Pershing Square Activist Presentation Deck

Appendix

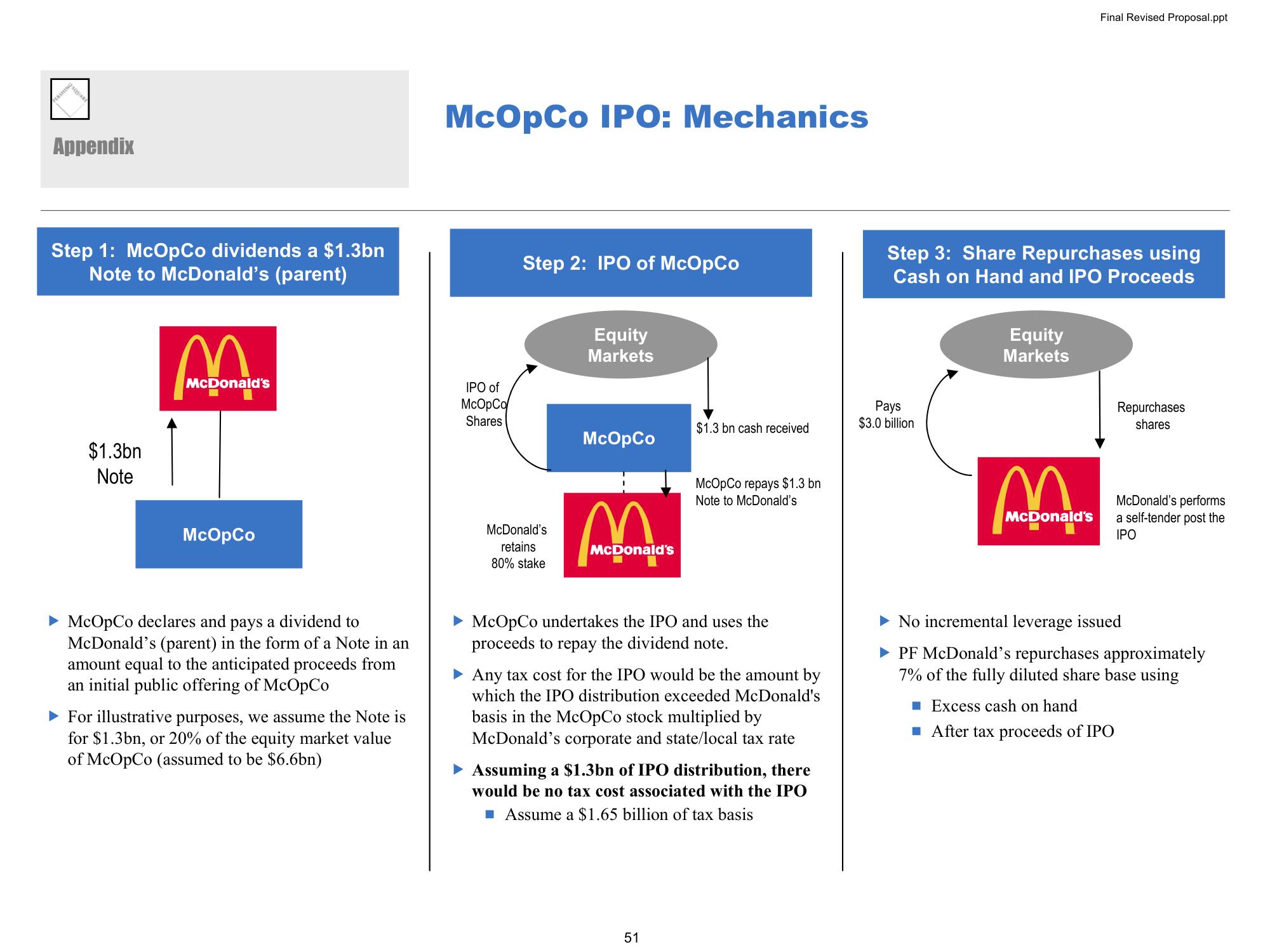

Step 1: McOpCo dividends a $1.3bn

Note to McDonald's (parent)

$1.3bn

Note

M

McDonald's

McOpCo

► McOpCo declares and pays a dividend to

McDonald's (parent) in the form of a Note in an

amount equal to the anticipated proceeds from

an initial public offering of McOpCo

► For illustrative purposes, we assume the Note is

for $1.3bn, or 20% of the equity market value

of McOpCo (assumed to be $6.6bn)

McOpCo IPO: Mechanics

IPO of

McOpCo

Shares

Step 2: IPO of McOpCo

McDonald's

retains

80% stake

Equity

Markets

McOpCo

McDonald's

$1.3 bn cash received

McOpCo repays $1.3 bn

Note to McDonald's

► McOpCo undertakes the IPO and uses the

proceeds to repay the dividend note.

► Any tax cost for the IPO would be the amount by

which the IPO distribution exceeded McDonald's

basis in the McOpCo stock multiplied by

McDonald's corporate and state/local tax rate

51

Assuming a $1.3bn of IPO distribution, there

would be no tax cost associated with the IPO

■ Assume a $1.65 billion of tax basis

Step 3: Share Repurchases using

Cash on Hand and IPO Proceeds

Pays

$3.0 billion

Equity

Markets

Final Revised Proposal.ppt

McDonald's

Repurchases

shares

■ Excess cash on hand

■ After tax proceeds of IPO

McDonald's performs

a self-tender post the

IPO

No incremental leverage issued

► PF McDonald's repurchases approximately

7% of the fully diluted share base usingView entire presentation