Deutsche Telekom Investor Day Presentation Deck

T-MOBILE US, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO GAAP FINANCIAL MEASURES

(UNAUDITED)

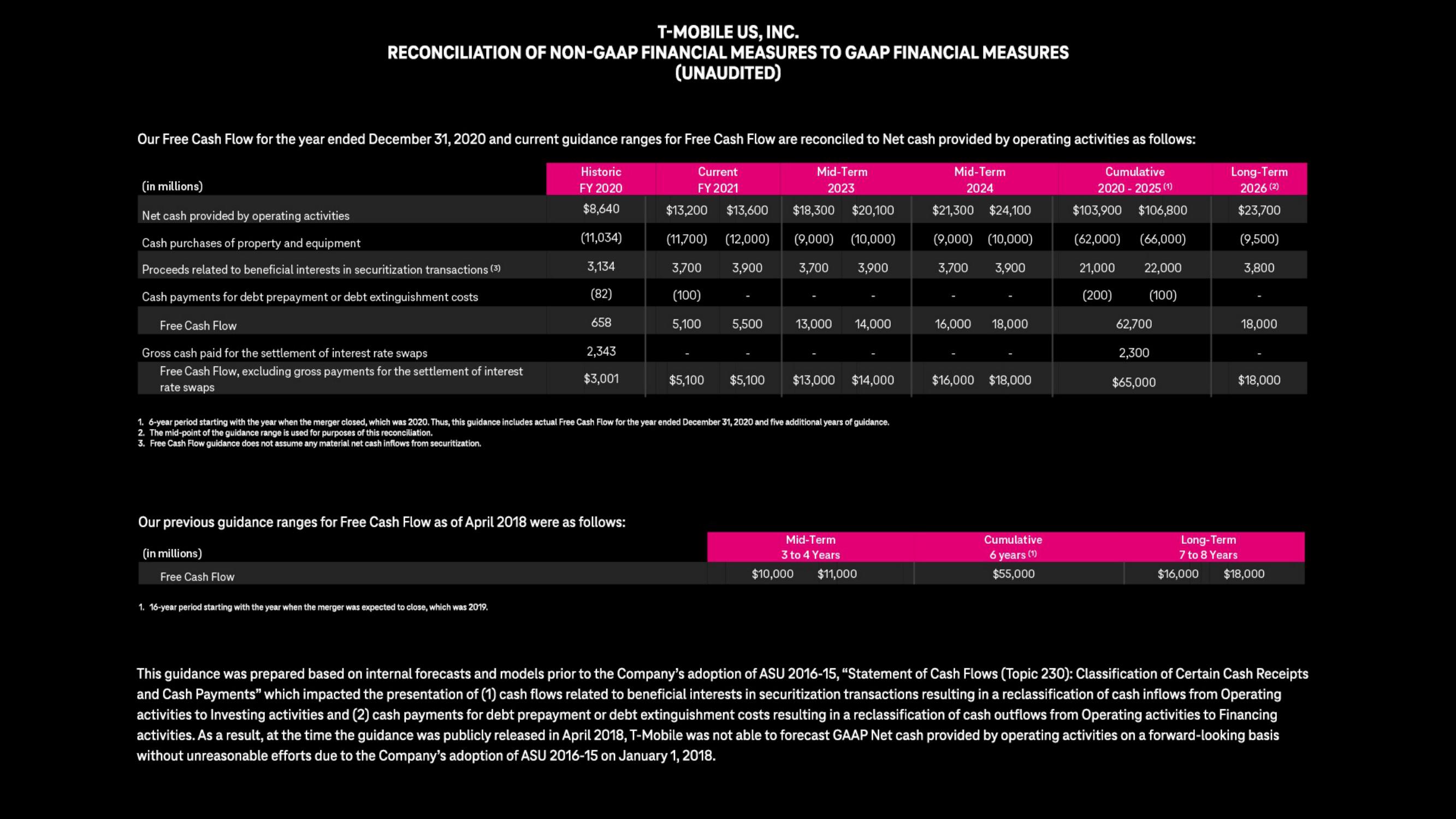

Our Free Cash Flow for the year ended December 31, 2020 and current guidance ranges for Free Cash Flow are reconciled to Net cash provided by operating activities as follows:

Current

FY 2021

Mid-Term

2023

Historic

FY 2020

$8,640

(11,034)

Cumulative

2020-2025 (¹)

$103,900 $106,800

(62,000) (66,000)

21,000 22,000

(200)

(100)

3,134

(82)

658

(in millions)

Net cash provided by operating activities

Cash purchases of property and equipment

Proceeds related to beneficial interests in securitization transactions (3)

Cash payments for debt prepayment or debt extinguishment costs

Free Cash Flow

Gross cash paid for the settlement of interest rate swaps

Free Cash Flow, excluding gross payments for the settlement of interest

rate swaps

Free Cash Flow

2,343

$3,001

Our previous guidance ranges for Free Cash Flow as of April 2018 were as follows:

(in millions)

1. 16-year period starting with the year when the merger was expected to close, which was 2019.

$13,200 $13,600

(11,700) (12,000)

3,700 3,900

(100)

5,100 5,500

$5,100 $5,100

$18,300 $20,100

(9,000) (10,000)

3,700 3,900

1. 6-year period starting with the year when the merger closed, which was 2020. Thus, this guidance includes actual Free Cash Flow for the year ended December 31, 2020 and five additional years of guidance.

2. The mid-point of the guidance range is used for purposes of this reconciliation.

3. Free Cash Flow guidance does not assume any material net cash inflows from securitization.

13,000 14,000

$13,000 $14,000

Mid-Term

3 to 4 Years

$10,000 $11,000

Mid-Term

2024

$21,300 $24,100

(9,000) (10,000)

3,700 3,900

16,000 18,000

$16,000 $18,000

Cumulative

6 years (¹)

$55,000

62,700

2,300

$65,000

Long-Term

2026 (2)

$23,700

(9,500)

3,800

$16,000

Long-Term

7 to 8 Years

18,000

$18,000

$18,000

This guidance was prepared based on internal forecasts and models prior to the Company's adoption of ASU 2016-15, "Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts

and Cash Payments" which impacted the presentation of (1) cash flows related to beneficial interests in securitization transactions resulting in a reclassification of cash inflows from Operating

activities to Investing activities and (2) cash payments for debt prepayment or debt extinguishment costs resulting in a reclassification of cash outflows from Operating activities to Financing

activities. As a result, at the time the guidance was publicly released in April 2018, T-Mobile was not able to forecast GAAP Net cash provided by operating activities on a forward-looking basis

without unreasonable efforts due to the Company's adoption of ASU 2016-15 on January 1, 2018.View entire presentation