Bank of America Investment Banking Pitch Book

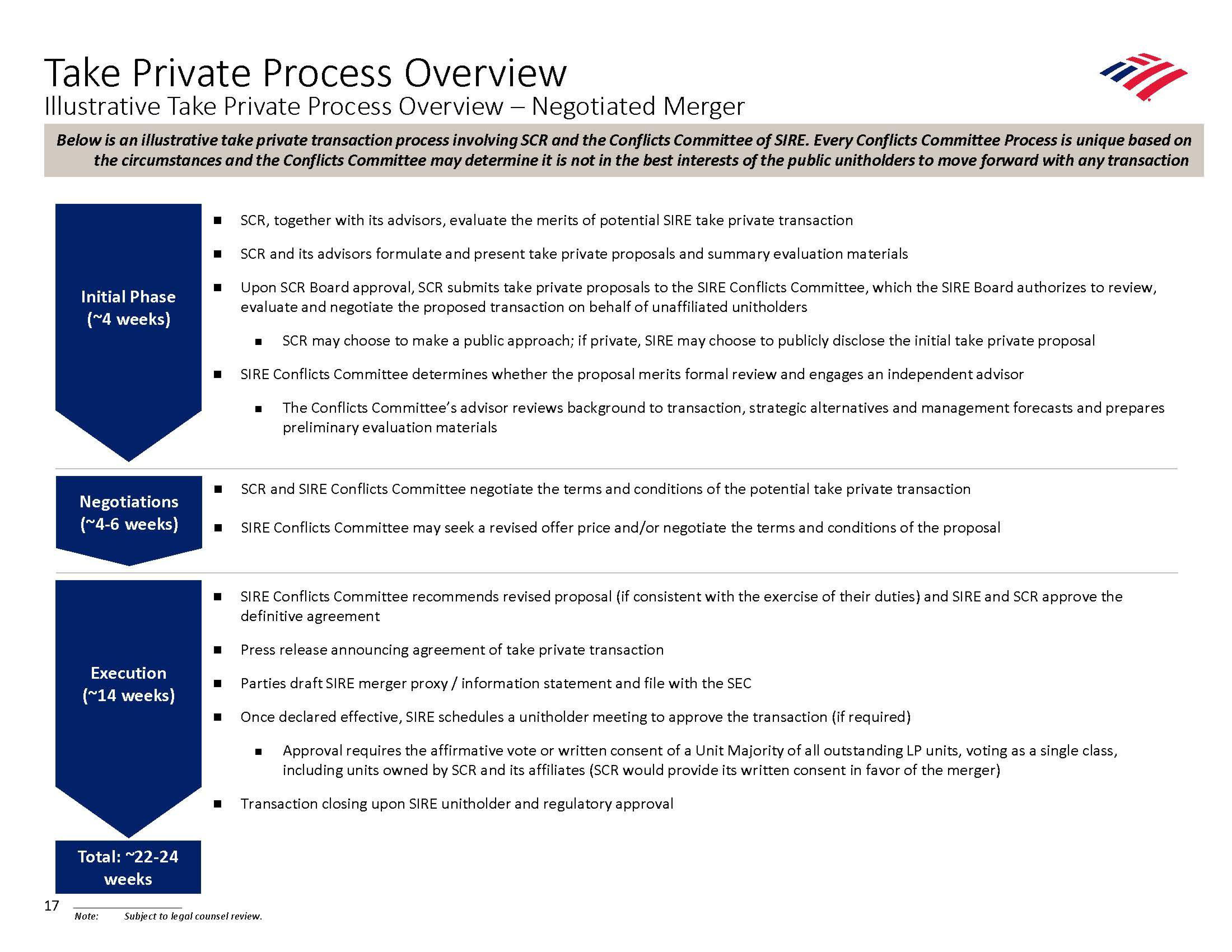

Take Private Process Overview

Illustrative Take Private Process Overview - Negotiated Merger

Below is an illustrative take private transaction process involving SCR and the Conflicts Committee of SIRE. Every Conflicts Committee Process is unique based on

the circumstances and the Conflicts Committee may determine it is not in the best interests of the public unitholders to move forward with any transaction

17

Initial Phase

(~4 weeks)

Negotiations

(~4-6 weeks)

Execution

(~14 weeks)

Total: ~22-24

weeks

Note:

■

SCR, together with its advisors, evaluate the merits of potential SIRE take private transaction

SCR and its advisors formulate and present take private proposals and summary evaluation materials

Upon SCR Board approval, SCR submits take private proposals to the SIRE Conflicts Committee, which the SIRE Board authorizes to review,

evaluate and negotiate the proposed transaction on behalf of unaffiliated unitholders

SCR may choose to make a public approach; if private, SIRE may choose to publicly disclose the initial take private proposal

■ SIRE Conflicts Committee determines whether the proposal merits formal review and engages an independent advisor

The Conflicts Committee's advisor reviews background to transaction, strategic alternatives and management forecasts and prepares

preliminary evaluation materials

■

■

■

■

I

SCR and SIRE Conflicts Committee negotiate the terms and conditions of the potential take private transaction

SIRE Conflicts Committee may seek a revised offer price and/or negotiate the terms and conditions of the proposal

Press release announcing agreement of take private transaction

Parties draft SIRE merger proxy / information statement and file with the SEC

■ Once declared effective, SIRE schedules a unitholder meeting to approve the transaction (if required)

SIRE Conflicts Committee recommends revised proposal (if consistent with the exercise of their duties) and SIRE and SCR approve the

definitive agreement

all

■ Approval requires the affirmative vote or written consent of a Unit Majority of all outstanding LP units, voting as a single class,

including units owned by SCR and its affiliates (SCR would provide its written consent in favor of the merger)

Transaction closing upon SIRE unitholder and regulatory approval

Subject to legal counsel review.View entire presentation