Trian Partners Activist Presentation Deck

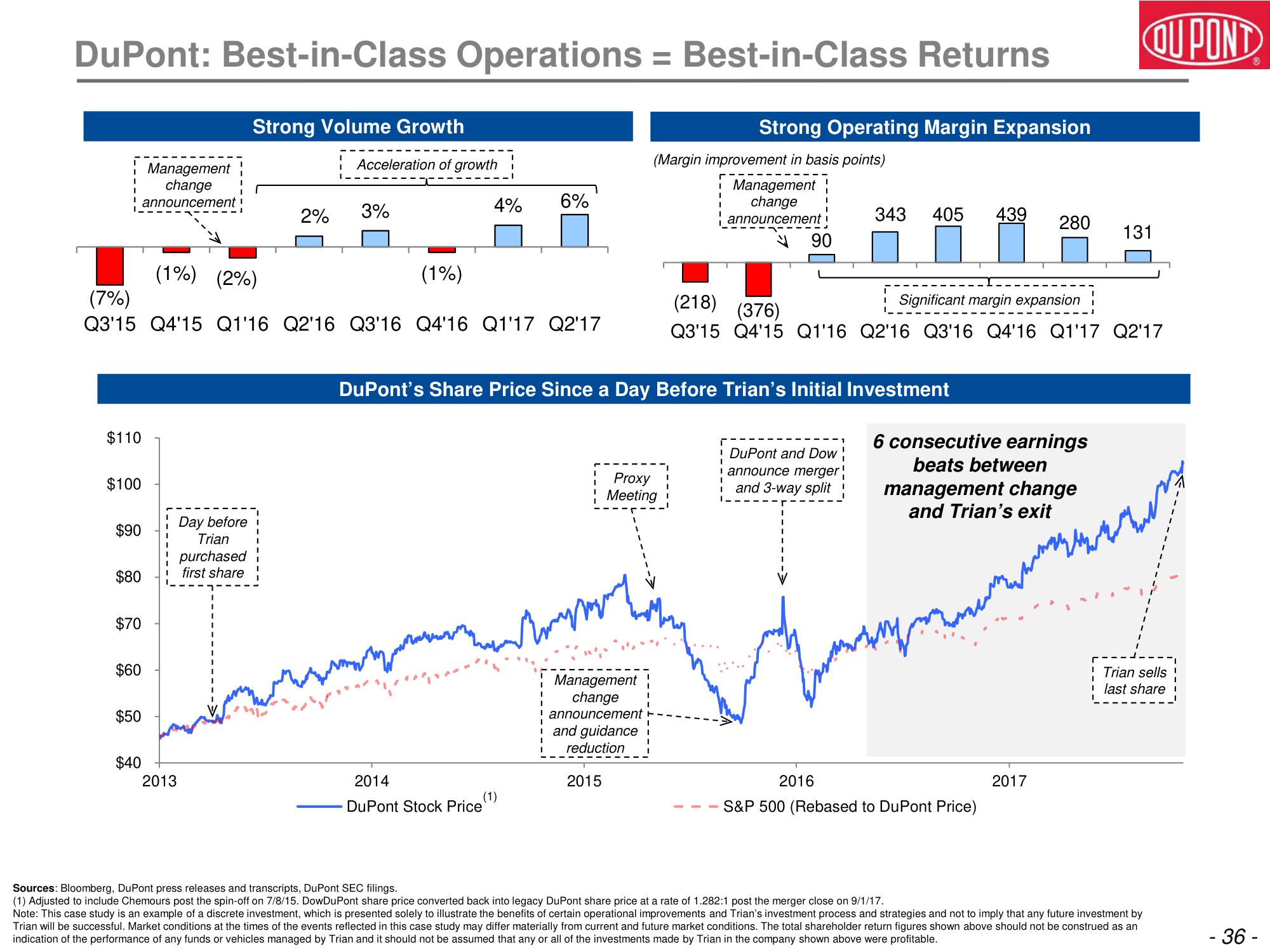

DuPont: Best-in-Class Operations = Best-in-Class Returns

Management

change

announcement

$110

$100

$90

$80

(1%) (2%)

(7%)

Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17

$70

$60

$50

$40

Strong Volume Growth

2013

Acceleration of growth

Day before i

Trian

purchased

first share

2% 3%

(1%)

4%

2014

DuPont Stock Price

6%

(1)

I

Empmany

Management

change

announcement

and guidance

reduction

2015

Strong Operating Margin Expansion

(Margin improvement in basis points)

DuPont's Share Price Since a Day Before Trian's Initial Investment

Proxy

Meeting

Management

change

announcement

90

343 405 439

DuPont and Dow!

announce merger

I and 3-way split

2016

(218)

Significant margin expansion

(376)

Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17

280

6 consecutive earnings

beats between

management change

and Trian's exit

S&P 500 (Rebased to DuPont Price)

2017

QU PONT

131

Trian sells

last share

Sources: Bloomberg, DuPont press releases and transcripts, DuPont SEC filings.

(1) Adjusted to include Chemours post the spin-off on 7/8/15. DowDuPont share price converted back into legacy DuPont share price at a rate of 1.282:1 post the merger close on 9/1/17.

Note: This case study is an example of a discrete investment, which is presented solely to illustrate the benefits of certain operational improvements and Trian's investment process and strategies and not to imply that any future investment by

Trian will be successful. Market conditions at the times of the events reflected in this case study may differ materially from current and future market conditions. The total shareholder return figures shown above should not be construed as an

indication of the performance of any funds or vehicles managed by Trian and it should not be assumed that any or all of the investments made by Trian in the company shown above were profitable.

- 36 -View entire presentation