Evercore Investment Banking Pitch Book

Financial Analysis

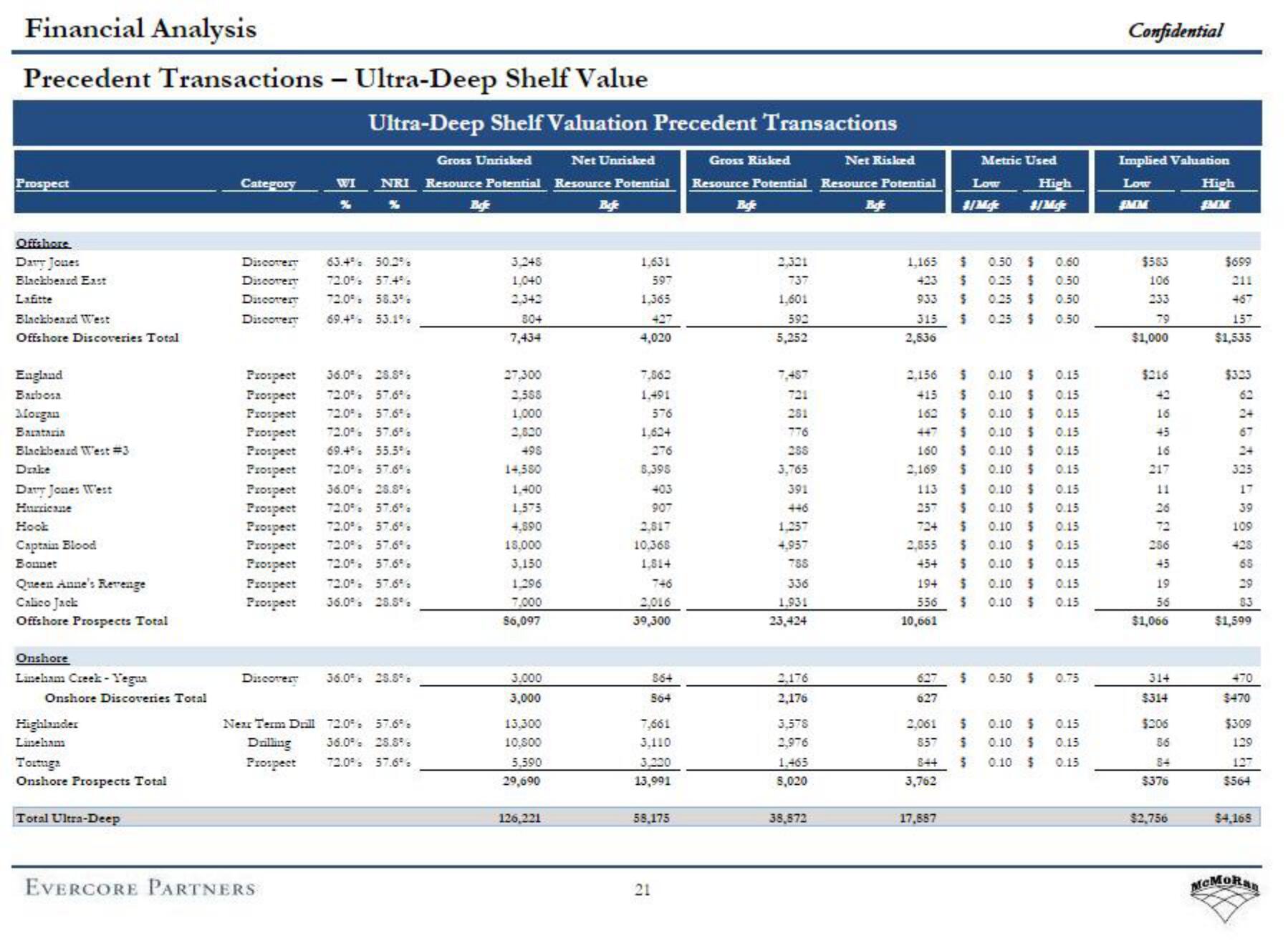

Precedent Transactions - Ultra-Deep Shelf Value

Prospect

Offshore

Davy Jones

Blackbeard East

Lafitte

Blackbeard West

Offshore Discoveries Total

England

Barbosa

Morgan

Barataria

Blackbeard West #3

Drake

Davy Jones West

Hurricane

Hook

Captain Blood

Bonnet

Queen Anne's Revenge

Calico Jack

Offshore Prospects Total

Onshore

Lineham Creek-Yegua

Onshore Discoveries Total

Highlander

Lineham

Tortuga

Onshore Prospects Total

Total Ultra-Deep

Category

WI

%

Ultra-Deep Shelf Valuation Precedent Transactions

Gross Unrisked

NRI Resource Potential

Discovery 63.4% 50.0%

Discovery 72.0% 57.4%

Discovery 72.0% 58.3%

Discovery 69.4% 53.1%

Prospect 36.0% 28.8%

Prospect 72.0% 57.6%

Prospect 72.0% 57.6%

Prospect 72.0% 57.6%

Prospect 69.4% 55.3%

Prospect 72.0% 57.6%

Prospect 36.0% 28.8%

Prospect 72.0% 57.6%

Prospect 72.0% 57.6%

Prospect 72.0% 57.6%

Prospect 72.0% 57.6%

Prospect 72.0% 57.6%

Prospect 36.0% 28.8%

EVERCORE PARTNERS

Discovery 36.0% 28.8%

Near Term Drill 72.0% 57.6%

Drilling

36.0% 28.8%

Prospect 72.0% 57.6%

Befe

3,248

1,040

2,342

804

7,434

27,300

2,588

1,000

2,820

498

14,580

1,400

1,575

4,890

18,000

3,150

1.296

7,000

$6,097

3.000

3,000

13,300

10,800

5,590

29,690

126,221

Net Unrisked

Resource Potential

Befe

1,631

597

1,365

427

4,020

7,862

1,491

576

1,624

276

8,395

403

907

2,817

10.368

1.814

746

2,016

39,300

864

564

7,661

3,110

3,220

13,991

58,175

21

Gross Risked

Net Risked

Resource Potential Resource Potential

Befe

2,321

737

1,601

592

5,252

7,487

281

776

288

3,765

391

446

1.257

4.957

788

336

1.931

23,424

2,176

2,176

3.578

2,976

1.465

8,020

38,872

Befe

1,165

423

933

315

2,836

2,156

$

415 $

162

$

$

160

$

2,169 $

113

257

724

$

$

2,855

10,661

627

627

Low

4/Mofe

454 5

194 $

556 S

3,762

$ 0.50 $

$

$

0.25 $

0.25 $

0.25 $

$

17,887

in in

Metric Used

0.15

0.15

0.15

0.15

0.15

0.10 $

0.10 $

0.10 $

0.10 $

0.10 $

0.10 $ 0.15

0.10 $ 0.15

0.10 $ 0.15

$ 0.10 S 0.15

0.10 S

0.10 S

0.15

0.15

0.15

0.10 $

0.10 $

0.15

2,061

S

857

$

844 $

$

High

0.60

0.50

0.50

0.50

0.10 S

0.10 $

0.10 S

0.50 $ 0.75

0.15

0.15

0.15

Confidential

Implied Valuation

Low

SMM

$563

106

233

79

$1,000

$216

42

16

45

16

217

11

26

286

45

19

56

$1,066

314

$314

$206

56

84

$376

$2,756

High

SMM

$699

211

467

157

$1,535

$323

62

24

67

325

17

39

109

428

68

83

$1,599

470

$470

$309

129

127

$564

$4,168

McMoRanView entire presentation