jetBlue Results Presentation Deck

TAKING ACTIONS TO PROTECT OUR STAKEHOLDERS

●

●

●

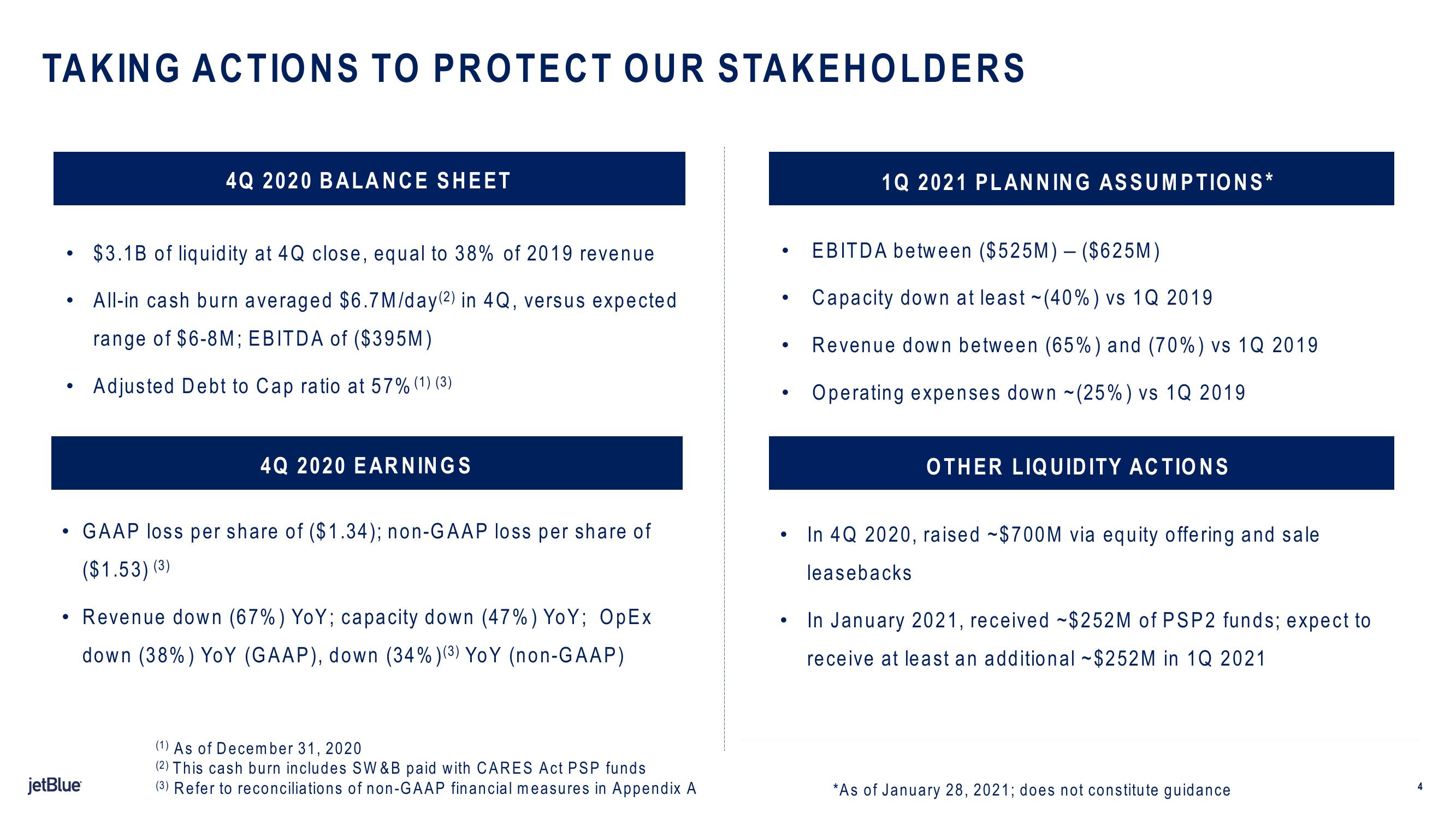

4Q 2020 BALANCE SHEET

$3.1B of liquidity at 4Q close, equal to 38% of 2019 revenue

All-in cash burn averaged $6.7M/day (2) in 4Q, versus expected

range of $6-8M; EBITDA of ($395M)

Adjusted Debt to Cap ratio at 57% (1) (3)

jetBlue

4Q 2020 EARNINGS

GAAP loss per share of ($1.34); non-GAAP loss per share of

($1.53) (3)

• Revenue down (67%) YoY; capacity down (47%) YoY; OpEx

down (38%) YoY (GAAP), down (34%)(3) YoY (non-GAAP)

(1) As of December 31, 2020

(2) This cash burn includes SW & B paid with CARES Act PSP funds

(3) Refer to reconciliations of non-GAAP financial measures in Appendix A

●

●

●

●

●

1Q 2021 PLANNING ASSUMPTIONS*

EBITDA between ($525M) - ($625M)

Capacity down at least ~(40%) vs 1Q 2019

Revenue down between (65%) and (70%) vs 1Q 2019

Operating expenses down (25%) vs 1Q 2019

-

OTHER LIQUIDITY ACTIONS

In 4Q 2020, raised $700M via equity offering and sale

leasebacks

In January 2021, received -$252M of PSP2 funds; expect to

receive at least an additional ~$252M in 1Q 2021

*As of January 28, 2021; does not constitute guidance

4View entire presentation