2nd Quarter 2021 Investor Presentation

Noninterest Expense

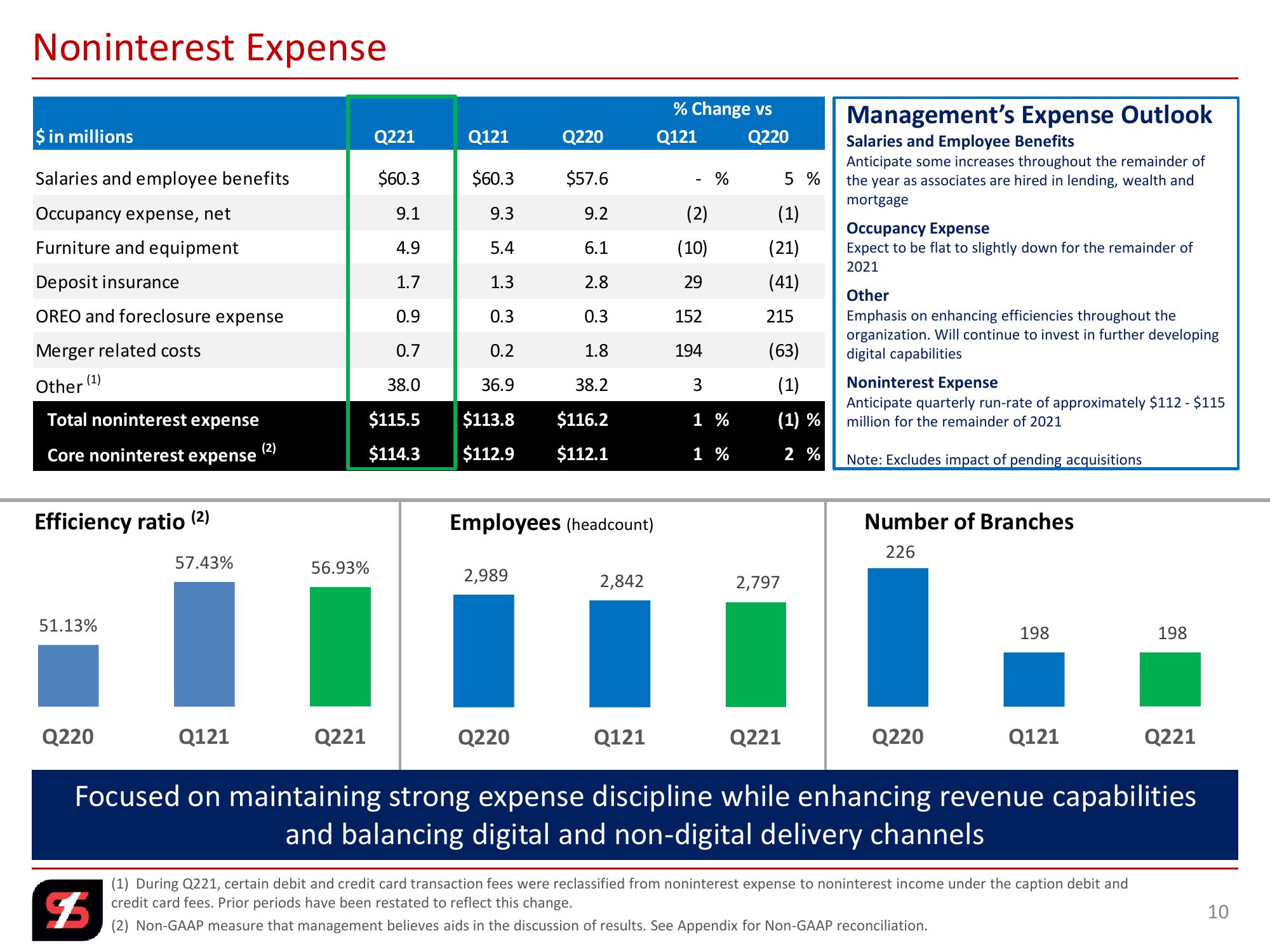

$ in millions

Q221

Q121

Q220

Q121

% Change vs

Q220

Salaries and employee benefits

$60.3

$60.3

$57.6

-

%

5 %

Occupancy expense, net

9.1

9.3

9.2

(2)

(1)

Furniture and equipment

4.9

5.4

6.1

(10)

(21)

Management's Expense Outlook

Salaries and Employee Benefits

Anticipate some increases throughout the remainder of

the year as associates are hired in lending, wealth and

mortgage

Occupancy Expense

Expect to be flat to slightly down for the remainder of

2021

Deposit insurance

1.7

1.3

2.8

29

(41)

Other

OREO and foreclosure expense

0.9

0.3

0.3

152

215

Merger related costs

0.7

0.2

1.8

194

(63)

(1)

Other

38.0

36.9

38.2

3

(1)

Total noninterest expense

$115.5

$113.8

$116.2

1 %

(1) %

Emphasis on enhancing efficiencies throughout the

organization. Will continue to invest in further developing

digital capabilities

Noninterest Expense

Anticipate quarterly run-rate of approximately $112 - $115

million for the remainder of 2021

Core noninterest expense

(2)

$114.3

$112.9

$112.1

1%

2 %

Note: Excludes impact of pending acquisitions

Efficiency ratio (2)

Employees (headcount)

Number of Branches

226

57.43%

56.93%

2,989

2,842

2,797

51.13%

Q220

Q121

Q221

Q220

Q121

Q221

Q220

198

198

Q121

Q221

Focused on maintaining strong expense discipline while enhancing revenue capabilities

and balancing digital and non-digital delivery channels

(1) During Q221, certain debit and credit card transaction fees were reclassified from noninterest expense to noninterest income under the caption debit and

credit card fees. Prior periods have been restated to reflect this change.

(2) Non-GAAP measure that management believes aids in the discussion of results. See Appendix for Non-GAAP reconciliation.

$

10View entire presentation