Advent Capital Balanced Strategy Update

BALANCED STRATEGY PERFORMANCE

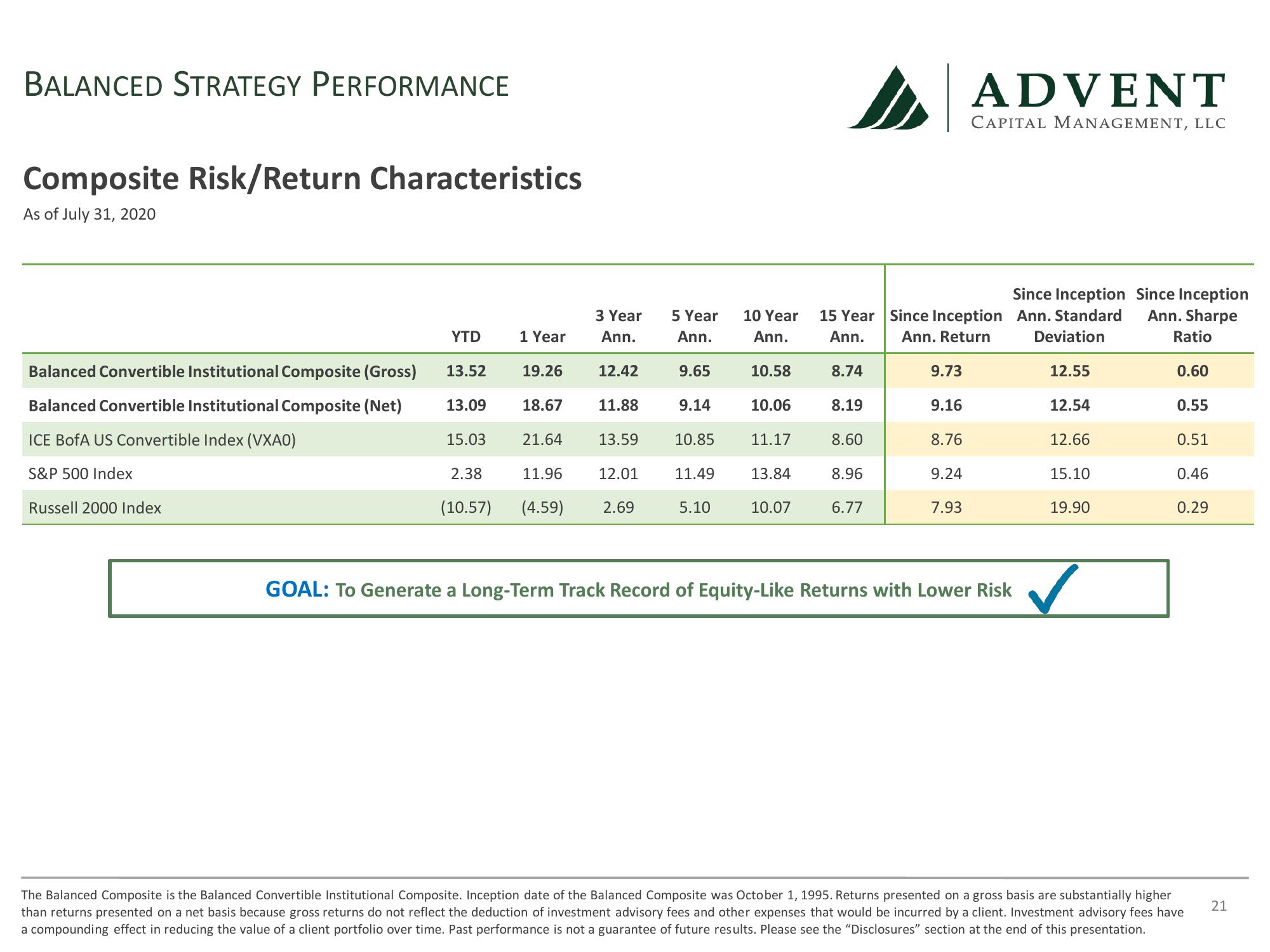

Composite Risk/Return Characteristics

As of July 31, 2020

Balanced Convertible Institutional Composite (Gross)

Balanced Convertible Institutional Composite (Net)

ICE BofA US Convertible Index (VXAO)

S&P 500 Index

Russell 2000 Index

YTD

13.52

13.09

15.03

2.38

(10.57)

1 Year

19.26

18.67

21.64

3 Year

Ann.

12.42

11.88

13.59

11.96

12.01

(4.59) 2.69

5 Year

Ann.

9.65

9.14

10.85

11.49

5.10

10 Year

Ann.

10.58

10.06

11.17

13.84

10.07

15 Year

Ann.

8.74

8.19

8.60

8.96

6.77

Since Inception

Ann. Return

9.73

9.16

8.76

9.24

ADVENT

CAPITAL MANAGEMENT, LLC

7.93

Since Inception Since Inception

Ann. Sharpe

Ann. Standard

Deviation

Ratio

12.55

12.54

12.66

15.10

19.90

GOAL: To Generate a Long-Term Track Record of Equity-Like Returns with Lower Risk

✓

0.60

0.55

0.51

0.46

0.29

The Balanced Composite is the Balanced Convertible Institutional Composite. Inception date of the Balanced Composite was October 1, 1995. Returns presented on a gross basis are substantially higher

than returns presented on a net basis because gross returns do not reflect the deduction of investment advisory fees and other expenses that would be incurred by a client. Investment advisory fees have

a compounding effect in reducing the value of a client portfolio over time. Past performance is not a guarantee of future results. Please see the "Disclosures" section at the end of this presentation.

21View entire presentation