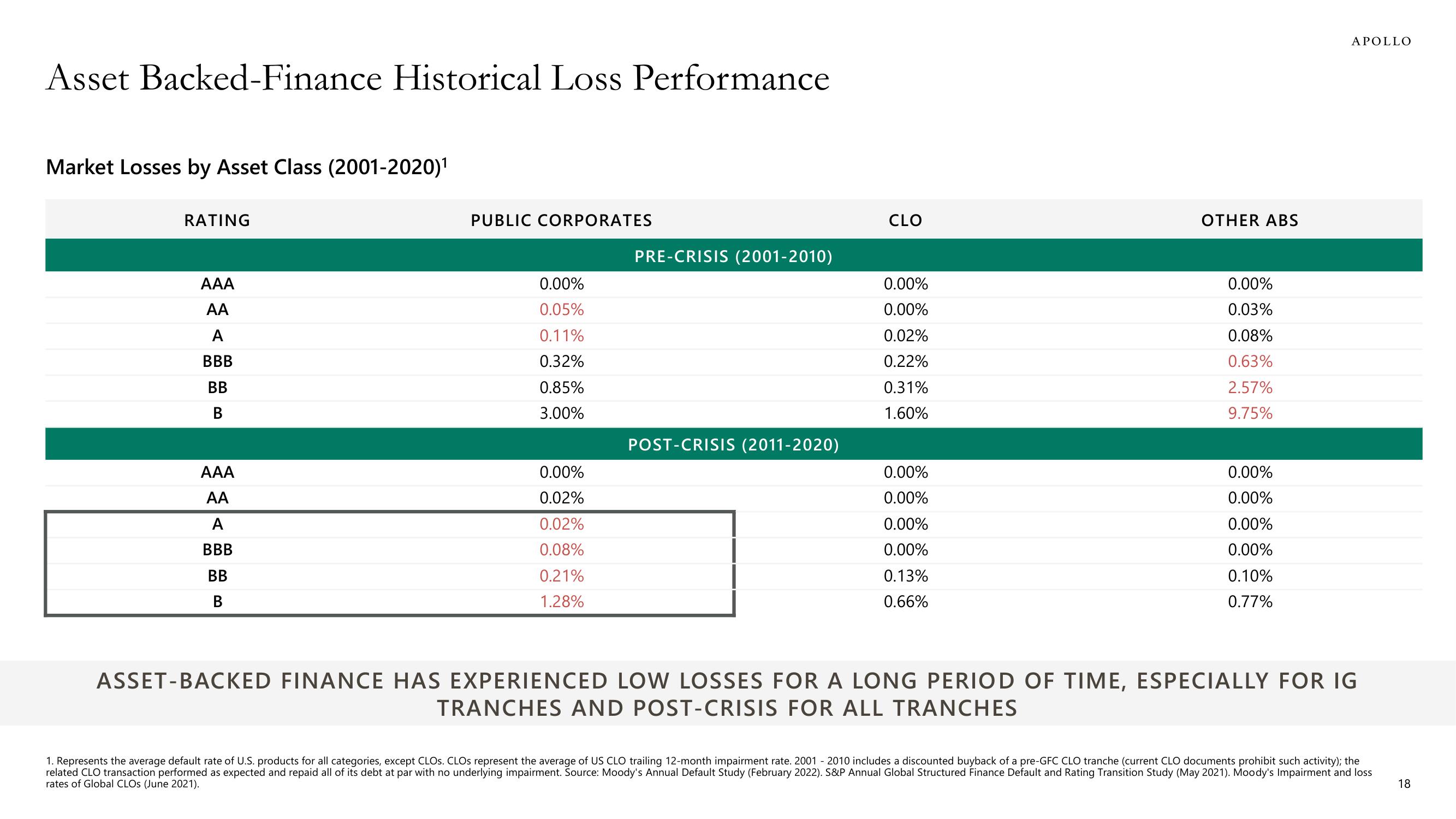

Asset Backed-Finance Historical Loss Performance

Market Losses by Asset Class (2001-2020)¹

RATING

AAA

AA

A

BBB

BB

AAA

AA

A

BBB

BB

B

PUBLIC CORPORATES

0.00%

0.05%

0.11%

0.32%

0.85%

3.00%

0.00%

0.02%

0.02%

0.08%

0.21%

1.28%

PRE-CRISIS (2001-2010)

POST-CRISIS (2011-2020)

CLO

0.00%

0.00%

0.02%

0.22%

0.31%

1.60%

0.00%

0.00%

0.00%

0.00%

0.13%

0.66%

OTHER ABS

0.00%

0.03%

0.08%

0.63%

2.57%

9.75%

0.00%

0.00%

0.00%

0.00%

0.10%

0.77%

APOLLO

ASSET-BACKED FINANCE HAS EXPERIENCED LOW LOSSES FOR A LONG PERIOD OF TIME, ESPECIALLY FOR IG

TRANCHES AND POST-CRISIS FOR ALL TRANCHES

1. Represents the average default rate of U.S. products for all categories, except CLOS. CLOS represent the average of US CLO trailing 12-month impairment rate. 2001 - 2010 includes a discounted buyback of a pre-GFC CLO tranche (current CLO documents prohibit such activity); the

related CLO transaction performed as expected and repaid all of its debt at par with no underlying impairment. Source: Moody's Annual Default Study (February 2022). S&P Annual Global Structured Finance Default and Rating Transition Study (May 2021). Moody's Impairment and loss

rates of Global CLOS (June 2021).

18View entire presentation