MP Materials Investor Conference Presentation Deck

12345

3.

4.

Significant

Stage I

normalized free

cash flow

5.

■

■

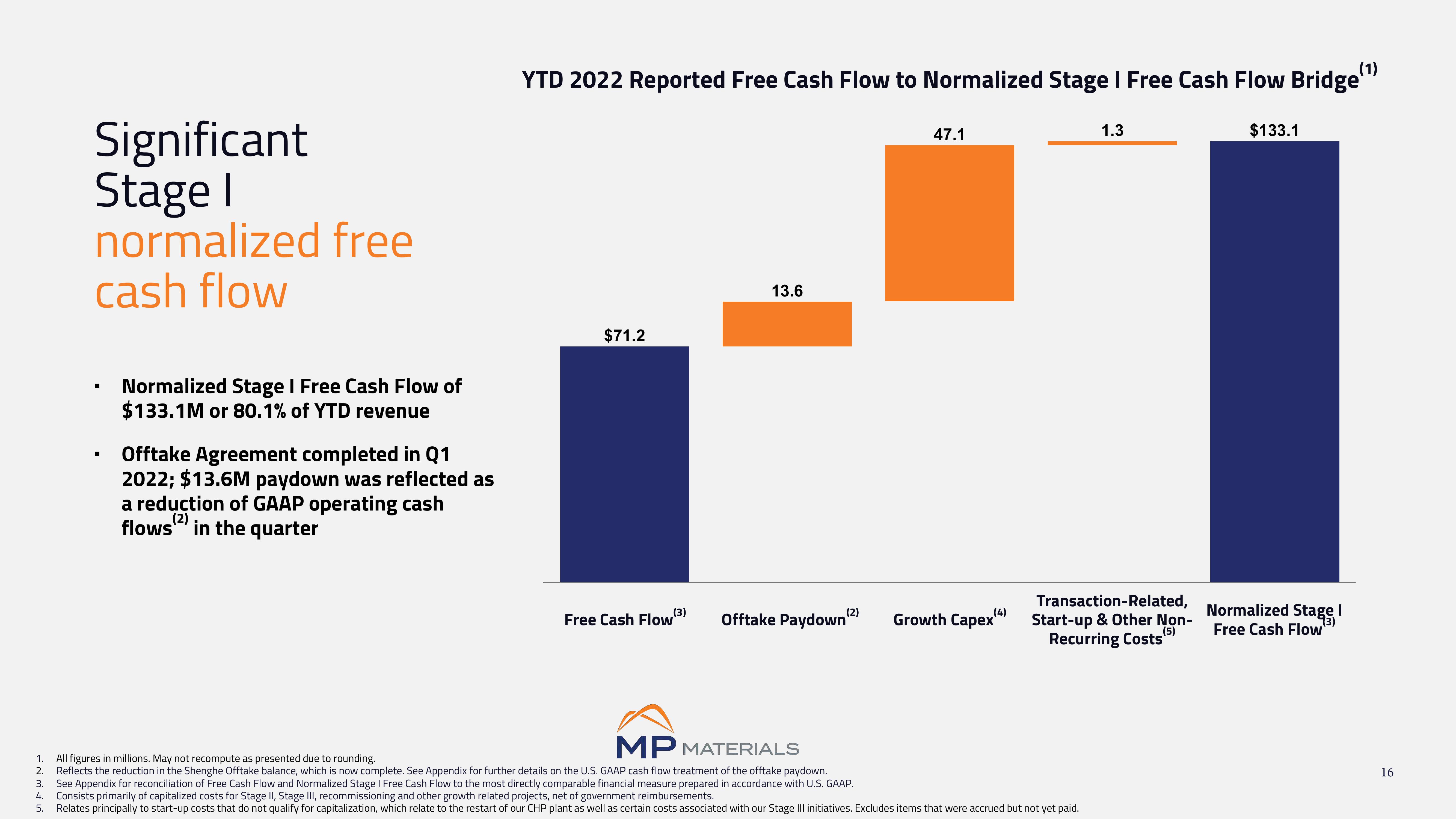

Normalized Stage I Free Cash Flow of

$133.1M or 80.1% of YTD revenue

Offtake Agreement completed in Q1

2022; $13.6M paydown was reflected as

a reduction of GAAP operating cash

flows in the quarter

(1)

YTD 2022 Reported Free Cash Flow to Normalized Stage I Free Cash Flow Bridge¹

$71.2

Free Cash Flow

MP MATERIALS

All figures in millions. May not recompute as presented due to rounding.

2. Reflects the reduction in the Shenghe Offtake balance, which is now complete. See Appendix for further details on the U.S. GAAP cash flow treatment of the offtake paydown.

(3)

13.6

(2)

Offtake Paydown

47.1

Growth Capex(4)

1.3

Transaction-Related,

Start-up & Other Non-

Recurring Costs

(5)

See Appendix for reconciliation of Free Cash Flow and Normalized Stage I Free Cash Flow to the most directly comparable financial measure prepared in accordance with U.S. GAAP.

Consists primarily of capitalized costs for Stage II, Stage III, recommissioning and other growth related projects, net of government reimbursements.

Relates principally to start-up costs that do not qualify for capitalization, which relate to the restart of our CHP plant as well as certain costs associated with our Stage III initiatives. Excludes items that were accrued but not yet paid.

$133.1

I

Normalized Stage

Free Cash Flow"

16View entire presentation