Nerdy Investor Presentation Deck

1

2

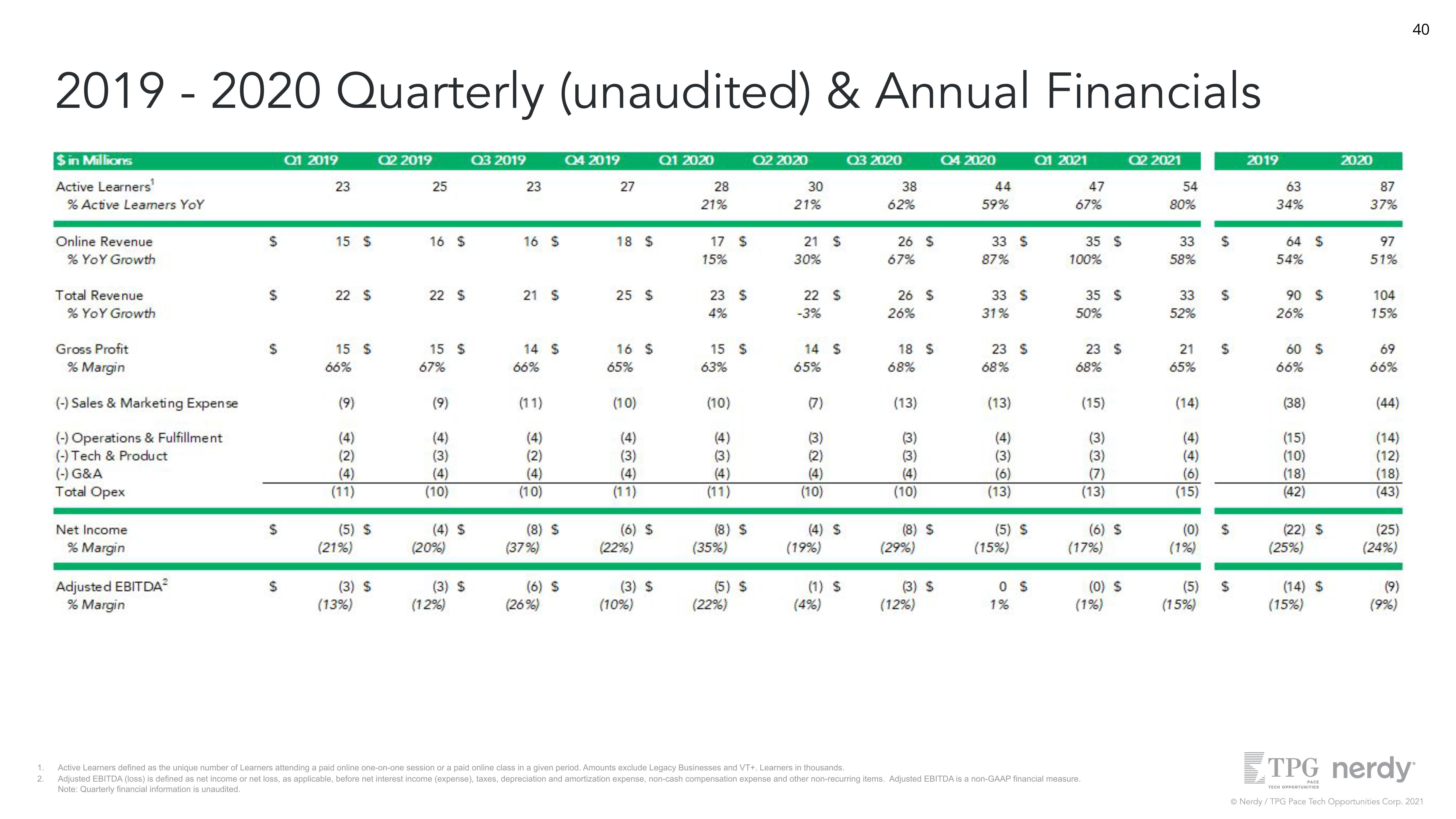

2019-2020 Quarterly (unaudited) & Annual Financials

$ in Millions

Active Learners¹

% Active Leamers YoY

Online Revenue

% YoY Growth

Total Revenue

% YoY Growth

Gross Profit

% Margin

(-) Sales & Marketing Expense

(-) Operations & Fulfillment

(-) Tech & Product

(-) G&A

Total Opex

Net Income

% Margin

Adjusted EBITDA²

% Margin

$

$

S

$

S

Q1 2019

23

15 S

22 S

15 S

66%

(9)

(4)

(2)

(4)

(11)

(5) S

(21%)

(3) S

(13%)

Q2 2019

25

16 S

22 S

15 S

67%

(9)

(4)

(3)

(4)

(10)

(4) S

(20%)

(3) S

(12%)

Q3 2019

23

16 S

21 S

14 S

66%

(11)

(4)

(2)

(4)

(10)

(8) S

(37%)

(6) S

(26%)

Q4 2019

27

18 S

25 $

16 S

65%

(10)

(4)

(3)

(4)

(11)

(6) S

(22%)

(3) S

(10%)

Q1 2020

28

21%

17 S

15%

23 S

4%

15 S

63%

(10)

(4)

(3)

(4)

(11)

(8) S

(35%)

(5) S

(22%)

Q2 2020

30

21%

21 S

30%

22 S

-3%

14 S

65%

(7)

(3)

(2)

(4)

(10)

(4) S

(19%)

(1) S

(4%)

Q3 2020

38

62%

26 S

67%

26 $

26%

18 S

68%

(13)

(3)

(3)

(4)

(10)

(8) S

(29%)

(3) S

(12%)

Q4 2020

44

59%

33 S

87%

33 S

31%

23 S

68%

(13)

(4)

(3)

(6)

(13)

(5) S

(15%)

0 S

1%

Q1 2021

47

67%

35 $

100%

35 $

50%

23 S

68%

(15)

(3)

(3)

(7)

(13)

(6) S

(17%)

Active Learners defined as the unique number of Learners attending a paid online one-on-one session or a paid online class in a given period. Amounts exclude Legacy Businesses and VT+. Learners in thousands.

Adjusted EBITDA (loss) is defined as net income or net loss, as applicable, before net interest income (expense), taxes, depreciation and amortization expense, non-cash compensation expense and other non-recurring items. Adjusted EBITDA is a non-GAAP financial measure.

Note: Quarterly financial information is unaudited.

(0) S

(1%)

02 2021

54

80%

33

58%

33

52%

21

65%

(14)

(4)

(4)

(6)

(15)

(1%)

$

(5)

(15%)

$

(0) $

$

S

2019

63

34%

64 S

54%

90 S

26%

60 S

66%

(38)

(15)

(10)

(18)

(42)

(22) S

(25%)

(14) S

(15%)

2020

87

37%

97

51%

104

15%

69

66%

(44)

(14)

(12)

(18)

(43)

(25)

(24%)

(9)

(9%)

40

TPG nerdy

PACE

TECH OPPORTUNITIES

Ⓒ Nerdy / TPG Pace Tech Opportunities Corp. 2021View entire presentation