Tradeweb Results Presentation Deck

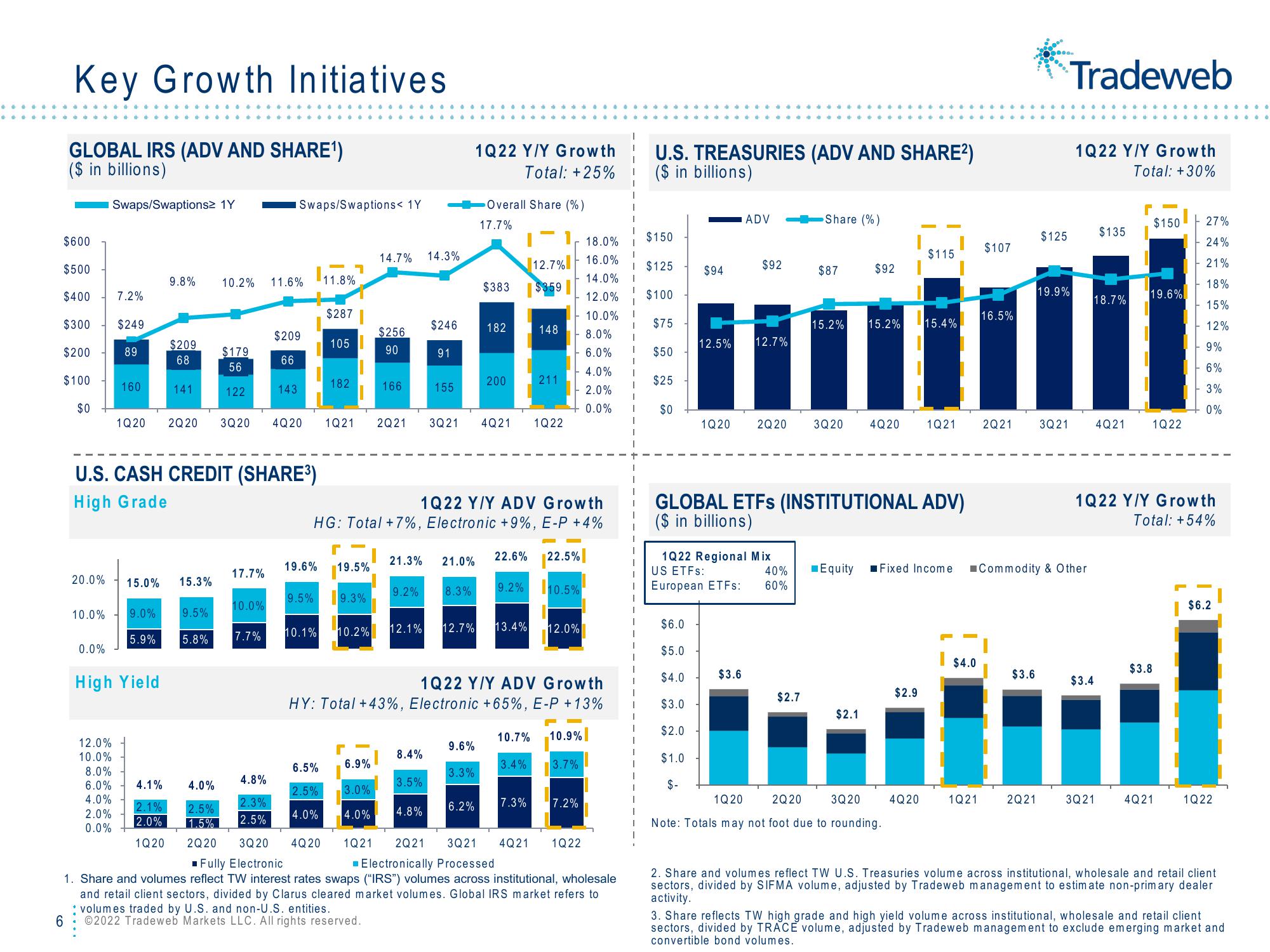

Key Growth Initiatives

GLOBAL IRS (ADV AND SHARE¹)

($ in billions)

$600

$500

$400

$300 $249

$200

89

$100

$0

Swaps/Swaptions> 1Y

10.0%

0.0%

7.2%

160

12.0%

10.0%

9.8%

20.0% 15.0% 15.3%

$209

68

1Q20 2Q 20

High Yield

141

9.0% 9.5%

5.9%

5.8%

2.1%

2.0%

1Q20

8.0%

6.0% 4.1% 4.0%

4.0%

2.0%

0.0%

10.2%

$179

56

U.S. CASH CREDIT (SHARE³)

High Grade

122

3Q20

17.7%

10.0%

7.7%

4.8%

2.3%

2.5%

Swaps/Swaptions< 1Y

11.6%

$209

66

143

11.8%

$287

105

182

14.7%

$256

90

166

4Q20 1Q21 2Q21

9.2%

14.3%

$246

r

6.5% 6.9%

2.5% 3.0%

4.0% 4.0% 4.8%

91

8.4%

155

21.3% 21.0%

3.5%

1Q22 Y/Y Growth

Total: +25%

Overall Share (%)

17.7%

$383

182

1Q22 Y/Y ADV Growth

HG: Total +7%, Electronic +9%, E-P + 4%

r

19.6% 19.5%

9.5% 9.3%

10.1% 10.2% 12.1% 12.7% 13.4% 12.0%

9.6%

3.3%

200

6.2%

3Q21 4Q21 1Q22

12.7%

$359

148

211

9.2%

8.3%

1Q22 Y/Y ADV Growth

HY: Total +43%, Electronic +65%, E-P+13%

22.6% 22.5%

7.3%

10.5%

F

10.7% 10.9%

3.4%

3.7%

7.2%

2.5%

1.5%

2Q20 3Q20 4Q 20

1Q21 2Q21 3Q21 4Q21 1Q22

■ Fully Electronic.

Electronically Processed

1. Share and volumes reflect TW interest rates swaps ("IRS") volumes across institutional, wholesale

and retail client sectors, divided by Clarus cleared market volumes. Global IRS market refers to

* volumes traded by U.S. and non-U.S. entities.

6

Ⓒ2022 Tradeweb Markets LLC. All rights reserved.

I

18.0%

16.0%

I $125

14.0% 1

12.0% $100

10.0% 1

1

8.0% 1

$75

6.0% I $50

4.0%

2.0%

I

1

$25

0.0%

U.S. TREASURIES (ADV AND SHARE²)

($ in billions)

$150

$0

$94

$6.0

$5.0

$4.0

$3.0

$2.0

$1.0

$-

ADV

$92

12.5% 12.7%

1Q20 2Q20

1Q22 Regional Mix

US ETFS:

40%

60%

European ETFs:

$3.6

Share (%)

$2.7

$87

15.2%

GLOBAL ETFS (INSTITUTIONAL ADV)

($ in billions)

$92

3Q20 4Q20

■Equity

$2.1

15.2% 15.4%

$115

Fixed Income

$2.9

1Q20 2Q20

Note: Totals may not foot due to rounding.

3Q20 4Q20

1Q21

$4.0

1Q21

$107

16.5%

2Q21

$3.6

$125

2Q21

19.9%

3Q21

Tradeweb

1Q22 Y/Y Growth

Total: +30%

Commodity & Other

$3.4

$135

18.7%

4Q21

3Q21

$150 -27%

24%

21%

18%

15%

12%

9%

6%

19.6%

1Q22 Y/Y Growth

Total: +54%

1Q22

$3.8

3%

0%

$6.2

4Q21 1Q22

2. Share and volumes reflect TW U.S. Treasuries volume across institutional, wholesale and retail client

sectors, divided by SIFMA volume, adjusted by Tradeweb management to estimate non-primary dealer

activity.

3. Share reflects TW high grade and high yield volume across institutional, wholesale and retail client

sectors, divided by TRACE volume, adjusted by Tradeweb management to exclude emerging market and

convertible bond volumes.View entire presentation